At the annual BNY Investments UK conference titled “A New Era” held at the Corinthia hotel in London, Newton Investment Management’s deputy head of equity income, John Bailer set out to convince investors that there is real value in the American market.

Key takeaways:

- Bailer sets out Trumps tariffs as a tool, a deliberate policy to slow the economy initially, reduce the trade deficit, generate revenue for extending and adding tax cuts, and ultimately create a more favourable market environment over a multi-year horizon.

- Trump is mirroring early Reagan. Early economic pain such as recession and higher unemployment, similar to the Reagan administration’s experience with high interest rates, can precede gains like reduced inflation, tax cuts, deregulation, and market growth.

- The decade of zero interest rates created an environment favouring growth stocks with high multiples, but with rising rates and slowing earnings growth for expensive stocks, a rotation toward value stocks with lower multiples and better downside protection is expected.

- Upcoming tax policies including permanent extensions of tax cuts, R&D credits, and incentives for manufacturing are expected to stimulate economic growth and benefit certain sectors like financials, especially with anticipated deregulation.

“I believe the common narrative is that President Trump and this administration don’t know what they're doing, and that these tariffs are really bad for the economy and the US economy is going to go into a tailspin. I'm going to make the case that maybe there's a plan here in terms of what this administration is doing.”

John Bailer set out a clear incentive at the beginning of his presentation, to provide an underlying method to the madness (as headlines would have investors believe) of Trump’s first 100 days in office.

Bailer believes Trump’s plan has three components:

1) To slow the economy with the announcement of tariffs.

2) To use the savings from the tariffs for tax cuts, specifically to extend the 2017 tax cuts which are due to expire at the end of 2025.

3) And to pay for those tax cuts with additional tax cuts.

Bailers insists: “Trump has a legacy he really cares about. So, I think what matters is what's going to go on four years from today, not what's going on today.”

With this belief that Trump is setting up a better economy for the next President to inherit in just under four years’ time, Bailer shares his key rationale for believing in Trump’s strategy – that it’s already been done, and successfully.

A return to Reagan

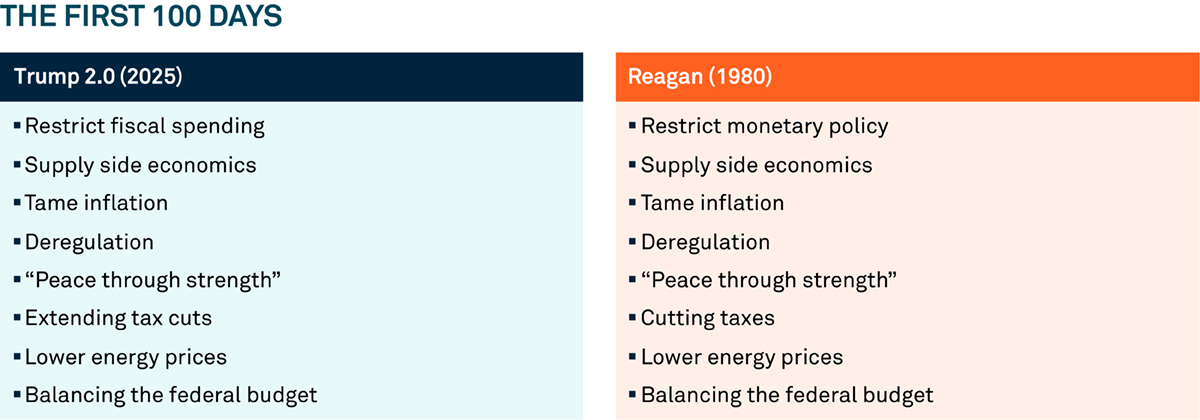

In 1980, President Ronald Reagan implemented a lot of policies that Trump 2.0 appears to have mirrored in the first 100 days of his second term.

