In today’s uncertain investing environment, understanding what’s driving markets is key to identifying risks and opportunities. This is the second report in a three-part series exploring the forces shaping global markets. The first report focused on the macroeconomic backdrop and central bank policy. In this edition, we examine the fixed income landscape, where evolving dynamics appear to be reshaping investor considerations.

At a glance

- U.S. bond markets have been more volatile than their peers this year and investors have appeared increasingly open to diversifying their investments globally.

- We would caution that 2025’s “sell America” trade has been a tactical trend, rather than a secular shift.

- There are, however, secular shifts in Europe, where we see opportunity.

- A disciplined approach to fixed income, and a diverse opportunity set may help investors add value to their portfolios and even potentially turn volatility to their advantage.

David Leduc, CEO, North America, Insight Investment1

Peter Bentley, Global Head of Fixed Income, Insight Investment

Brendan Murphy, Head of Fixed Income, North America, Insight Investment

Historically a favorable time

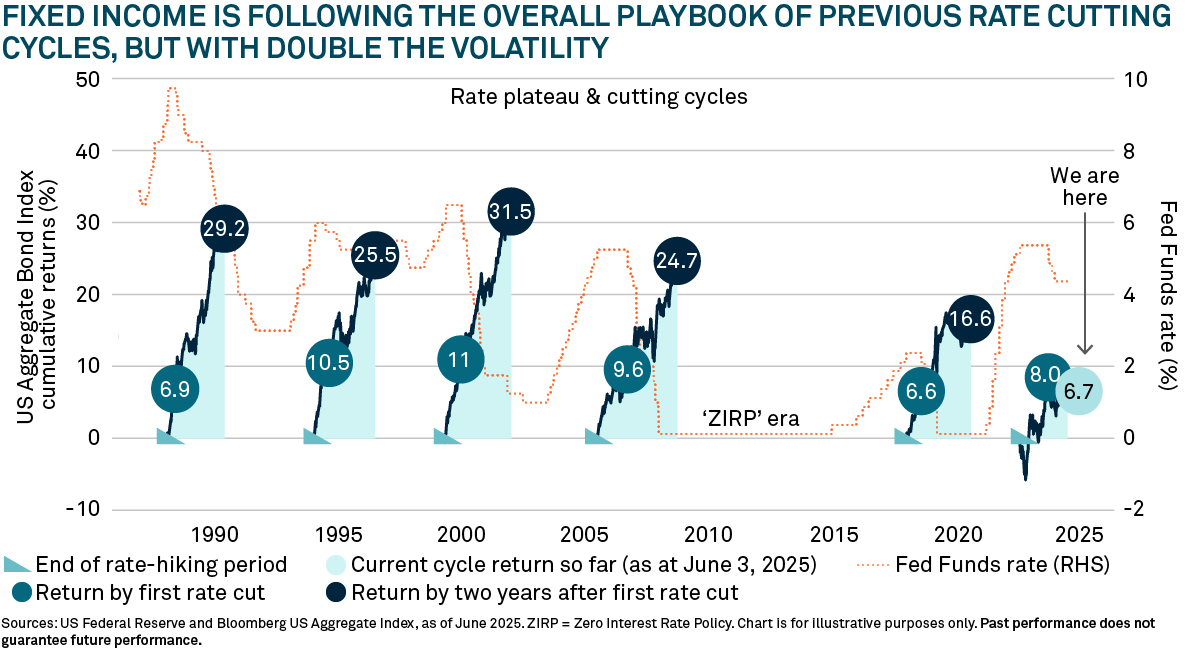

We are currently in a global rate cutting environment. These periods have historically been favorable for bond markets. During the last five cycles, U.S. bonds delivered total returns between 17% and 32%. So far this cycle, fixed income returns have been following the script overall, but with almost twice the volatility as in the past (Figure 1).

It’s important to keep in mind that bonds are contractual assets. Their long-term yields are locked in from the point of purchase (absent default).

