After climbing 17% year to date through late October, the S&P 500 declined 5% through November 20. We believe the market was due for a healthy correction. While further downside is possible, it would not concern us.

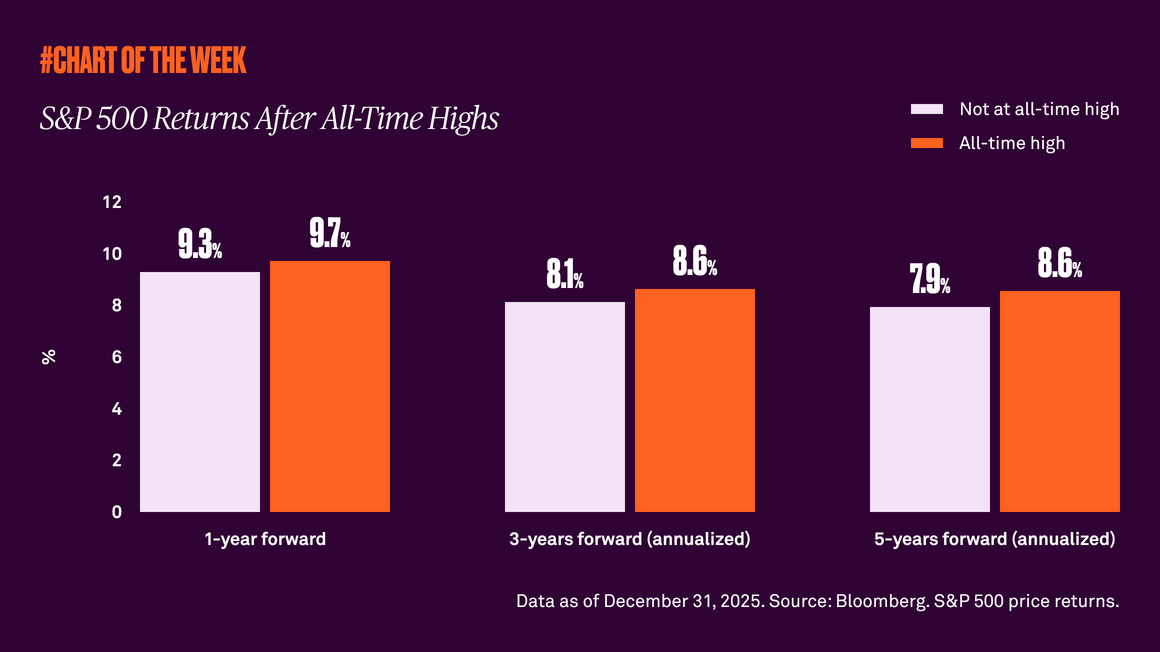

After reaching a new all-time high on October 28, the S&P 500 declined 5% through November 20, leading to concerns of a renewed correction. We believe the market was due for a healthy correction and while further volatility may persist, additional downside would not concern us.

