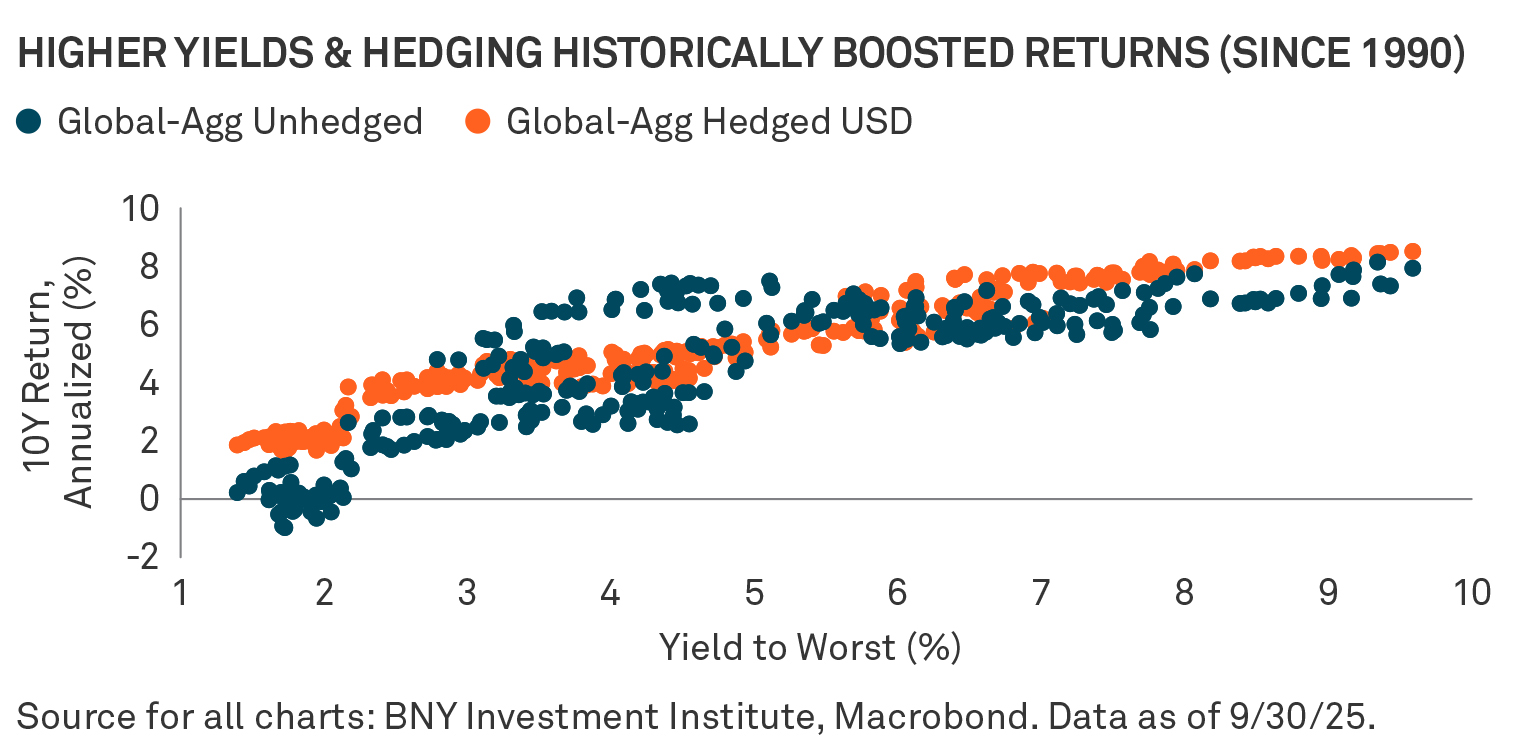

Global sovereign bonds with currency-hedged exposure may present an attractive tactical investment opportunity amid ongoing uncertainty, according to the BNY Investment Institute. With interest rate differentials currently favouring the US and developed market (DM) government bond yields elevated, the environment supports a positive outlook for fixed income investors seeking income and risk diversification.

