Uncertainty around tariffs, inflation and interest rates has been looming for months. Meanwhile, the Federal Reserve (the Fed) left rates unchanged at its July meeting, to the surprise of market observers. So, the question remains — what’s the Fed’s next move?

When determining monetary policy, the Fed analyses several factors under its dual mandate to maximise employment and stabilise prices.

Typically, above target inflation should lead the Fed to raise rates (but because rates are already in restrictive territory today, the Fed has held rates steady). However, if job numbers continue to show signs of weakness, the Fed is likely to turn its focus toward the labour market.

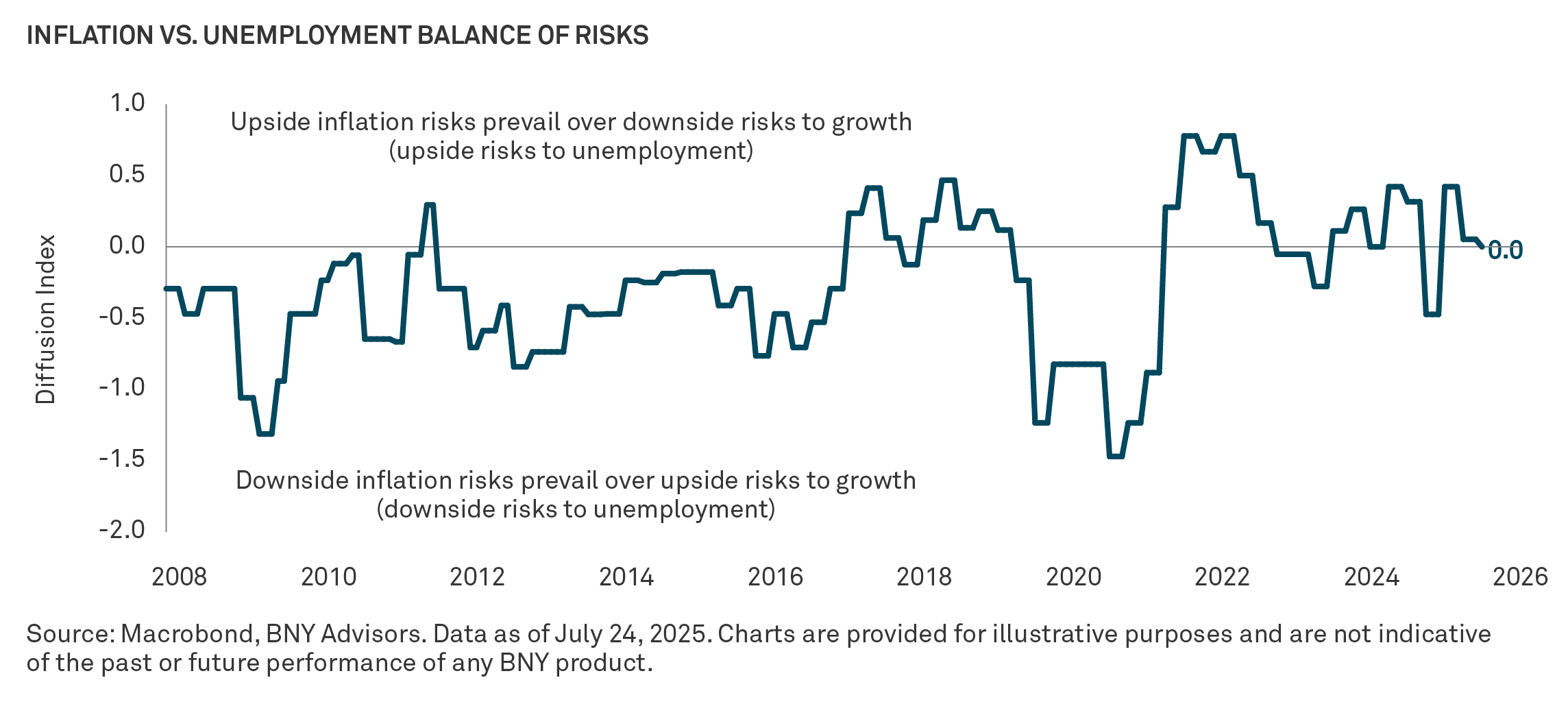

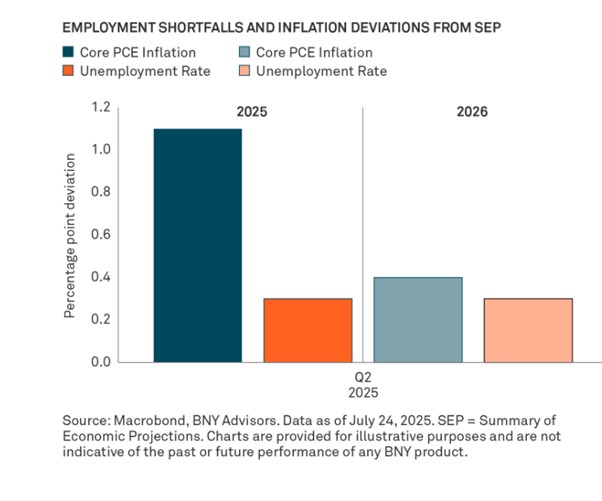

We witnessed that scenario in September 2024 when the Fed lowered interest rates by 50 basis points due to a brief, but short-lived, labour market scare. Fast forward to 2025, and the focus has slowly shifted. Currently, the risks for both continued inflation and labour market softening seem to be somewhat in balance. Inflation has remained higher than the Fed’s 2% target and continued to hold steady in the July Consumer Price Index (CPI) report, while employment has shown some weakness, but not enough to prompt a cut so far.

As detailed in the chart, both inflation and unemployment projections are treading the zero line, or staying in balance in terms of potential risk, at least for the moment.

Weaker job numbers remain on the Fed’s radar

We believe this backdrop could change, especially if tariff-related price increases cause a spike in inflation. This could strain consumer spending, leading to lower corporate outlooks, potentially weakening job growth further, heading into 2026.

In fact, jobs numbers have already begun to soften. In July, the Bureau of Labor Statistics revised its labour report for May and June. The change in total non-farm payroll employment for May was revised down by 125,000, from +144,000 to +19,000, and the change for June was revised down by 133,000, from +147,000 to +14,000. With these revisions, employment in May and June combined is 258,000 lower than previously reported1.

We expect the Fed to cut its policy rate by 25 basis points in September. We believe this could be one of possibly two rate cuts this year and anticipate more aggressive easing in 2026.

1Source: Bureau of Labor Statistics, July 2025. Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.

For more in-depth research analysis, see the latest Vantage Point Q3 2025: Resilience at the rubicon

2625009 Exp: 1 December 2025