BNY Investments Newton head of mixed assets investment, Paul Flood, reflects on market trends and policies impacting the yield curve in bond markets and compares the nuance between the US and UK fiscal deficits.

Key Takeaways:

- Inflation is driving bond yields higher, with pressure on long-term UK bonds amid fiscal uncertainty and lack of demand from pension funds

- Flood believes a focus in the UK on growth rather than taxation could be beneficial.

- Strategic risk management includes protective equity positions and calibrated gold exposure amid market volatility.

Bond yields have increased globally over the past several months, driven in part by inflationary pressures. The UK has seen a notable rise in its 30-year bond yield, moving from just under 5.2% to 5.6% since the start of the year.

However, demand for long-dated UK debt appears to be softening, with the Treasury signalling intentions to reduce issuance at the long end. In contrast, US 30-year yields have remained relatively stable, reflecting differing economic and fiscal dynamics.

The yield curve – UK versus US

There are some market concerns around the UK’s fiscal position amid what Flood highlights is limited growth prospects.

Flood explains: “The United Kingdom fiscal deficit is projected to go from 5% down to 4% over the next three to five years, whereas in the United States it continues to rise up towards the 6% level. However, unlike the US, where GDP growth is relatively robust, the UK is facing stagnant growth, making its fiscal deficit more problematic.”

Flood outlines the need to see more growth in the UK, emphasising that raising economic growth is preferable to increasing tax burdens.

“The UK’s high savings rate — higher than that of the US — also dampens consumer spending, as households remain cautious amid job market uncertainties,” continues Flood. “This consumer caution further complicates efforts to stimulate growth through domestic demand.”

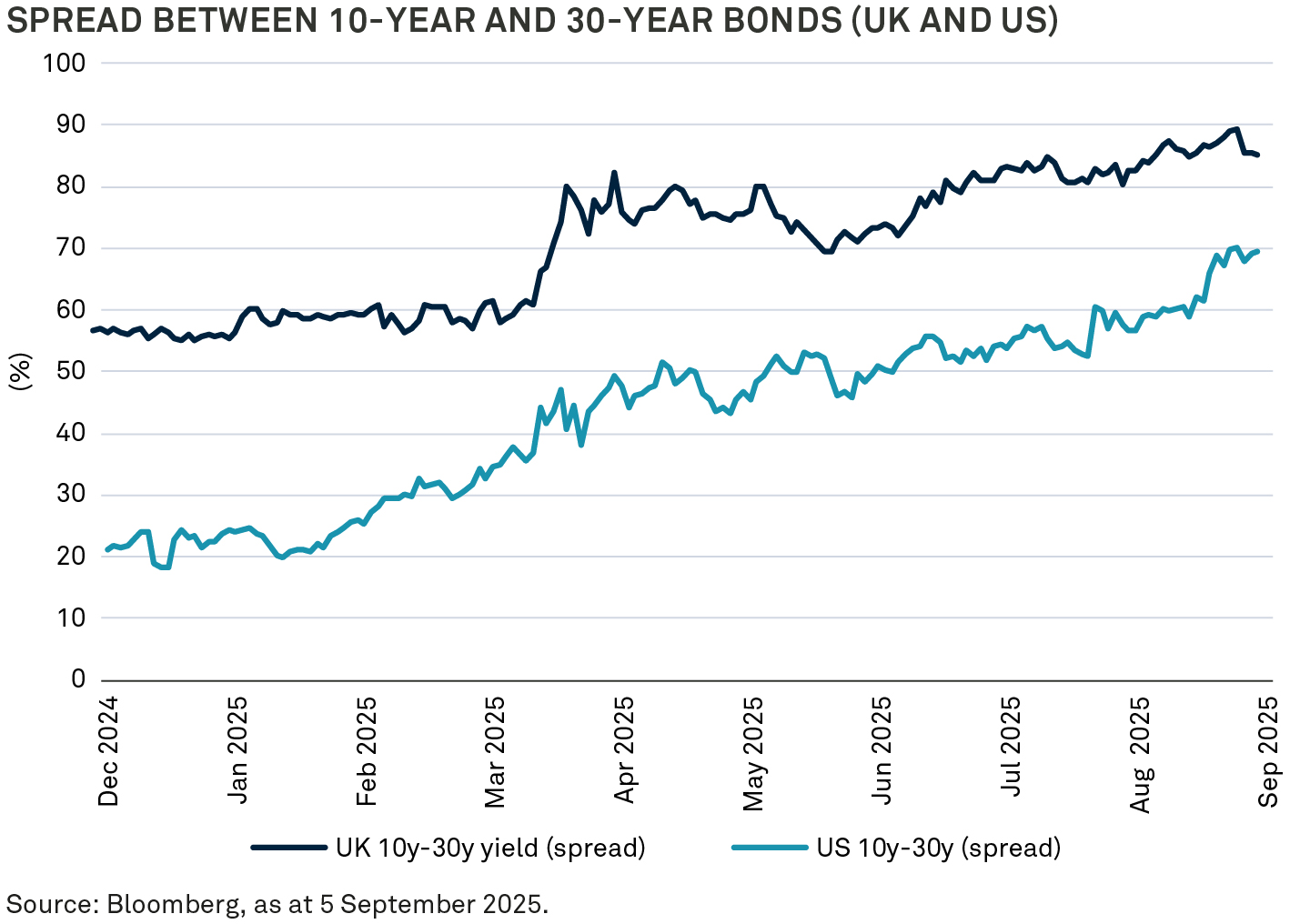

These factors contribute to the steepening yield curve, with longer-term yields rising more than shorter-term ones. The UK’s 10-year versus 30-year yield spread has widened to about 85 basis points, reflecting increased risk premiums on longer maturities.