Improved yields

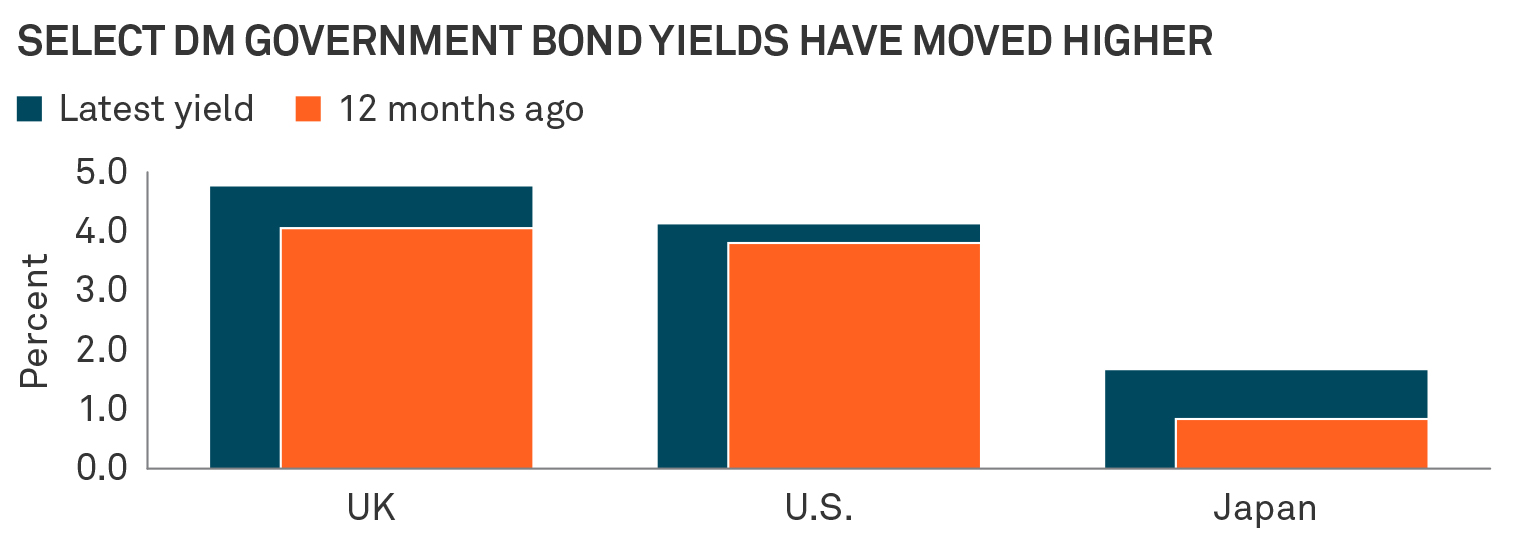

After a decade of low yields, fixed income investors now face a vastly improved global landscape. Global government bond yields, particularly in developed markets, have risen broadly, and higher starting yields have historically been closely correlated to improved forward returns.

Positive carry potential

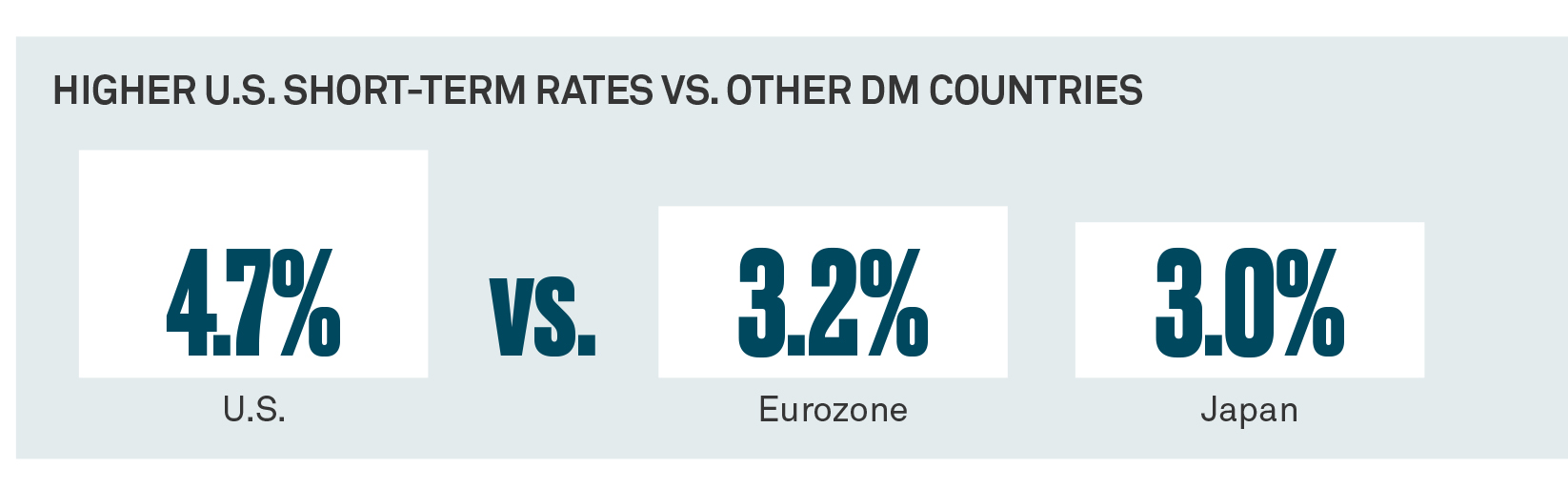

Higher US short-term interest rates compared to DM peers could enable investors to gain additional yield by hedging currency risk. The interest rate differential may reduce income volatility while providing potential for foreign bond duration returns. US investors who hedge their currency exposure can gain a yield increase roughly equal to the interest rate differential between the two countries.

Opportunities for active management

Targeted US trade policies and evolving geopolitical dynamics are likely to produce differentiated global monetary policy cycles and increased dispersion in fixed income returns across regions. We believe this macroeconomic environment is particularly conducive to active management.

This is an extract from Checkpoints, a comprehensive monthly chartbook that provides insights into major themes affecting financial markets.

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

2776200 Exp: 28 February 2026