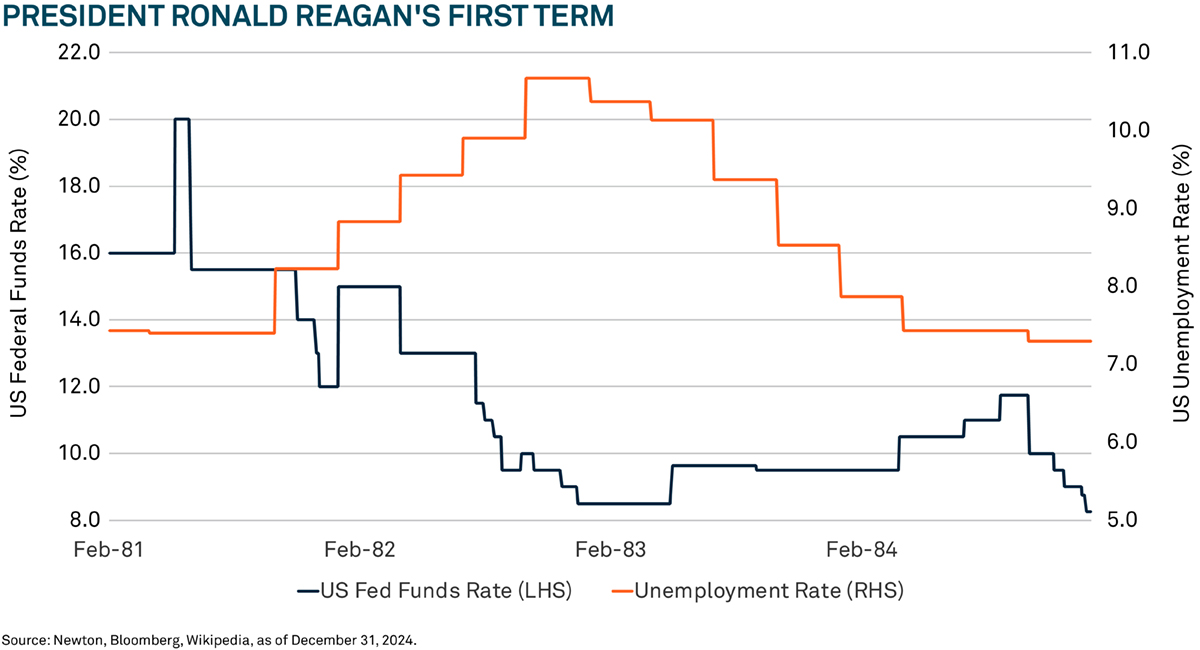

“What happened during Reagan's first term as President? He had Volcker doing his dirty work, which was raising the Fed funds rate. And you can see the Fed funds rate got to 20% early on in the administration. It caused a recession, and it caused unemployment to go up pretty meaningfully.”

As the chart above demonstrates, this fund rate hike didn’t last through the Reagan administration, but the unemployment rate did drop.

Bailer believes that, like Volcker and Reagan, Trump is creating a lot of pain at the beginning of his term with his tariff policies.

“There is no doubt that most of us don’t believe that tariffs are a good policy long term,” says Bailer. “But I think it is helping in terms of getting inflation down at the beginning part of the term by slowing the economy.”

Bailer goes on to explain that he believes Reagan was elected because of inflation in the late 70’s hurting Carter’s prospects as an opponent. This, he thinks is mirrored with Trump, Biden and Harris and is the catalyst for Trump’s tariff policies.

“By causing some pain early on, going into a recession, maybe even having a little higher unemployment, that stamps out inflation.”

Despite the early pain in Reagan’s presidency, he was elected for a second term.

Bailer argues, that by following Reagan’s footsteps, Trump is demonstrating a focus on winning a second election in his favour. Though he is dubious Trump will get a third term.

