Insight Investment senior portfolio manager Harvey Bradley takes an opportunistic and active approach to fixed income and makes the case for global exposure.

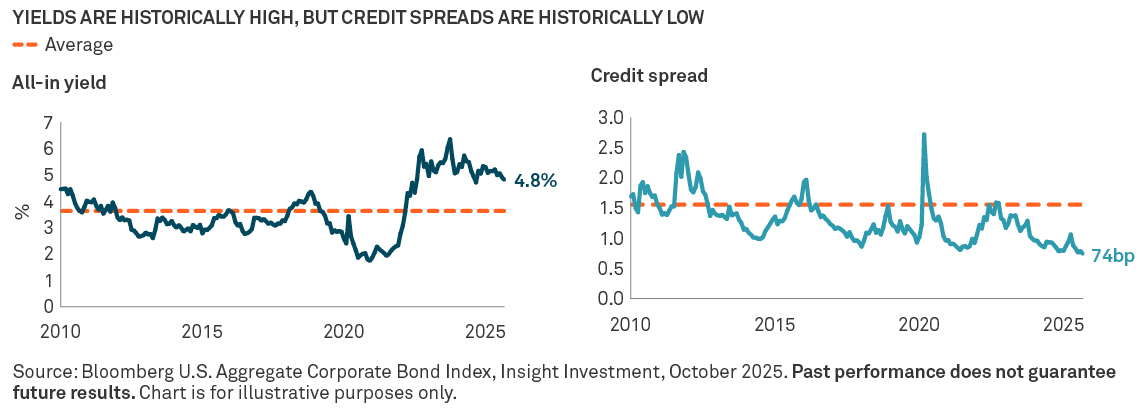

What should investors consider in a market where credit spreads are narrow, but yields are historically high?

Ultimately, we think yield trumps spread for most investors.

For those looking for regular and reliable returns from bonds, yield – absent default – is what they will get paid over the long term.

In most macroeconomic environments, we expect credit spreads and government bond yields to be negatively correlated and move in opposite directions. Since the pandemic, however, the monthly correlation of these two series has been -0.2.1 This means that waiting to invest at a wider spread will not necessarily guarantee a higher all-in yield.

This is not to say that credit spreads are not important. They are a key valuation metric, and current levels suggest stretched pricing. We think taking an active approach could therefore be important here. As an active player with a wide opportunity set, our approach is to be highly selective and keep some powder dry in case market sell-offs deliver opportunities.

Consensus estimates indicate the economy is slowing, is this a threat to credit?

Provided nominal growth remains comfortably positive, a slowing economy is not necessarily a problem for credit. A significant deceleration in economic activity would be a danger to credit, however. While a recession is not our base case, or projected by consensus forecasts, we cannot rule it out. With that in mind, we focus on compensation for risk.

Unfortunately, at present we find that many assets with lower credit ratings and lower liquidity do not generally offer that compensation. So, our current bias is to stay relatively high quality and relatively liquid to be ready for opportunities.

Is fixed income attractive for those concerned about US fiscal risks to the Treasury market?

We believe many investors, but particularly those concerned about US debt dynamics, may wish to consider expanding their exposure into a global fixed income approach.