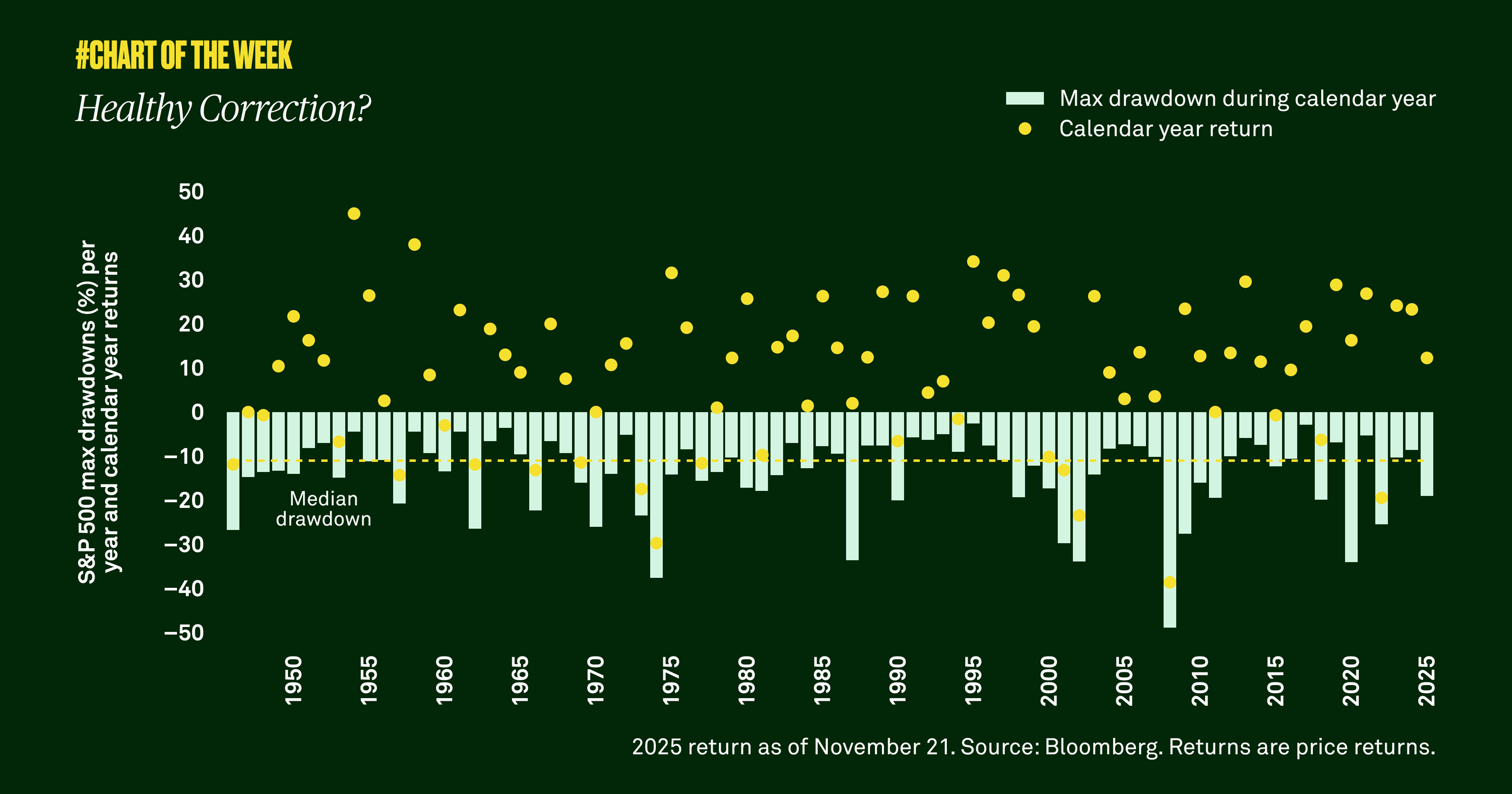

History shows that markets don’t move in a straight line, and drawdowns are normal. Since 1946, the S&P 500 has experienced a median annual correction of 11%.

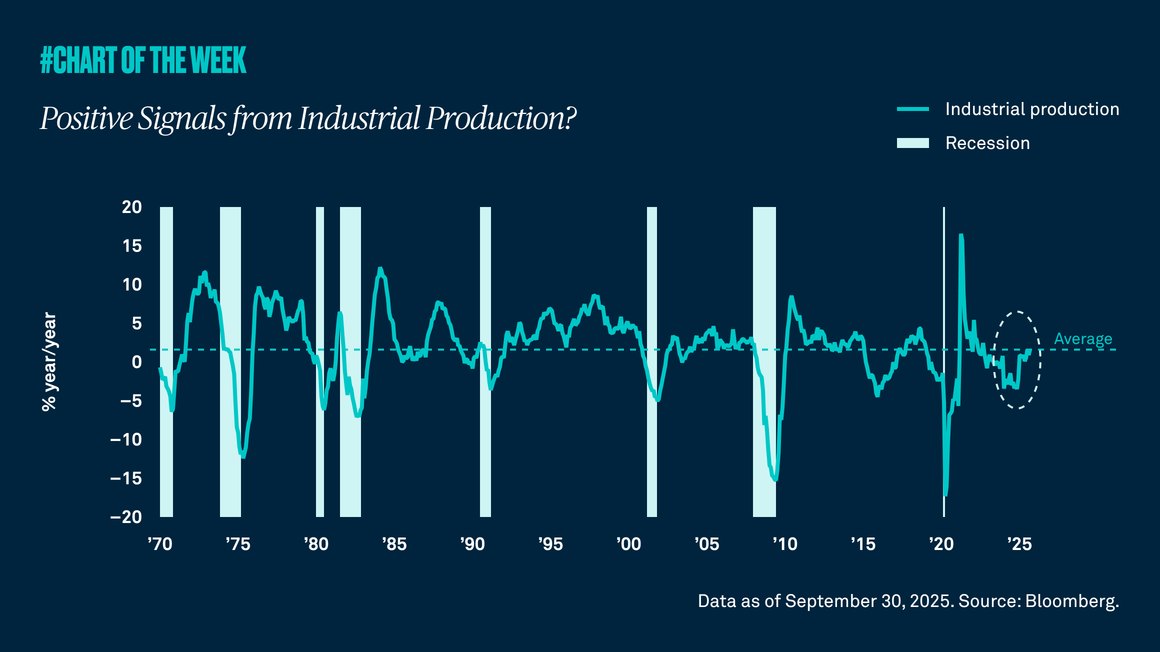

Additionally, we do not believe we’re heading for a bear market or imminent recession, and we see the latest decline as more technically driven rather than a change in fundamentals or a more negative outlook. In 2026, we expect economic growth near 2% and earnings growth to continue to broaden beyond the tech sector, which should support equity performance. Therefore, staying invested and weathering the downside is critical for capturing potential upside.