Taxes and regulatory savings

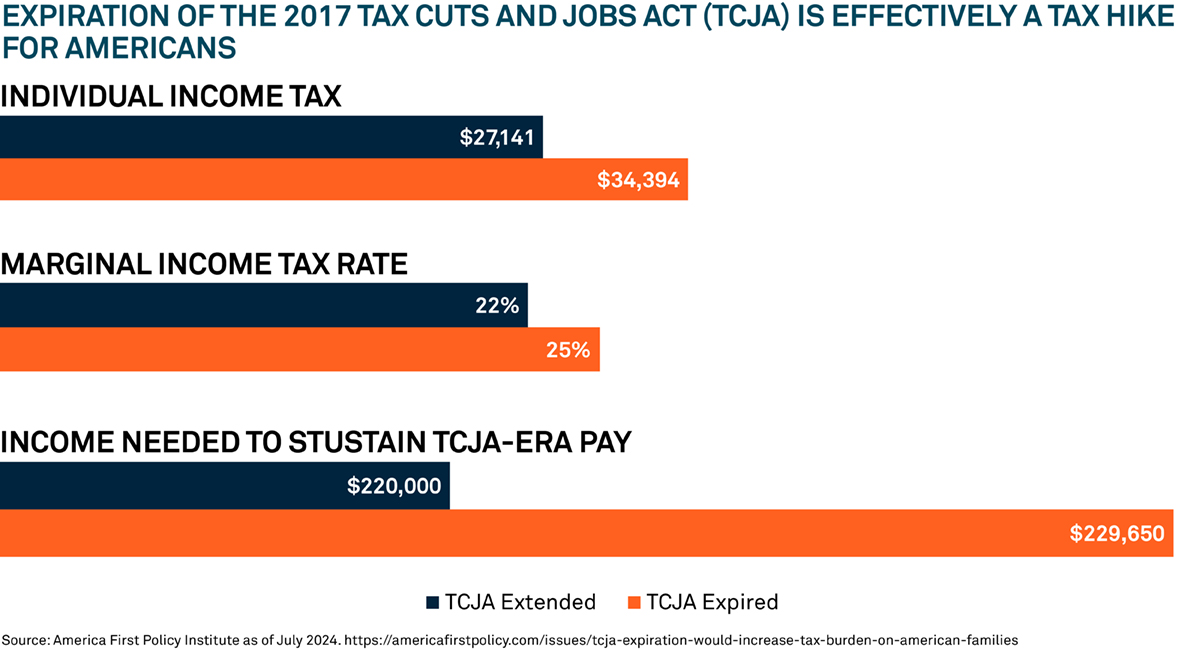

Bailer highlights that a lot of the reporting on the tariffs focuses on the doom and gloom aspects, however he insists there are bright spots: “One of those is taxes. You can see (in the below chart) if we don't extend those 2017 tax cuts, how much more individuals would pay.”

Sample taxpayer:

▪ Married couple with two young children in Pennsylvania without owning property.

▪ Combined annual salary: $220,000.

▪ In 2026, pay $6,800 in state and local income taxes.

▪ Upon TCJA expiration, the family would pay $7,240 more in income tax, and 3% higher marginal tax rate.

▪ Family would need to earn $9,650/yr more to sustain take home pay equal to the TCJA tax cut era.1

Bailer says this would be a real negative in terms of economic growth for the US and as such, believes that Republicans will pass Trump’s so-called big, beautiful bill.

“I personally think there should be more pro-growth type of tax policy in this plan. Right now, it doesn't look like we're going to get a corporate income tax reduction, but maybe that'll come with this Senate looking at it.”

There’s also a possibility according to Bailer that these tax cuts could be permanent, a marked difference from 2017. He believes this will prove useful for reinvestment and R&D.

“That's going to encourage more manufacturing in the US, and there are companies that we own in the portfolio that would benefit specifically from more US manufacturing, and more jobs coming back to the US,” he says.