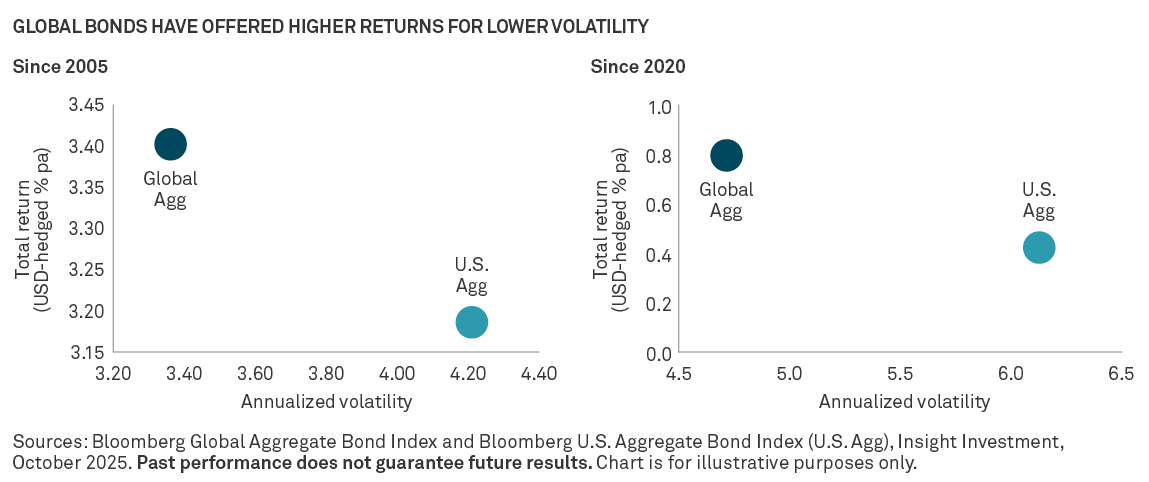

We do not advocate leaving the US behind entirely as a capital market of this size will also offer opportunities of some sort to the active manager. That said, global diversification increases the breadth of the investment opportunity and, historically, has yielded a less volatile return stream than single market strategies.

Global bonds have historically delivered higher returns for meaningfully lower volatility than US bonds on a currency-hedged basis. Since 2005, the US has never been the best performing country within the Bloomberg Global Aggregate Bond Index (Global Agg) in a calendar year.2

Global bonds also offer a larger universe for those with large enough global teams to mine alpha opportunities from. Such opportunities may be driven by rising monetary policy divergence and geopolitical uncertainty (relating to tariffs for example), which can create sectoral and security-selection based winners and losers across the globe.

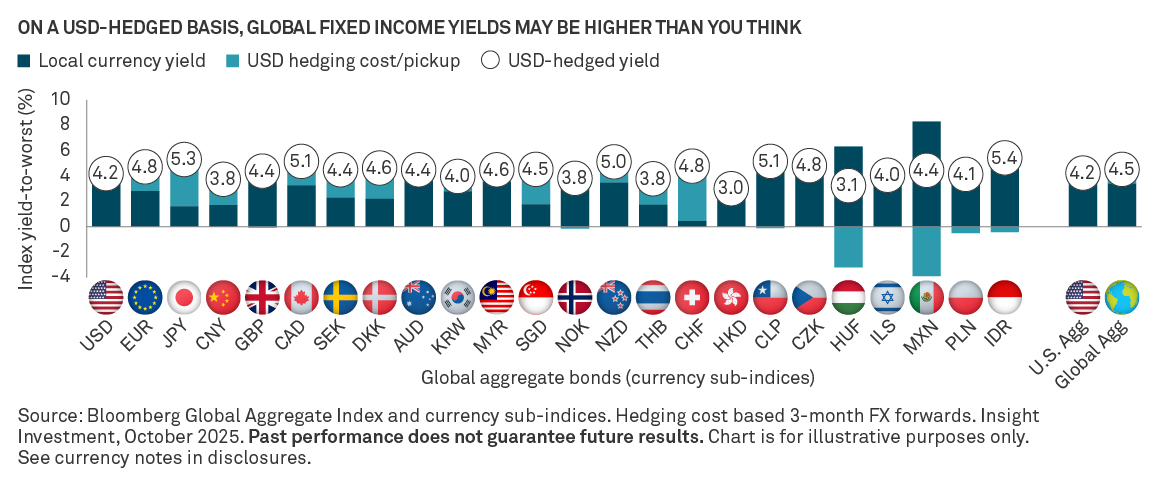

Given that markets like Europe and Japan have significantly lower central bank interest rates than the US, is that not likely to be a drag on global bond returns relative to the US?

That would be true if investing on an unhedged currency basis. But in a USD-hedged strategy, currency hedging costs are negative for markets like euros and Japanese bonds, which effectively add yield back to the strategy. Hedging costs are determined by short-term interest rate differentials.

For example, the Japanese yen portion of the Global Agg currently yields 1.6% in local currency terms, but 5.3%, when hedged to US dollars on a three-month basis, which is higher than the 4.2% yield on the US dollar component3.