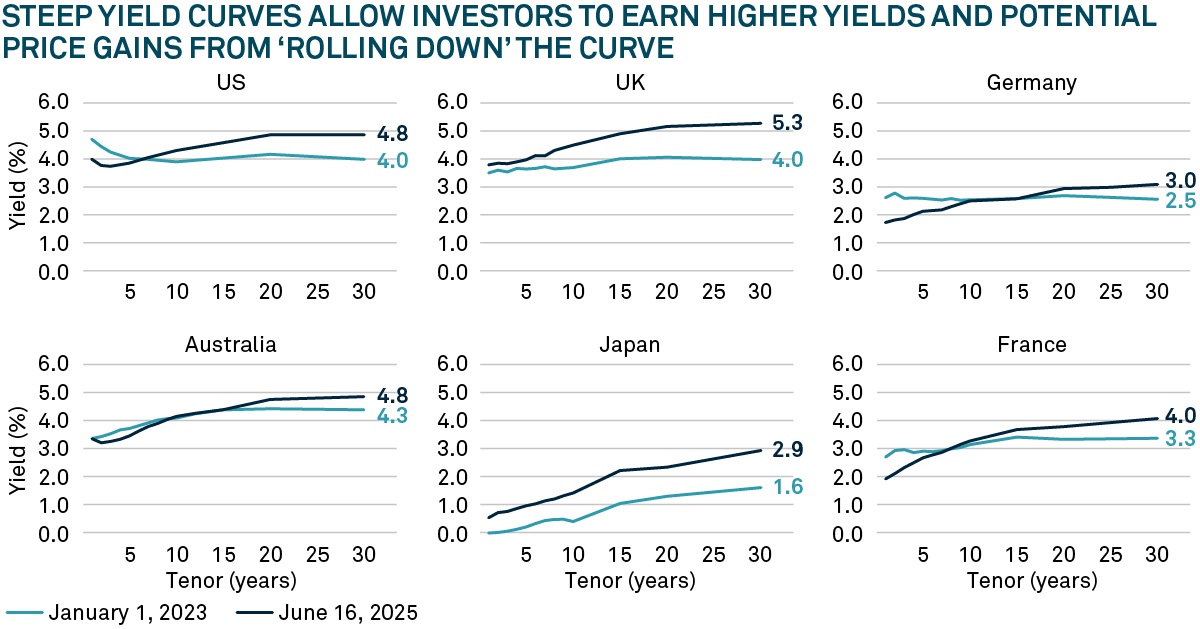

The good news is that those long-term yields have risen and can now offer a meaningful advantage over cash (Figure 2). When yield curves steepen, we also often see the potential for price gains from what is known as the “roll down” effect: as bonds move closer to maturity, yields tend to fall and prices often rise.

As such, building a robust bond market allocation could offer essential diversification and the added benefit of a potentially reliable return stream.

Source: Bloomberg, Insight, June 2025. The yield curve illustrates how yields across a country's government bond market differ by their remaining years until maturity. US, UK, German, Australian, Japanese, and French data represent the US Treasury, UK Gilt, German bund, Australian government bond (AGB), Japanese government bond (JGB) and French Obligations Assimilables du Trésor (OAT) markets respectively. Chart is for illustrative purposes only. Past performance does not guarantee future performance.

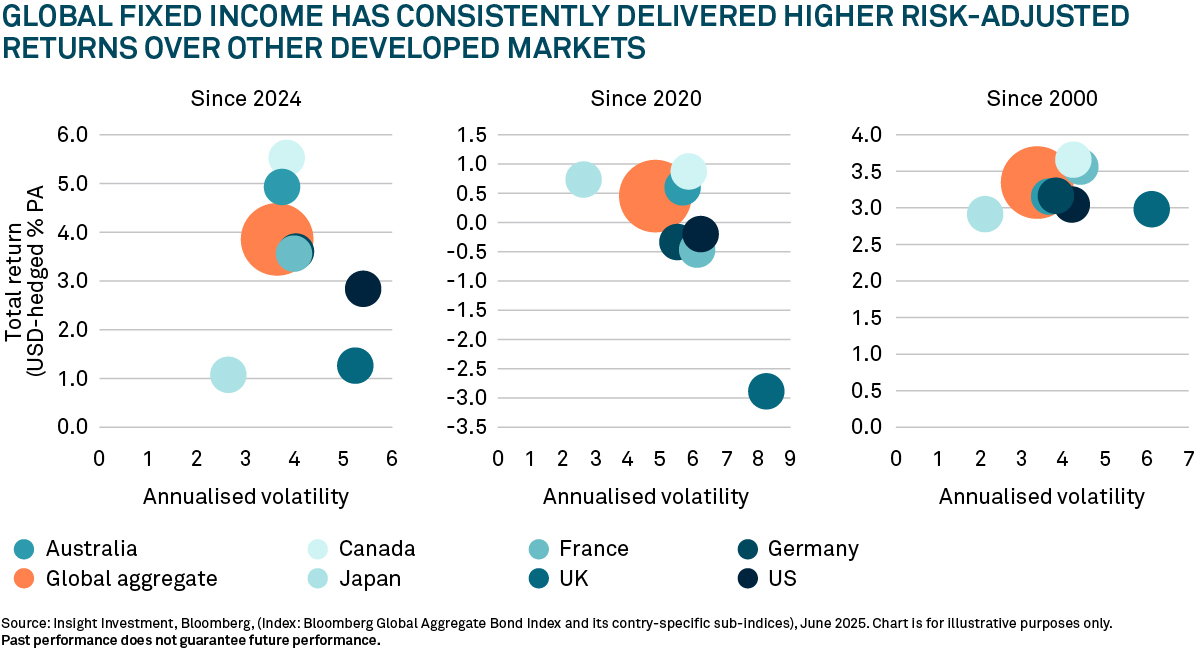

We have noted bond investors are also considering expanding their horizons beyond their home-base or domestic markets in an attempt to further smooth out volatility in their portfolios.