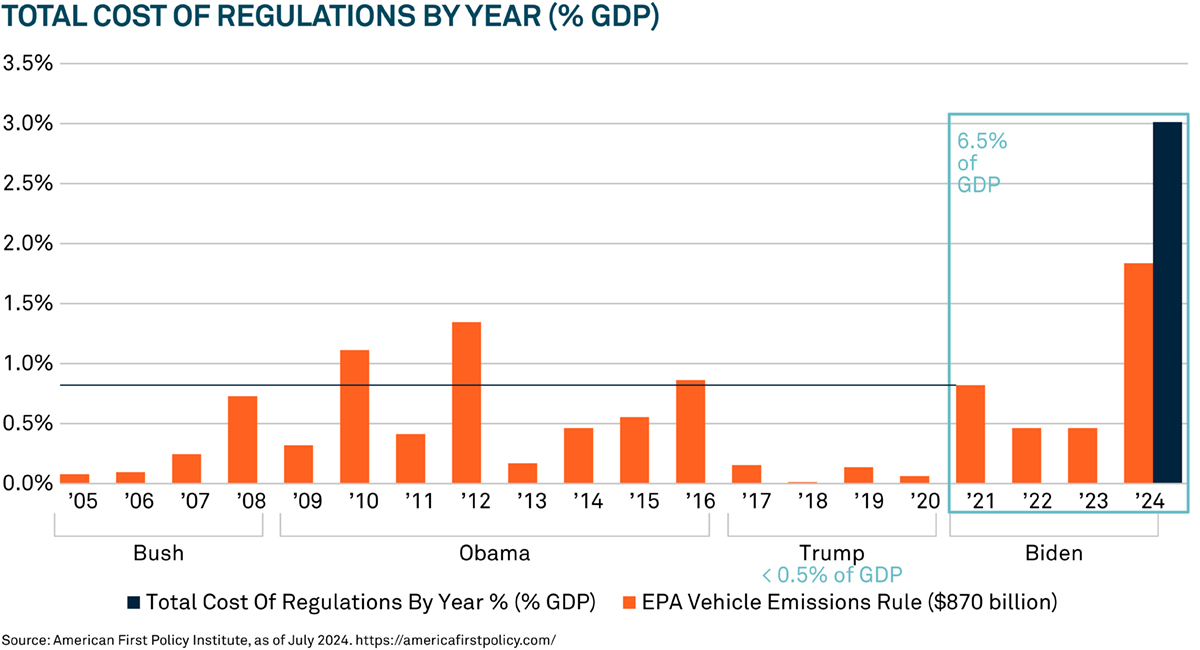

Bailer also highlights the potential regulatory benefit, which he believes will be particularly beneficial for financials.

The chart below demonstrates that the cost of regulations was significantly lower under Trump than both Obama and Biden. Bailer believes that returning to lower regulatory costs could be “really meaningful in terms of equity”.

“This takes time,” says Bailer. “You're not going to see it right away. This is something that I think President Trump hopes that you're going to see four years from now during the next Presidential election in terms of less regulation on businesses.”

