China–U.S. relations are expected to stabilize for the foreseeable future, following the meeting of Presidents Trump and Xi in October. The highly anticipated “trade truce” reaches beyond the chips-for-minerals appeasement and runs the gamut — from soybeans to TikTok.

U.S. President Donald Trump and China’s President Xi Jinping came away from their in-person meeting with a long list of trade concessions. The agreement marked the culmination of tense discussions between the two nations, sparked by Trump’s tariff imposition earlier this year, and recently countered by Xi’s rare earth export controls.

Highlighting the trade arrangement, the U.S. agreed to cut tariffs on Chinese imports to 47% from 57%, while China agreed to tighten oversight of fentanyl distribution to the U.S. China also agreed to pause export controls on rare earth minerals for a year and resume purchasing soybeans from the U.S. for the next three years.

Impact on currency

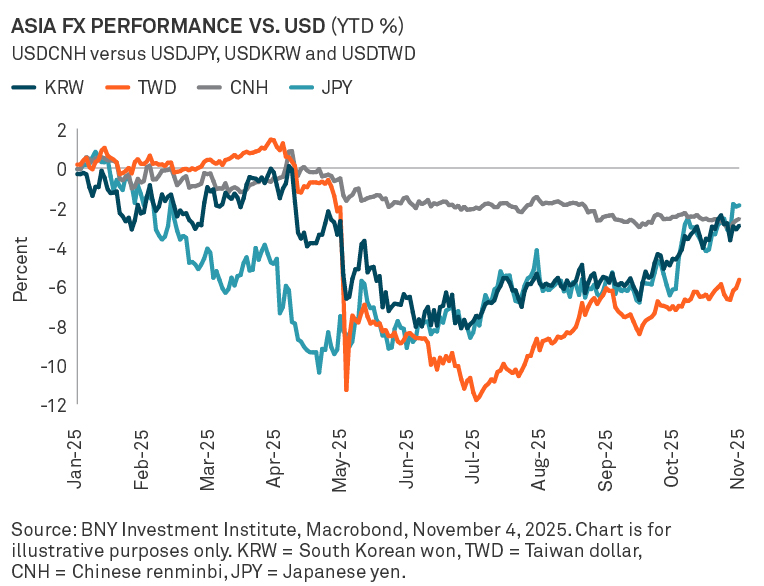

The “trade truce” allows China to return to a lower tariff rate than before the Liberation Day announcement on April 1. From a macroeconomic perspective, China’s apparent geopolitical resilience should prove beneficial for the Chinese renminbi (CNH) and shield its tech sector from potential future export and investment controls by the U.S.

Over time, these developments could also allow more policy space for the CNH to slowly appreciate — at a pace which may support a gradual rebalancing of its economy without undermining its export sector.

The CNH has appreciated more gradually but is starting to gain ground against a more volatile Japanese yen ( JPY) and other East Asian currencies which led regional FX gains versus the U.S. dollar earlier this year on increased hedging of under-hedged exposure in USD assets.

Expectations for long-term China-U.S. negotiations

Although this recent meeting has driven some optimism in the markets, it’s important to keep in mind that the “trade truce” is based on a mutual understanding and is not treaty-bound or legally binding. We believe long-term decoupling implies flare-ups are likely to recur sporadically.

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

BNY Investment Institute consists of our macroeconomic research, asset allocation, manager research and operational due diligence teams. BNY Advisors is the brand name under which BNY Mellon Advisors, Inc. conducts its investment advisory business. BNY Mellon Advisors, Inc. is an investment adviser registered as such with the U.S. Securities and Exchange Commission pursuant to the Investment Advisers Act of 1940, as amended. BNY Mellon Advisors, Inc. is a subsidiary of The Bank of New York Mellon Corporation.

Disclaimer

The information contained herein reflects general views and is provided for informational purposes only. This material is not intended as investment advice nor is it a recommendation to adopt any investment strategy.

Opinions and views expressed are subject to change without notice.

Past performance is no guarantee of future results.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

©2025 THE BANK OF NEW YORK MELLON CORPORATION

BABR-834160-2025-11-04

GU-742 - 4 June 2026