On the flip side, the effect is the opposite for markets that have higher interest rates than the US, like Mexico. The Mexican peso share of the Global Agg yields 8.3% on an unhedged basis, but 4.3% on a USD-hedged basis.

But overall, because yields are mostly lower outside the US, the Global Agg yields 3.4% on an unhedged basis, but 4.4% on a USD-hedged basis, or slightly higher than the 4.2% yield on US bonds. In other words, global fixed income strategies do not force you to give up yield.

Could unhedged local currency global bond exposure benefit from a weakening dollar over time?

Yes, the upside of investing on an unhedged basis is the portfolio would likely gain from US dollar depreciation over time. In a hedged portfolio, currency fluctuations become irrelevant.

But currencies are highly volatile and can end up dominating the periodical performance of a bond portfolio. Fixed income investors typically look for a negative correlation against equities, which may be less reliable when assuming a high degree of currency risk.

What are the main risks to fixed income right now?

We are clearly in unusual and uncertain times, so there are many non-traditional as well as traditional sources of uncertainty.

On the immediate horizon, continued interest in US sovereign debt dynamics has meant greater sensitivity to US Treasury supply patterns. At the same time, foreign demand for US Treasuries may be about to weaken, which could be a challenge to the Treasury market. From a fundamental standpoint, a reacceleration in developed market inflation could limit the ability of policymakers to meet weaker economic activity with monetary stimulus. In our view, these remain tail risks, but tail risks of sufficient magnitude to meaningfully impact the performance of the asset class in aggregate.

Elsewhere, the ongoing recalibration of global trade may have unexpected side effects on private-sector demand.

Ultimately, we believe this justifies a value-based, diligent approach targeting security selection and diverse opportunities across the widest possible universe and fixed income sectors, with the flexibility to deploy capital quickly when value presents itself.

Currency

USD: U.S. dollar. EUR: Euro. JPY: Japanese yen. CNY: Chinese renminbi. GBP: Great British pound. CAD: Canadian dollar. SEK: Swedish krona. DKK: Danish krone. AUD: Australian dollar. KRW: South Korean won. MYR: Malaysian ringgit. SGD: Singapore dollar. NOK: Norwegian krone. NZD: New Zealand dollar. THB: Thai baht. CHF: Swiss franc. HKD: Hong Kong dollar. CLP: Chilean peso. CZK: Czech koruna. HUF: Hungarian forint. ILS: Israeli new shekel. MXN: Mexican peso. PLN: Polish zloty. IDR: Indonesian rupiah.

Alpha is a measure of selection risk in relation to the market. A positive alpha is the excess return awarded to the investor for taking a risk and beating the market. Basis point (bp) is one-hundredth of a percent.

Bloomberg Global Aggregate Bond Index is a comprehensive measure of the global investment-grade fixed-income market.

Bloomberg U.S. Aggregate Corporate Bond Index measures the investment-grade, fixed-rate, taxable corporate bond market. Investors cannot invest directly in an index.

Risks

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries. Currencies can decline in value relative to a local currency, or, in the case of hedged positions, the local currency will decline relative to the currency being hedged. These risks may increase volatility. Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines.

IN THE UNITED STATES: FOR GENERAL PUBLIC USE.

IN ALL OTHER JURISDICTIONS: FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS.

Disclaimer

The information contained herein reflects general views and is provided for informational purposes only. This material is not intended as investment advice nor is it a recommendation to adopt any investment strategy Opinions and views expressed are subject to change without notice. Past performance is no guarantee of future results.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue Eugène Ruppert L-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

©2025 THE BANK OF NEW YORK MELLON CORPORATION

MARK-836363-2025-11-06

1Bloomberg US Aggregate Corporate Bond Index, October 2025.

2Source: Bloomberg (Global Agg = Bloomberg Global Aggregate Bond Index, US Agg = Bloomberg US Aggregate Bond Index), October 2025.

3Bloomberg Global Aggregate Bond Index, October 2025

GU-744 - 7 November 2026