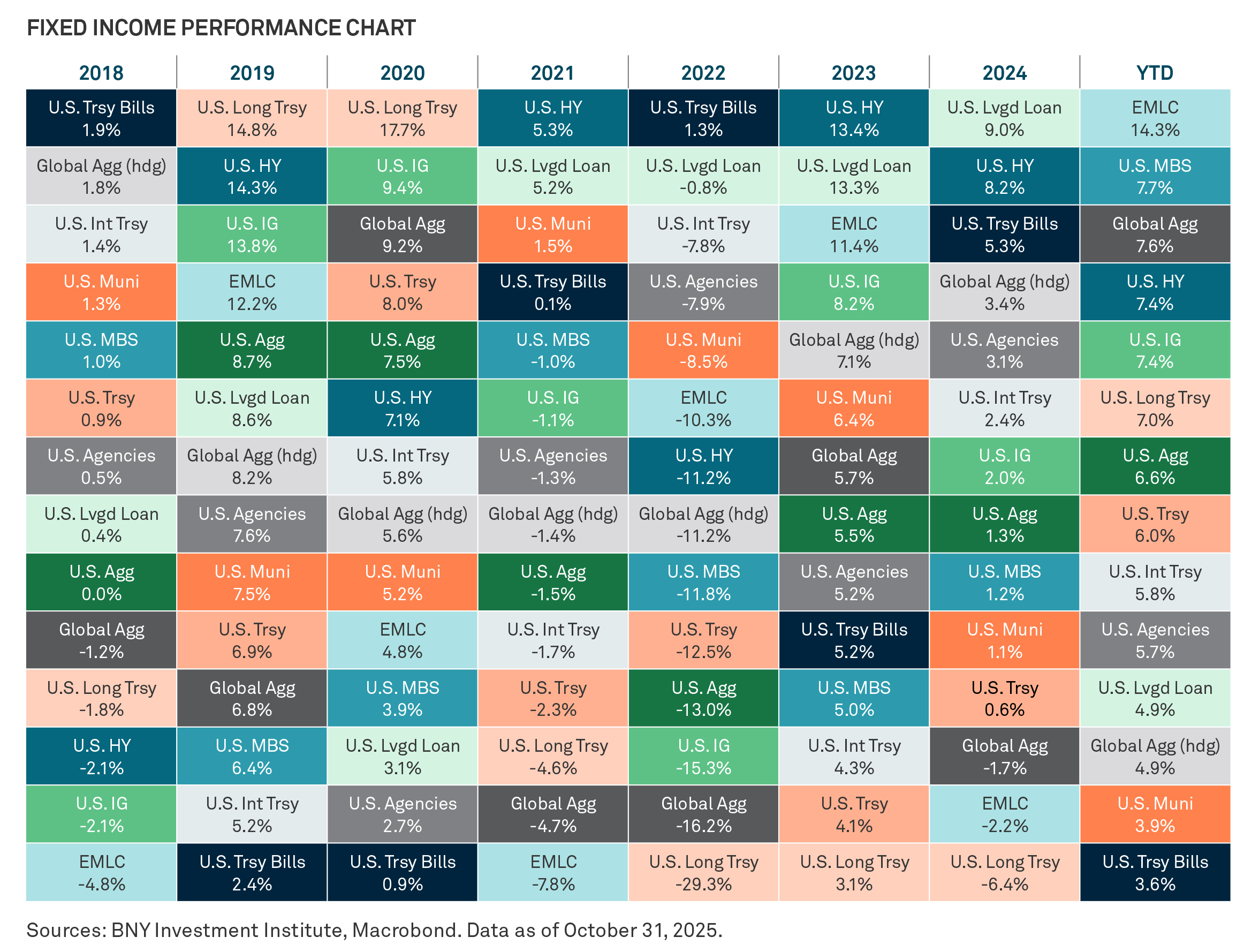

Leaders rotate in and out. No single fixed income sector consistently dominates performance over time, and strong performance in one sector rarely carries over from one year to the next. For example, U.S. Treasury bills led in 2018 and 2022 but are one of the weakest performers year-to-date.

Meanwhile, emerging markets local debt and global bonds, two of 2024’s worst performing sectors, have topped performance so far this year. Timing fixed income markets and predicting which sector will lead next is extremely difficult.

The key takeaway: diversification is essential. A well-balanced and active fixed income strategy with diverse exposure across sectors, credit, and geography may provide ballast to equities, be a potential source of income, and help mitigate risk.

This is an extract from Checkpoints, a comprehensive monthly chartbook that provides insights into major themes affecting financial markets. For additional analysis, read the full report.

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

GLOSSARY

EM Local Currency Government 10% Country Capped: The Bloomberg EM Local Currency Government 10% Country Capped Index is a country-constrained version of the flagship Emerging Markets Local Currency Government Index, which is designed to provide a broad measure of the performance of local currency emerging markets (EM) debt.

Global Aggregate: The Bloomberg Global Aggregate Total Return (USD hedged) Index is a broad-based measure of the global investment-grade fixed income market.

U.S. Agencies: Bloomberg U.S. Agencies Total Return Unhedged USD measures U.S. dollar–denominated agency debt.

U.S. Aggregate: Bloomberg U.S. Agg Total Return Value Unhedged USD Index is a widely accepted, unmanaged total return index of corporate, government and government-agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1–10 years.

U.S. Corporates: Bloomberg U.S. Corporate Total Return Value Unhedged USD Index tracks the investment-grade, fixed-rate, taxable corporate bond market.

U.S. High Yield: Bloomberg U.S. Corporate High Yield Total Return Index Value Unhedged USD Index tracks the performance of U.S. dollar–denominated below-investment-grade-rated corporate debt publicly issued in the U.S. domestic market.

U.S. Leveraged Loans: The Morningstar LSTA U.S. Leveraged Loan Index is a market-value weighted index designed to measure the performance of the U.S. leveraged loan market.

U.S. MBS: The Bloomberg U.S. Mortgage Backed Securities (MBS) Index tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC).

U.S. Munis: Bloomberg Municipal Bond Index Total Return Index Value Unhedged USD Index tracks the municipal fixed income market in the United States.

U.S. Treasury: The Bloomberg U.S. Treasury Index is the U.S. Treasury component of the U.S. Aggregate Index and uses public obligations of the U.S. Treasury with a remaining maturity of one year or more.

U.S. Treasury Bills: The Bloomberg U.S. Treasury Bill 3-6 Months Index tracks the market for treasury bills with 3 to 5.9 months to maturity issued by the U.S. government. U.S. Treasury bills are issued in fixed maturity terms of 4, 13, 26 and 52 weeks.

U.S. Treasury Intermediate: The Bloomberg U.S. Treasury Intermediate Index measures U.S. dollar–denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of 1 to 9.9 years to maturity.

U.S. Treasury Long: The Bloomberg U.S. Treasury: Long Index measures U.S. dollar–denominated, fixed-rate, nominal debt issued by the U.S. Treasury with 10 years or more to maturity.

Asset allocation and diversification cannot ensure a profit or protect against a loss.

Important Information

For sole and exclusive use by Institutional Investors, Accredited Investors and Professional Investors only. Not for further distribution. This is a financial promotion and is not investment advice. Any views and opinions are those of the investment manager, unless otherwise noted. The value of investment can fall. Investors may not get back the amount invested. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation. In Hong Kong, the issuer of this document is BNY Mellon Investment Management Hong Kong Limited, which is registered with the Securities and Futures Commission (Central Entity Number: AQI762). In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited, Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore.

GU-754-30 November 26