BNY Investments Newton’s Global Real Return portfolio manager, Lars Middleton, discusses the value of risk overlay strategies in an era of tightening market correlations and unprecedented idiosyncratic risks.

Key points:

- Bonds are no longer a reliable hedge to equities, demanding more sophisticated diversification strategies.

- The rapid pace of technological development and increasingly divergent monetary and fiscal policies are exacerbating market uncertainty.

- Tail-risk hedging is a strategy that, while not often used, is designed to help mitigate losses caused by market volatility at a lower cost.

The era of ‘easy money’ is over and the traditional safeguard of diversification, predicated on the negative correlation between bonds and equities, is increasingly unreliable. Additionally, higher interest rates and the swift progress of technologies like artificial intelligence (AI) are intensifying market pressures, forcing companies to justify their valuations without the cushion of ample capital. These market dynamics demand an updated investment toolkit that moves away from traditional equity and bond diversification strategies and is rooted in a keen awareness of liquidity, valuation and concentration risks for a more resilient return stream.

No safe haven

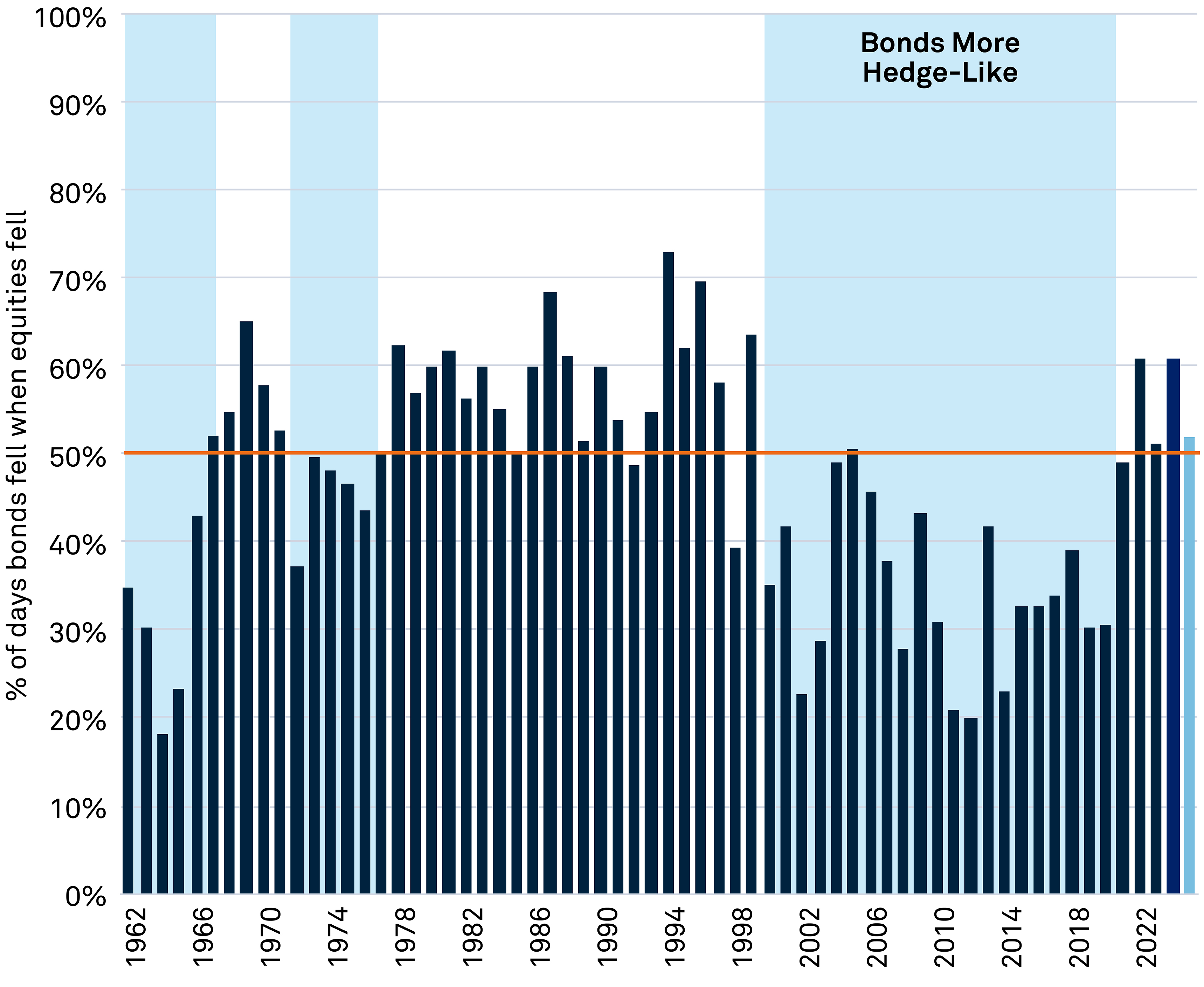

Historically, bonds have served as a hedge against equity market downturns, often delivering positive results when equities are under pressure. However, recent market dynamics indicate a notable shift from what was a reliable diversification strategy between 2000 and 2020. Since 2020, markets have reverted to a regime where bonds are a less effective hedge. This shift was exemplified in 2022 when both bonds and equities sold off simultaneously. On days when equities were in negative territory, bonds fell in tandem 60% of the time in 2022 compared to just 35% of days on average in the previous two decades.