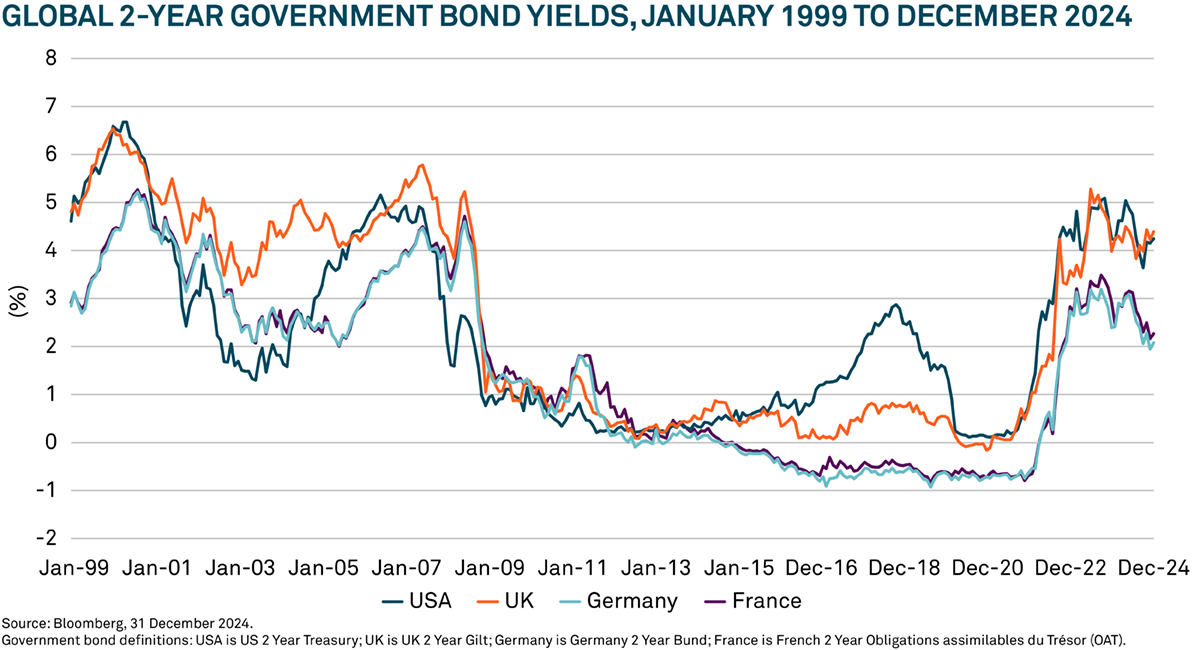

The chart above illustrates that in the decade since the global financial crisis there has been what Bailer calls a “very unique” environment of zero rates.

“I think you have to be very suspect on the companies that have done well, the multiples that you're looking at. I see so many analysts go back and look at last 10-year multiple rates for companies,” he explains. “I would argue, I'm not so sure you should be using the last 10 years. This is an unusual period in history of ‘free money’, zero rates. You should also be a little sceptical of the companies that did well over those last 10 years.”

He explains that financials were burned by zero rates, and they tend to do better in higher rate markets.

