In today’s uncertain environment, understanding what’s driving markets is key to identifying risks and opportunities. This report is part of a series looking at the forces shaping global markets. Prior reports explored macroeconomic backdrops and the fixed income space. In this edition, we examine the equity landscape.

At a glance

- U.S. trade policy, mixed economic signals, and fiscal uncertainty is driving equity market volatility.

- While equity markets were resilient going into the summer, we believe volatility will persist.

- Certain investing styles, such as value, can offer a defensive tilt that can help enhance portfolio resilience.

- Diversification into segments with structural tailwinds, such as infrastructure and international equities, may help balance core allocations to broad equity strategies.1

John Porter III, Chief Investment Officer, BNY Investments Newton2

George Saffaye, Global Investment Strategist, BNY Investments Newton

Equity markets have experienced renewed turbulence in recent months. Investors are navigating a complex environment shaped by shifting trade policy, inconsistent macroeconomic data, softening labor market, and rising fiscal pressures. These forces are fueling uncertainty around growth expectations, inflation dynamics, and the future path of interest rates.

Tariff policy & geopolitical trade friction

Since early 2025, U.S. tariff policy has taken a protectionist turn. The introduction of the “Liberation Day” tariffs in April raised the average effective U.S. tariff rate from 2.5% to an estimated 27%, the highest in over a century3 . A subsequent 90-day pause on most reciprocal tariffs (excluding China) was announced on April 9, providing temporary relief. A baseline 10% tariff persists. Meanwhile, President Trump said in July that he may increase the rate from 20% to 40% for a number of countries.

Mixed growth signals in U.S.

The U.S. economy is delivering a patchwork of data. GDP growth remains positive, supported by fragile consumer spending and non-residential investment, but forward-looking indicators suggest a deceleration in momentum. Institute for Supply Management (ISM) manufacturing data, leading economic indicators, and small business sentiment surveys point to a maturing cycle with narrowing growth breadth.

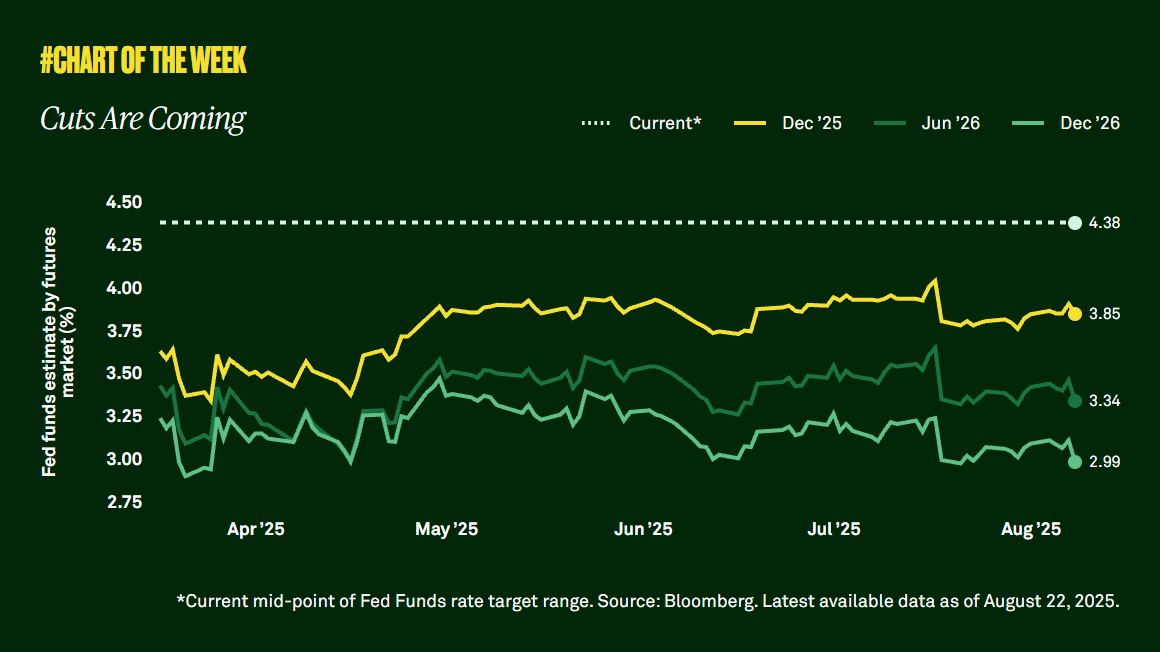

Equities have reacted with sensitivity to data points. Positive surprises often spark concerns the Federal Reserve (Fed) may delay rate cuts, while downside data often increase fears of a more abrupt slowdown or earnings recession. This push-and-pull dynamic creates a volatile environment for equity pricing, particularly in cyclical sectors like financials, transport, and materials.