“In the United States, the 30-year yield has remained stable and, unlike in the UK where the yield curve has steepened due to the rise of the 30-year yield, the curve steepening in the US has come about as the 10-year yield has dropped, suggesting that people believe the Fed is going to bring interest rates down and will have the flexibility to do that,” Flood explains.

From a sectoral perspective, Flood says the steeper yield curve benefits financial stocks, which have rallied strongly over the past six months. Conversely, bond proxy sectors such as consumer staples and healthcare face headwinds.

“Healthcare, in particular, is under pressure due to political initiatives aimed at reducing pharmaceutical prices,” says Flood. “This is reflecting broader concerns about affordability and pricing fairness.”

Is all that glitters gold?

When considering the BNY Mellon Multi-Asset Diversified Return Strategy, Flood has some reservations on equity pricing.

“We are becoming more concerned of valuations, particularly in the US equity market,” he says. “Because of that, we've decided to put in some derivative strategies to ensure we're more protected should the equity market come off again.”

He cites the US as a market they are keenly watching, explaining that the strategy has taken a cautious stance by implementing put options on the S&P 500 to protect against downside risk, reflecting a prudent response to market strength and valuation concerns.

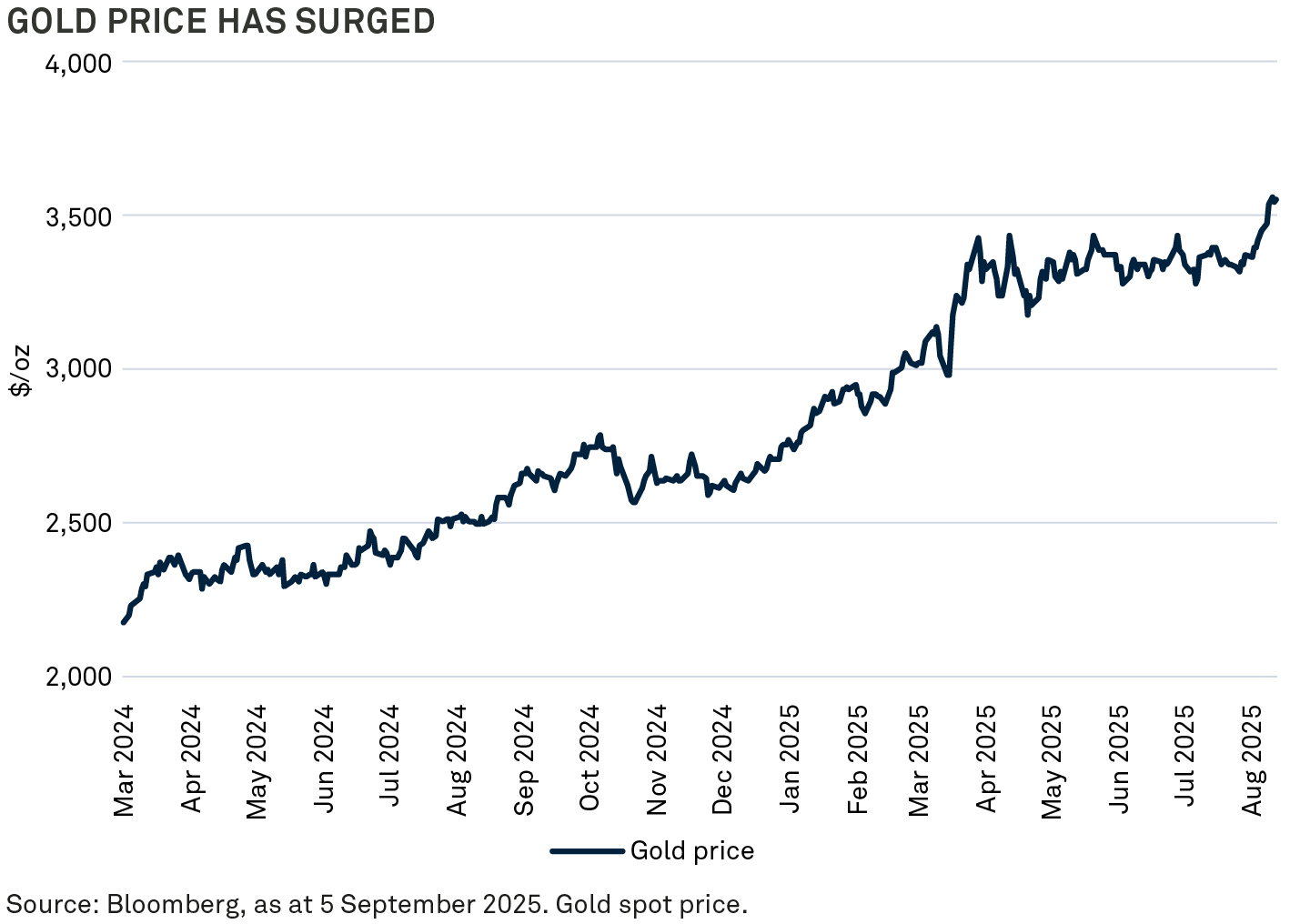

The strategy is also exercising caution in gold, which has rallied 35% year-to-date, supported, Flood believes, by foreign central banks’ preference for gold over US Treasuries in their reserves.

Despite this, Flood highlights that holidngs of physical gold ETFs have not increased substantially, suggesting potential for further price support if institutional and retail investors increase their exposure.

“The gold rally may continue, which may lead to continued performance in gold should those participants also come into the market,” says Flood. “However, for us, given the significant gold price appreciation we've seen year to date, we have trimmed our gold position back within this strategy.”

The value of investments can fall. Investors may not get back the amount invested.

2684750 Exp: 24 March 2026