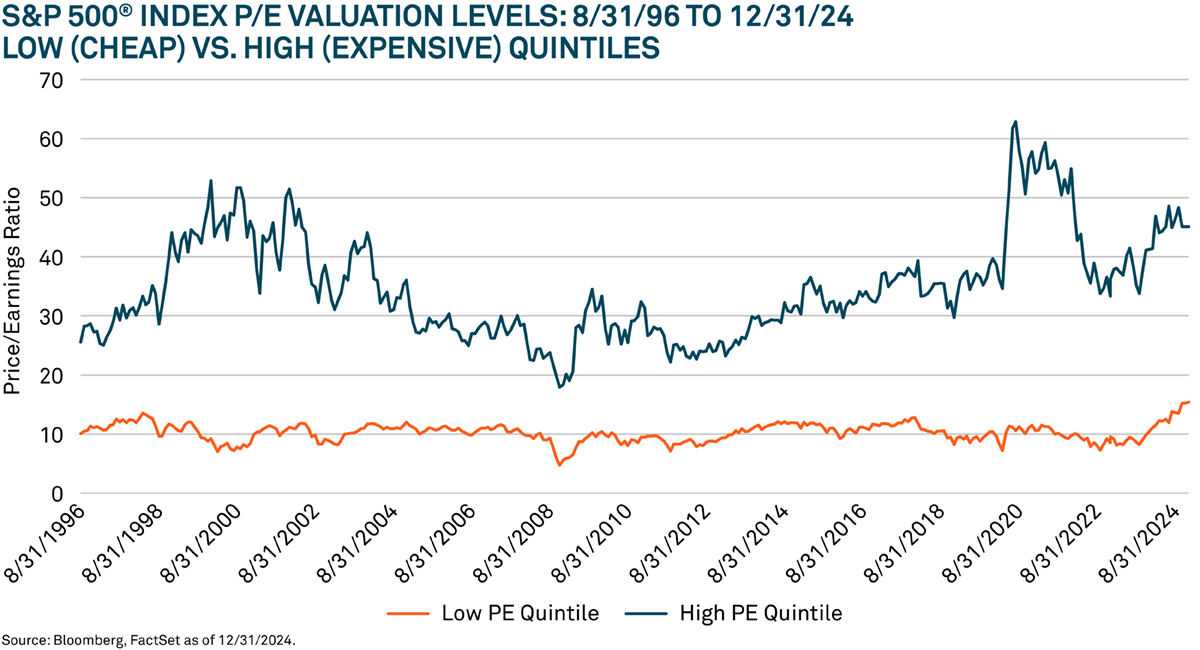

‘Free money’ also caused the S&P 500 P/E ratio to be elevated, says Bailer.

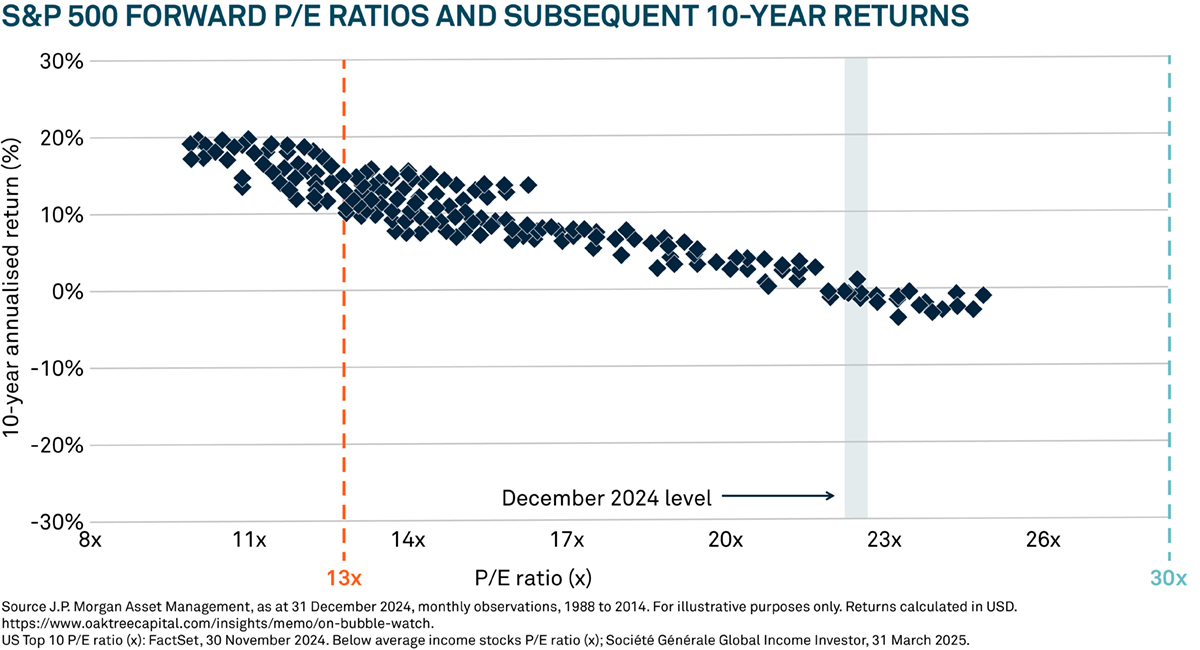

“The US market is pretty expensive. If you look at a 22 times P/E multiple, there’s a pretty good regression line, you tend to get 0% returns over the next 10 years. But luckily, we're an active manager, we're a value manager.”