This has been particularly noticeable in the U.S. The administration’s hawkish trade policies have led to rising concerns about foreign demand for U.S. financial assets. As a result, U.S. bond markets have been more volatile than their peers over the last 18 months, performing out of step with historical norms.

Even U.S. Treasuries – generally considered the global “safe havens” of fixed income – have not been unscathed from U.S. market volatility this year.

In April, after “Liberation Day”, the S&P 500 Index suffered a 12.1% sell-off, but 10-year Treasury yields unexpectedly rose by 16 basis points (bp), suffering a temporary bout of dysfunction, partly on concerns about foreign demand2. Most of the U.S.’ developed market peers fared better however, with yields generally falling by 3bp to 20bp. Non-U.S. bond markets have also traded more in line with historical norms this year (Figure 3).

As a result, for the first time in recent memory, U.S. and international investors have appeared increasingly open to diversifying their investments globally. For many bond investors, this has meant re-thinking their particularly strong “home bias”.

As investors question their exposure to U.S. assets, we would caution that 2025’s “sell America” trade may have been a tactical trend, rather than a secular shift. When investing globally, separating the secular themes from the tactical trades impacting markets may be a key to success.

Opportunities in Europe

Although core European markets have outperformed the U.S. over the last 18 months, we believe investors need to be cautious. of the bloc’s longer-term structural challenges.

For example, energy costs are some of the highest in the world3 and provide a major roadblock to industrial activity, which is a consideration for corporate bond markets, while aging demographics also loom over the long term.

Nonetheless there are potentially encouraging secular shifts to consider. German politicians’ decision to amend the “debt brake” (a mechanism to limit government borrowing) earlier this year has the potential to unlock half a billion euros of defense and infrastructure spending.

This may have been a concern in government bond markets, reflected by German bunds initially selling off on the news. However, we considered the move to be an overreaction (and a potential investment opportunity) as Germany, given its budget surplus, may have the fiscal headroom to increase spending.

The spending may be beneficial for corporate bond markets, particularly for corporate issuers aligned to it, offering opportunities for sector and security selectors. In general, euro investment grade markets also offer a spread premium over their U.S. equivalents for (in our view) no clear fundamental justification, albeit this differential has come down significantly after hitting a ~70bp peak in 2022, in our view justifying a selective approach.

Looking deeper into Europe can also unlock opportunities. Peripheral Europe has been a bright spot in recent years. For example, Spain grew faster than any G104 country in 2024 and its sovereign spreads tightened against Germany and inverted against France. Elsewhere, European asset backed securities (ABS) markets (as with their UK and Australian counterparts) offer some clear advantages over U.S. ABS, such as lower default rates5 and more creditor-friendly environments in some markets. The continent also offers “esoteric” structured credit opportunities that can offer potential spread premiums over corporate bonds.

Opportunities elsewhere

UK bonds have come under pressure partly given the gilt market’s relatively high-interest rate risk. The 2022 gilt crisis was also a notable driver of volatility in recent years. However, looking at the debt management office’s supply intentions across the curve, we believe long-dated UK bonds may offer value for international buyers.

Elsewhere, Japan has been the “odd one out”. While ~70% of central banks last moved to cut rates, the Bank of Japan is still discussing hikes, given delayed inflation relative to other regions. Once it reaches the top of its rate cycle, it may enter its own fixed income “golden age”. We also see potentially compelling yield and spread opportunities in other regions, such as emerging markets, although downside risks remain, and opportunities differ by region.