A robust labor market starts to soften

Recent data indicate a mixed picture for the U.S. labor market. Ultimately, tariff volatility will likely begin to more meaningfully affect profits and business planning, with anticipated economic impact later this year.

Wage inflation creates margin pressure for labor-intensive industries such as retail, leisure, and healthcare. The employment backdrop also complicates the Fed’s ability to engineer a soft landing, as persistently strong job growth reduces the urgency to ease monetary conditions.

Fiscal uncertainty & rising government debt

An often-underappreciated contributor to equity market volatility is the deteriorating U.S. fiscal position. The Congressional Budget Office projects the debt-to-GDP ratio will exceed 130% within the next decade, and budget deficits are already tracking above $1.5 trillion annually—even in the absence of a recession.

President Trump’s 2025 budget significantly expands spending, while simultaneously advancing permanent tax cuts. This budget is expected to accelerate the structural deficit and force Treasury issuance to climb sharply, increasing upward pressure on long-term yields.

The Trump administration, led by Treasury Secretary Bessent, asserts that increased tariff revenues will generate sufficient funds to more than offset the budget deficits arising from expanded spending and permanent tax cuts. It argues that tariffs on imports will provide a substantial and reliable source of government income, helping to mitigate the fiscal impact of the structural deficit.

This perspective suggests, despite rising debt projections, tariff revenue could play a key role in stabilizing the fiscal outlook and alleviating upward pressure on Treasury issuance. Additionally, the administration believes lower taxes will spur economic growth in the U.S., further offsetting fiscal concerns. Investors remain skeptical these results will materialize.

Ultimately, higher sovereign borrowing costs feed directly into equity volatility. Rising yields compress equity valuations—particularly for long-duration growth assets—and crowd out private investment. Moreover, fiscal policy uncertainty increases the risk premium investors demand for holding equities, especially in interest rate-sensitive sectors like technology and real estate.

As Treasury supply continues to expand and the Fed steps back from active balance sheet support, equity markets are exposed to higher volatility through both interest rate and liquidity channels. One last thing to keep an eye on is the U.S. dollar. The U.S. dollar has experienced its worst start to a calendar year in decades. The DXY (an Index measuring the U.S. dollar’s strength relative to other currencies) fell by approximately 10% in the first half of 2025, marking its worst first-half performance since 1973. This translates to a substantial depreciation in the world’s reserve currency 4.

This depreciation reflects shifting investor sentiment amid evolving economic conditions, U.S. administration policies, and overall geopolitical uncertainties that bears watching.

Despite trade uncertainty and macroeconomic crosscurrents, equity markets were resilient in June and into July. Several factors helped to offset downside pressures:

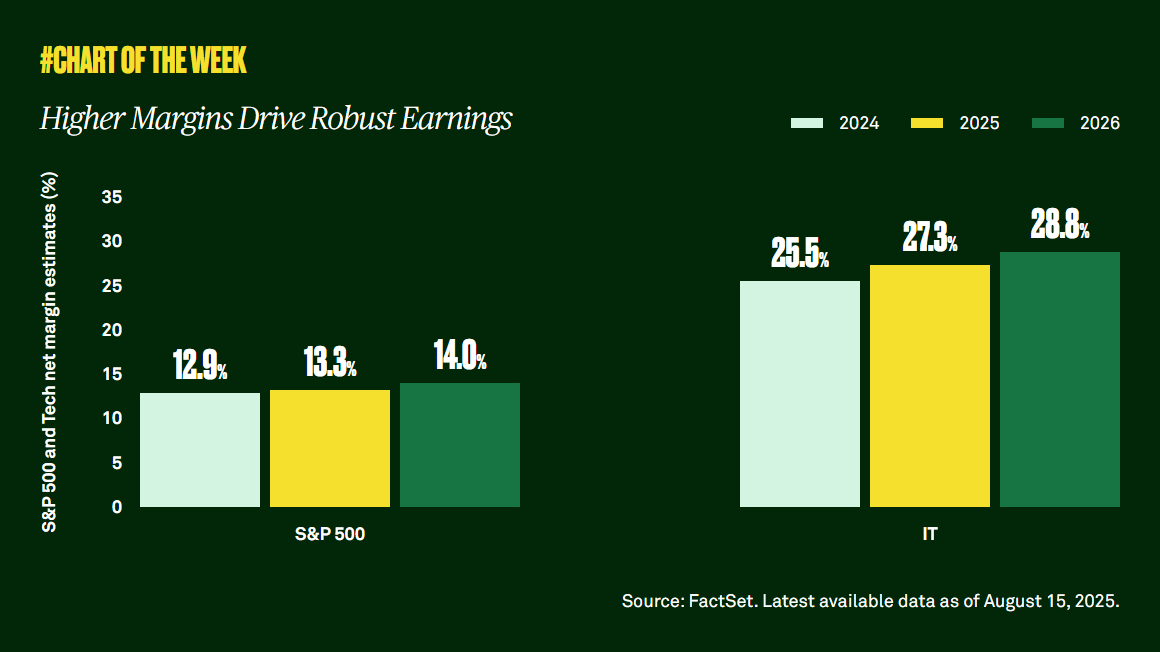

- Strong domestic demand and innovation in sectors such as technology and healthcare supported earnings with the S&P 500 projected to grow 10% in 20255 .

- A still tight labor market and solid consumer spending are boosting corporate revenues.

- The Fed’s signal of a possible late-2025 rate cut has helped anchor borrowing costs and support valuations.

Despite the recent resilience, equity market volatility is likely to persist. As firms reconfigure supply chains and hedge against future trade policy shocks, investors should be prepared for greater volatility in earnings and valuation multiples.

While volatility creates risk, it also presents an opportunity for selective positioning. In this environment, discipline, diversification, and a clear investment framework are critical.

Certain investing styles, such as value, can offer a defensive tilt that can help enhance portfolio resilience. Meanwhile, core allocations to broad equity strategies can be enhanced by diversification into segments with structural tailwinds, such as infrastructure and international equities.

Following an extended period of growth leadership, value investing has started to make a comeback given the changing backdrop. With inflation poised to be higher and more persistent, resulting in higher-for-longer interest rates, company valuations will likely play a larger role in determining the relative winners and losers in terms of stock price appreciation. Value investing has the potential to be an additional source of total return, complementing growth-oriented strategies, as well as providing diversification and risk mitigation, within an overall equity allocation.

However, not all value is created equal, and investors should avoid simply buying “cheap” stocks. While we stand by the comment that “there has never been more value in value,” there has also never been more “value traps” in the market.

We view “value traps” as companies that are “cheap,” but cheap for a reason and take up valuable space in a portfolio. We think it’s important to consider a company’s fundamentals, which will help it hold up in periods of heightened uncertainty and volatility, and its business momentum—what will close the gap between its current share price and its true intrinsic value.

We believe this could be the start of a longer-term, more sustainable period for value leadership in the U.S. equity markets. As discussed above, the Trump administration’s long-term pro-growth policies will likely come with short-term “disruption.” Companies with stronger fundamentals, current earnings and cash flow growth, and less demanding valuations have historically been able to weather periods of economic uncertainty better than their lower-quality peers.

Over the medium- to longer-term, the administration’s pro-growth policies will likely stimulate value-oriented areas of the market, like energy and financials. Furthermore, we think artificial intelligence will start to “spread the wealth” to Main Street and not remain concentrated in companies residing in Silicon Valley.

Global infrastructure emerged as a standout performer in the first half of 2025, outperforming many traditionally riskier asset classes during a period of heightened volatility6. The sector’s strong year-to-date performance builds on momentum from 2024, particularly in U.S. utilities, which benefited from a turnaround in electricity demand and AI-driven data center expansion.

Supportive policy trends in Europe, where the German fiscal stimulus package and the European Competitiveness Compass created a favorable environment for European infrastructure, also fueled the year-to-date rally.

Historically, the asset class has offered diversification as well as inflation mitigation relative to global equities. These characteristics have become especially valuable in today’s volatile environment.

Looking ahead, we see multiple tailwinds for infrastructure:

- Domestic Focus: Many infrastructure businesses are less exposed to global trade dynamics and derive revenue from stable, regulated domestic markets.

- Inflation-Linked Cash Flows: Core segments—such as utilities, pipelines, and transport—often feature inflation-indexed pricing through long-term contracts.

- Electrification: We anticipate increased infrastructure spending as governments seek to meet rising electricity demand from AI and reshoring.

- Grid Upgrades: Even without AI, there are rising electricity needs. For example, the U.S. electrical grid has been underfunded for decades, and there are growing concerns that it could collapse by the end of the decade. We believe regulated utilities will need to upgrade their infrastructure to meet growing electrical demand.