Bailer says that he does not have to buy from the S&P 500 and that he is has the agility to buy stocks trading at 13 times; which he believes to generally have better return expectations over the next 10 years.

“Even if we have a low return environment in the US - income, dividend yield is going to be a big portion of that, much bigger than it has been over the last 10 years.”

There have been 16 years of growth outperforming value stocks. The top dark blue line (see chart below) is the most expensive P/E quintile of the S&P 500, and the orange line is the least expensive. The gap between the two is wide.

Earnings growth poised to normalize before chart with magnificent 7 earnings growth , current (%)

“I think there's real risk in overpaying for those expensive stocks, which everybody loves. And I think there is some catalyst here for that to reverse itself.”

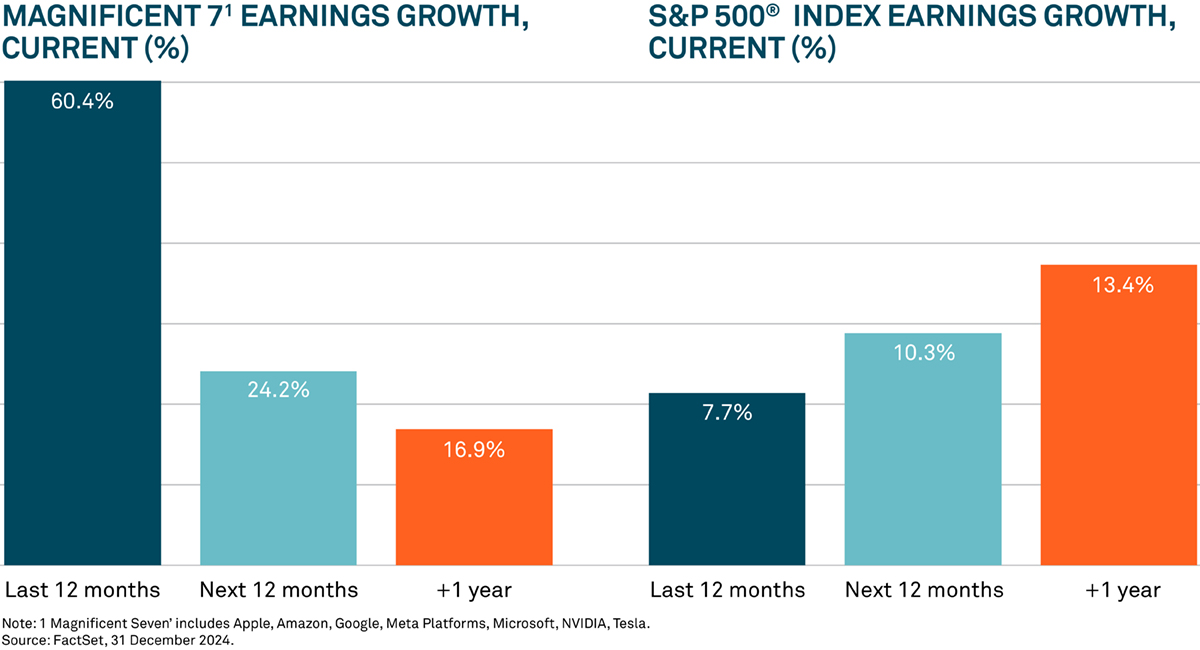

Bailer believes that those expensive stocks, and more specifically, the Magnificent 7 are likely going to contract when compared with the rest of the market.

“There's a reason people were paying so much for those growth stocks, because they were growing so much faster. But if you look, over the next 12 months that really narrows,” says Bailer. “I think that's a good argument for why the multiple compression will happen from those most expensive stocks.”

It's clear that Bailer has an eye for history’s patterns – whether it’s the connection between two Presidents, or stock bubbles bursting.

Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

1TCJA expiration would increase tax burden on American families, America First Policy Institute, as at July 2024

2504609 Exp: 31 December 2025