The U.S. still offers what we see as unrivalled depth and unique opportunities

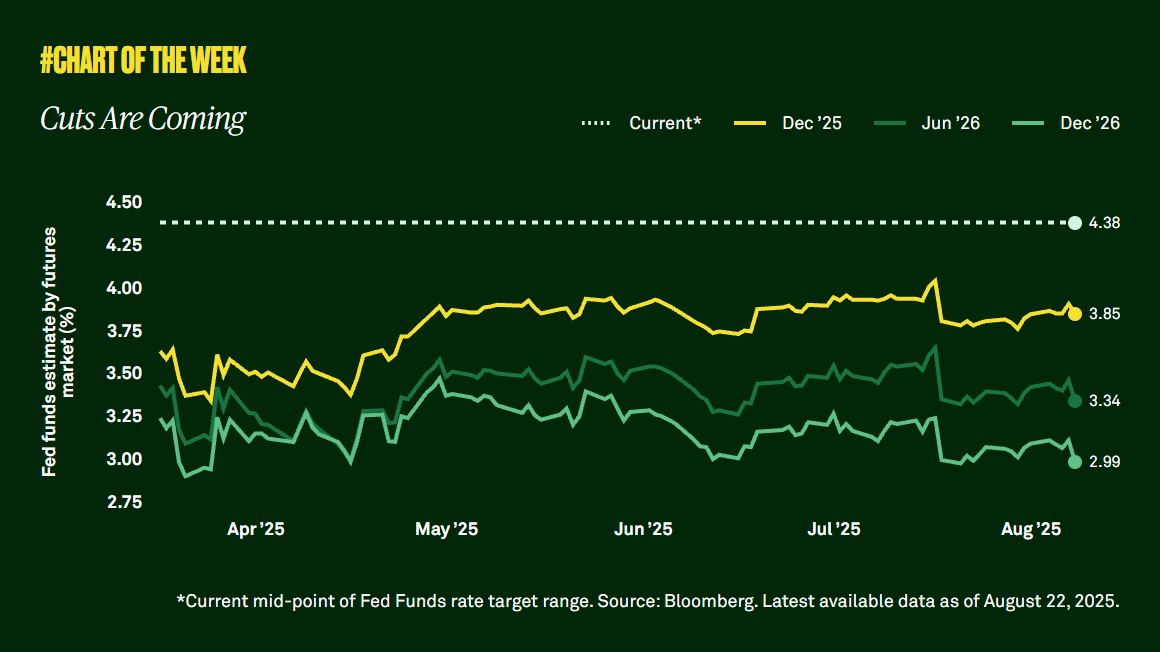

Looking beyond the U.S. should certainly not mean ignoring it. Ultimately, we see no alternative to the U.S. for reserve currency status. The debate about deficits and term premia – the additional yield that investors demand for holding longer-term versus shorter-term bonds – will continue. Repeats of the “Liberation Day” liquidity squeeze in long-dated Treasuries cannot necessarily be ruled out. However, if long-term Treasury yields were to reach the 5% to 6% region, we believe they would once again become attractive to many global investors. Further, the U.S. Federal Reserve (the Fed) would stand ready in the event of more severe disruptions, and it may be a matter of time before investors once again warm to long-dated U.S. duration exposure.

The U.S. market offers a number of opportunities that we believe global investors should consider. After all, its bond market is the world’s largest and most liquid. The US$7 trillion agency mortgage-backed securities (MBS) market alone is larger than most countries’ entire fixed income market capitalizations and is a market without a non-U.S. counterpart6.

Many opportunities also lie outside the mainstream, like so-called “esoteric” ABS, an asset class featuring innovative structures and asset types. It is a key vehicle for financing the digital infrastructure (like datacenters, fiber-optic cables and cell towers) powering tech innovation.

An intentional approach

Bonds may be well placed to withstand a challenging backdrop. Yet geopolitical uncertainty and volatility can still be difficult for investors to navigate. A disciplined approach to fixed income and a diverse opportunity set may help investors add value to their portfolios and even potentially turn volatility to their advantage.

About us

Our experts

David Leduc is Insight Investment’s Chief Executive Officer, North America, responsible for supporting the firm’s U.S. strategy and leading the U.S. management committee.

Peter Bentley joined Insight Investment in January 2008 and was promoted to Co-Head of Fixed Income in 2021, having been Deputy Head of Fixed Income and Head of Global Credit since 2018. He became Global Head of Fixed Income in 2024.

Brendan Murphy, is Head of Fixed Income, North America for Insight Investment. In this role, Brendan is responsible for overseeing the implementation of the fixed income investment process of the U.S. core, core plus, multi sector, U.S. rates, mortgages, insurance and U.S. investment grade credit strategies. Brendan is also the lead portfolio manager for the global aggregate strategy and mutual fund.

Insight Investment

Insight Investment is a global investment manager and fixed income specialist firm within BNY Investments.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

This is a financial promotion.

1 Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2 Liberation Day refers to April 2, 2025, when President Trump announced a widescale U.S. import tariff policy that included reciprocal tariffs to be imposed on various countries.

3 Source: Statista, Household electricity prices worldwide in March 2025, by country, June 2025

4 The Group of Ten (G10) consists of 11 industrialized nations that meet annually to discuss international finance. The member countries are Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the U.K. and the U.S.

5 Source: S&P Global, Default, Transition, and Recovery: 2024 Annual Global Structured Finance Default and Rating Transition Study, February 2025.

6 Source: Bloomberg US MBS Index, June 2025.

2535350 Exp: 12 January 2026