While these assets are not immune to market fluctuations, they tend to be more resilient. Their business models are typically less cyclical, and revenues are often contractually protected. In our view, the long-term outlook remains constructive, especially given structural themes such as decarbonization, grid modernization, and supply chain realignment.

As investors seek shelter from rising volatility and macroeconomic uncertainty, infrastructure may offer a compelling combination of defensiveness and long-term growth potential.

There has rarely been a more interesting time for international equities, from both a macroeconomic and country perspective.

For decades, U.S. equities outperformed global peers, driven in part by the outsized influence of the “Magnificent Seven” technology giants7. While this period of outperformance was notable, it also resulted in a highly concentrated market.

However, market performance this year points to a rebalancing. During the first quarter of 2025, the S&P 500 declined more than 4%, its worst quarterly performance since the first quarter of 20228.

We do not interpret the notable market move as an end of “U.S. exceptionalism.” Instead, we believe the recent volatility suggests a normalizing and rebalancing of a market that had previously experienced robust but narrow growth.

Though the U.S. market has rebounded since the rocky first quarter, we view Europe’s relative strength earlier this year as evidence of a structural shift. In our view, investors are reallocating toward international exposure and will continue to seek diversification and value outside of the U.S.

Opportunities in international markets

In Europe, we’re seeing substantial regulatory and political change. Considering the U.S.’ protectionist stance, Europe is laying out a path toward innovation and increased global competitiveness. The European Competitiveness Compass sets a roadmap for the region to become a leader in the development of technologies, services, and clean products, while Germany’s bumper fiscal package aims to boost the country’s infrastructure and defense.

Japan, too, is changing. After years of economic stagnation and muted shareholder returns, we believe Japanese companies are shifting toward more shareholder-friendly practices, emphasizing capital efficiency and corporate returns.For example, energy costs are some of the highest in the world3 and provide a major roadblock to industrial activity, which is a consideration for corporate bond markets, while aging demographics also loom over the long term.

We see opportunities across selected international sectors:

- Industrials: The sector, particularly in Europe, is expected to benefit from increased fiscal and energy spending.

- Healthcare: There are opportunities where the product cycle, driven by past investments in innovation, are strong enough to withstand negative impacts from tariffs.

- Financials: The sector should benefit from strong capital positions combined with the macro factors discussed in this report.

Overall, international equities are trading at a discount to U.S. markets, which presents opportunities for active international stock pickers. In this volatile environment, buying the right assets at the right price is a key to both risk management and alpha. It’s also important to focus on the fundamentals and long-term drivers of companies. We believe companies that have strong assets (differentiated products, strong cashflows and robust balance sheets) and attractive valuations provide opportunities for idiosyncratic stock selection.

Resilience versus reactivity

Equity volatility is likely to remain for an extended period. As markets continue to absorb shifting policies and economic signals, diversification and long-term discipline are essential. In our view, resilient positioning, not reactive shifts, will be key to navigating uncertainty while staying aligned with long-term objectives.

About us

Our experts

John Porter III is BNY Investments Newton’s Chief Investment Officer. Porter joined Newton in September 2021, following the integration of Mellon Investments Corporation’s equity and multi-asset capabilities into the Newton Investment Management Group. Before joining Newton, John was chief investment officer at Mellon Investments Corporation. Earlier roles included head of equity, active equity chief investment officer, and senior portfolio manager at Mellon and The Boston Company Asset Management (both BNY group companies).

George Saffaye is BNY Investments Newton’s Global Investment Strategist. Saffaye is a global investment strategist guiding the messaging and positioning of the Thematic Equity, U.S. Large Cap Growth Equity, U.S. Small Mid Cap Growth Equity and Global Natural Resources strategies. He joined Newton in September 2021.

BNY Investments Newton

BNY Investments Newton seeks to deliver strong outcomes to clients across active equities, income, absolute return (including fixed income), multi-asset (both fundamental and systematic), thematic and sustainable strategies.

See more research from BNY Investments on our Insights page: www.bny.com/investments.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

This is a financial promotion.

1 Tailwinds refer to favorable conditions that can support growth.

2 Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

3 BNY Investment Institute.

4 Bloomberg, July 2025.

5 Newton Investment Management.

6 Bloomberg, July 2025.

7 The Magnificent 7 refers to a group of seven major technology stocks that have significantly influenced the market’s performance. This group includes Alphabet, Amazon, Apple, Broadcom, Meta Platforms, Microsoft, and NVIDIA.

8 Bloomberg, Wall Street Journal, March 31, 2025.

2535350 Exp: 12 January 2026