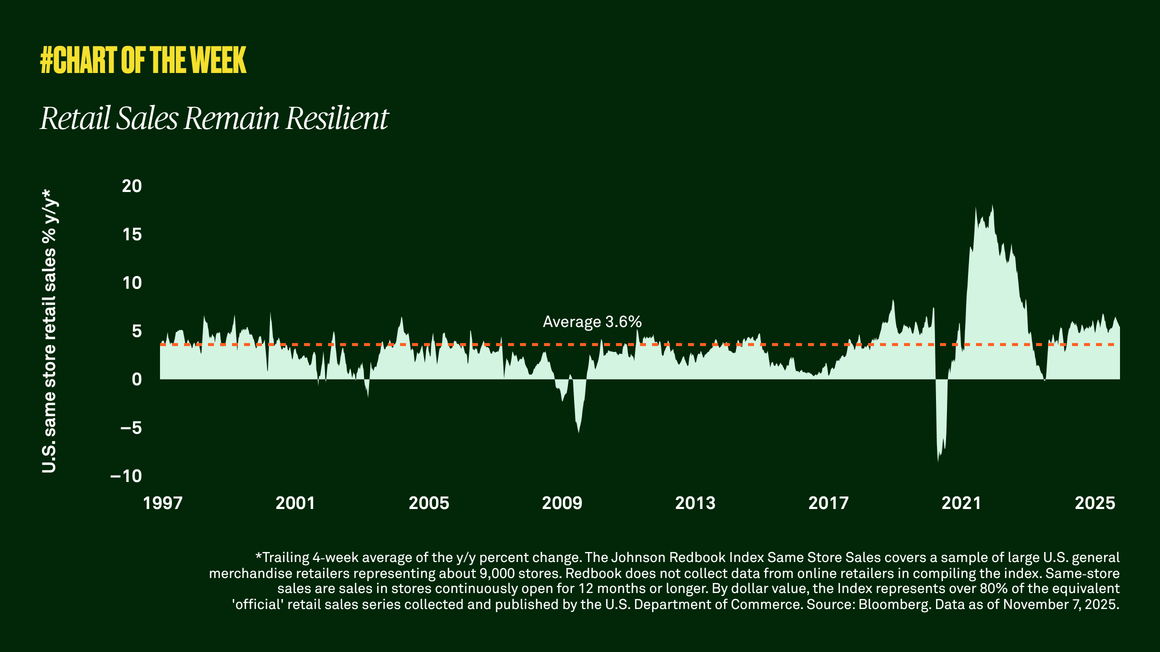

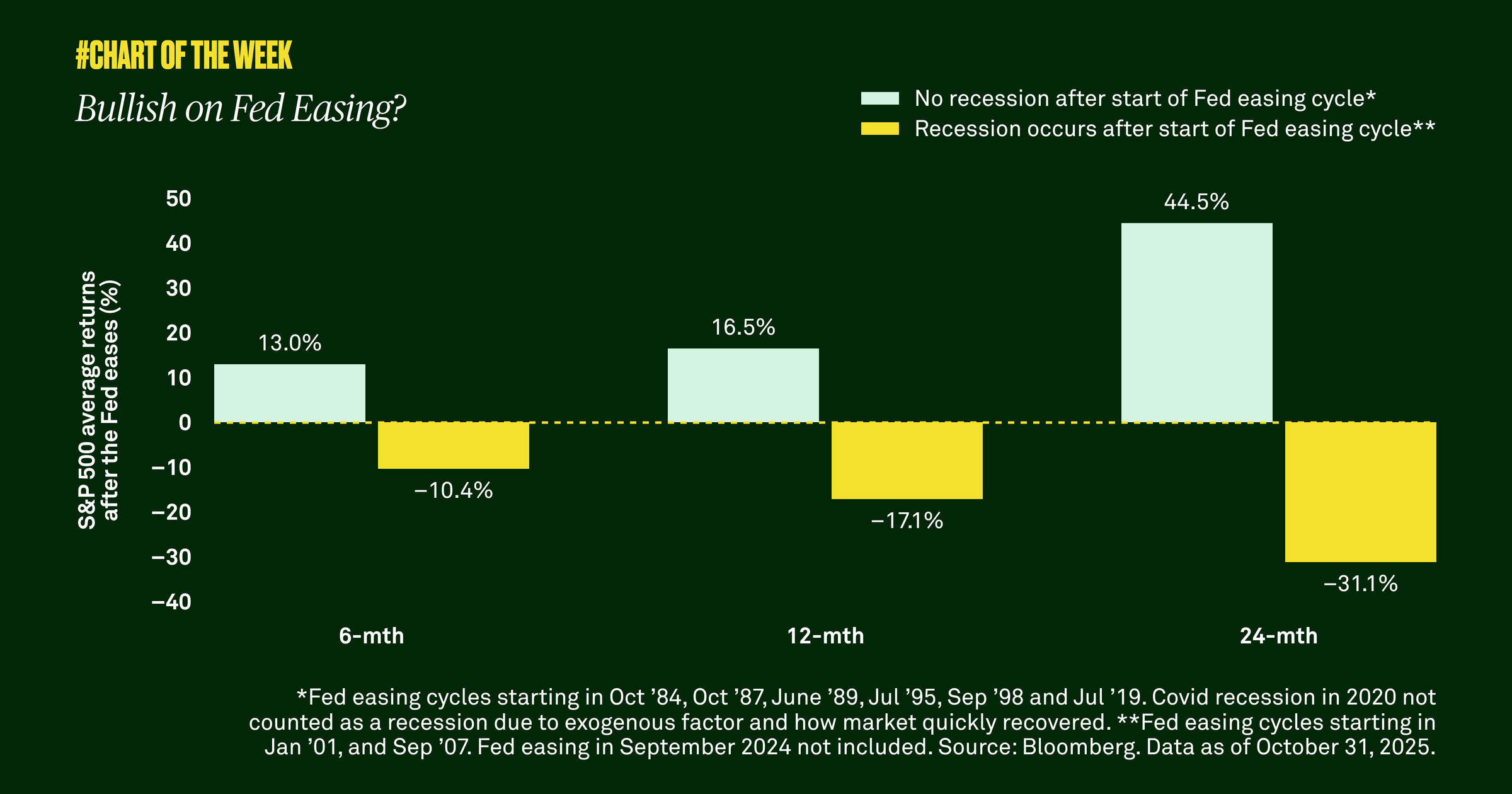

As expected, the Federal Open Market Committee delivered another 25-basis point rate cut. Investors are now focused on the pace of cuts from here. However, the more important driver of future equity returns is whether the Fed is easing into an economy that is growing or not.

Last week, the Federal Reserve delivered a widely anticipated 25-basis point rate cut, What caught the market’s attention was pushback by Fed Chair Powell on the certainty of a December cut. But, regardless of the pace of easing from here, history tells us that future equity market performance is positive when the Fed eases into a growing economy.

According to our research dating back to the 1980s, stocks delivered an average gain of 16.5% in the 12 months following the first cut of an easing cycle as long as a recession was avoided. The number ticks up to 44.5% over the first 24 months. While the Fed’s easing arguably started last year, we view the latest cuts and future expectations as a new cycle.

Given our outlook for continued positive economic growth over the next year, combined with an improving earnings backdrop, we expect more equity gains to come.