% of Days Bond and Equities Fell Simultaneously

Source: BofA Global Research. Data from 2 January 1962, to 26 September 2025. Based on the 7-10 Year US Treasury Index (G402) from its inception; prior returns simulated using changes in 10-year US Treasury yields multiplied by duration.

The rapid pace of technological development continues to amplify idiosyncratic risks facing companies. Consider that the launch of China-based DeepSeek’s cheaper AI model sparked a massive $589bn single-day loss in US technology company Nvidia in a five-sigma event1. Despite Nvidia’s subsequent recovery to new highs, it shows how fast-moving competition in AI can affect companies heavily reliant on AI chip demand. Moreover, the concentration risks of the dominant ‘magnificent seven’ US technology stocks can cause havoc when elevated expectations start to unravel.

A changing world order

Another observable shift is the formation of spheres of influence in the world, evidenced by the increasing geopolitical tensions with tangible consequences, notably the outbreak of wars in the Middle East and Ukraine. A changing world order will have major implications for capital and how we choose to invest. Indeed, it can be viewed as the reshaping of the capital system which, while daunting when viewed through one lens, can also be viewed as an opportunity for growth and innovation.

In the short term, the White House’s approach to trade policy is generating significant uncertainty for US companies and households. There are already observable signs of a material weakening in consumption, while consumer sentiment is beginning to sour2. With household income growth decelerating, even a one-time increase in prices due to tariffs is likely to exert substantial pressure on consumption. The downside risks to consumption will undoubtedly increase if businesses reduce hiring and investment. The economic impact of tariffs will not be borne solely by the US, especially as other countries reciprocate with similar measures.

Higher barriers to trade are likely to have a negative impact on global hiring and investment. The World Economic Forum’s Future Jobs Report suggests 23% of global employers view trade and investment restrictions as transformative3. And, despite Germany’s relaxed fiscal policy and a more unified Europe, it is unlikely that the US will face a significant economic slowdown or recession while the rest of the world avoids one. Nonetheless, as it becomes increasingly evident to other nations that they can no longer depend on the US as they once did, countries are taking matters into their own hands.

Globalisation in decline

In this environment, we observe increasingly divergent monetary and fiscal policies. For several years, we have maintained that peak globalisation is in the rearview mirror, with the global order shifting towards increasing divergence. This perspective has gradually proven accurate, and the current US administration’s approach is accelerating this trend. Consequently, investors should encounter a broader range of risks across different regions as the world’s primary economic blocs become progressively less synchronised.

The outlook for equities in the upcoming months, and potentially quarters, may be adversely affected by central banks’ caution. For now, risks posed to long-term economic growth are outweighing inflationary pressures posed by tariffs for policymakers. Since September, the US Federal Reserve (Fed) has shifted from a “wait and see” approach to a more proactive easing path, cutting the policy rate to support economic stability.

From a long-term perspective, investors face two contrasting potential outcomes. On the one hand, an intensifying trade war could cause a prolonged global recession. On the other, assertiveness from the US in trade policy might prompt other nations to reduce their trade barriers, potentially fostering increased globalisation.

Mitigating volatility with tail-risk hedging

Tail-risk hedging can reduce overall portfolio volatility and create a smoother path to plan objectives. It can also mitigate significant drawdowns and improve total returns through effective compounding. Acting as an additional portfolio tool, these strategies can sit alongside or replace other systematic strategies or traditional cross-asset diversifiers. Tail-risk hedging is a strategy that is available to help protect portfolios at a lower cost than the losses caused by market volatility, often referred to as a volatility tax. Tail-risk hedging strategies are not designed to mitigate everyday market fluctuation but can be effective at reducing losses during sharp market sell-offs and sustained downturns, as they offer deeply convex, negative correlation. They can also be used as an overlay to a client's portfolio of global equities/risk assets, seeking to generate improved risk-adjusted returns.

As with any insurance, there is an ongoing cost of use/implementation, with a negative expected return in the absence of market drawdowns. However, we believe the costs of carry can be reduced to the point where the benefits outweigh the costs in the long run, dependent on market conditions.

The value of investments can fall. Investors may not get back the amount invested.

1Reuters, “China’s DeepSeek sets off AI market rout,” 27 January 2025.

2Advisor Perspectives, Consumer Sentiment Stalls in October as High Prices and Job Worries Persist, 10 October 2025.

3World Economic Forum, The Future of Jobs Report 2025, 7 January 2025.

2764105 Exp: 22 April 2026