From tariffs to volatility and slowing growth to artificial intelligence, there was plenty to talk about at this year’s European Investment Conference in Lisbon. The event discussed the theme ‘a new era’, with portfolio managers from across BNY Investments sharing insights on what this could mean for equities and fixed income.

Is high yield beta attractive? Should it be a core rather than tactical part of investment portfolios? Insight Investment head of fixed income specialists April LaRusse explains how a systematic approach can offer the potential for enhanced beta exposure to the asset class.

Insight Investment head of fixed income specialists April LaRusse, assesses the potential impact of shifting patterns in the global economy on credit markets.

High-Yield-Unternehmen machen ihren "Big Brothers" mit Investment-Grade-Rating in Bezug auf Größe und Rendite das Leben schwer, sagt Ulrich Gerhard, Senior Portfolio Manager bei Insight Investment.

Hohe Bewertungen und Konzentrationsrisiken scheinen derzeit einen anhaltenden Wechsel der Spitzenreiter am Aktienmarkt zu fördern, der auf einen potenziellen Wandel der dominanten Marktsektoren hindeutet, so Jon Bell, Portfoliomanager bei Newton.

Walter Scott client investment manager Dennis Wyles asks: in a world where artificial intelligence is leading the charge, what type of company is likely to stand the test of time?

Supply shocks, such as tariffs, are likely to create significant global economic disruption, according to BNY Investments head of macro research Sebastian Vismara. But what does this mean for the economic outlook and investment portfolios?

After a busy decade for regulatory intervention in Europe, are we moving towards a simpler regime? BNY Investments assembled a panel of experts to discuss three of the key areas.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1 Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2398059 Exp: 17 October 2025

RELATED INSIGHTS

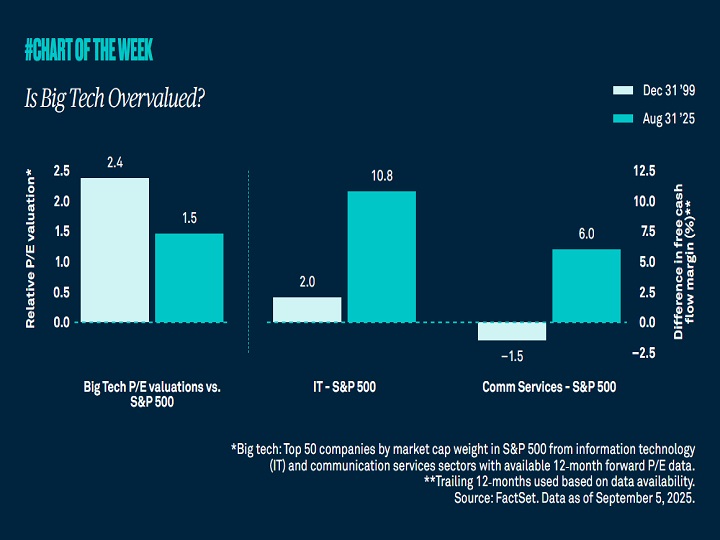

It’s true that the S&P 500 currently exhibits high valuations, with the technology sector alone comprising over 40% of its market capitalization and driving concerns about valuations. Are those high multiples justified?

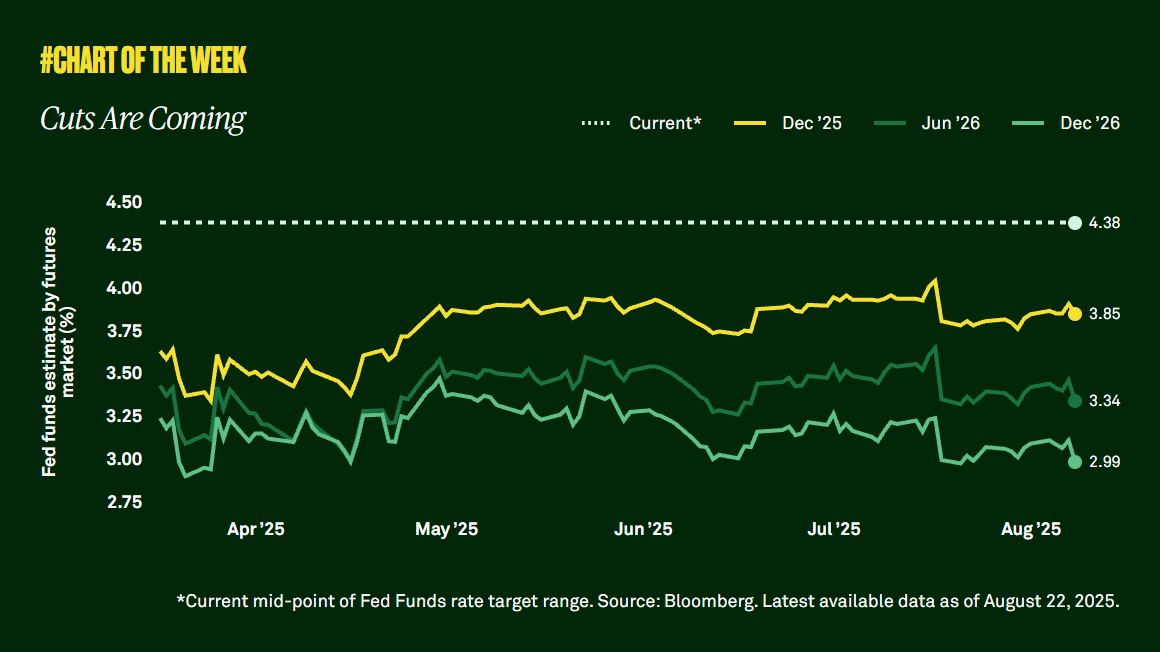

Uncertainty around tariffs, inflation and interest rates has been looming for months. Meanwhile, the Federal Reserve (the Fed) left rates unchanged at its July meeting, to the surprise of market observers. So, the question remains — what’s the Fed’s next move? The BNY Investment Institute considers the factors influencing the central bank's path ahead.

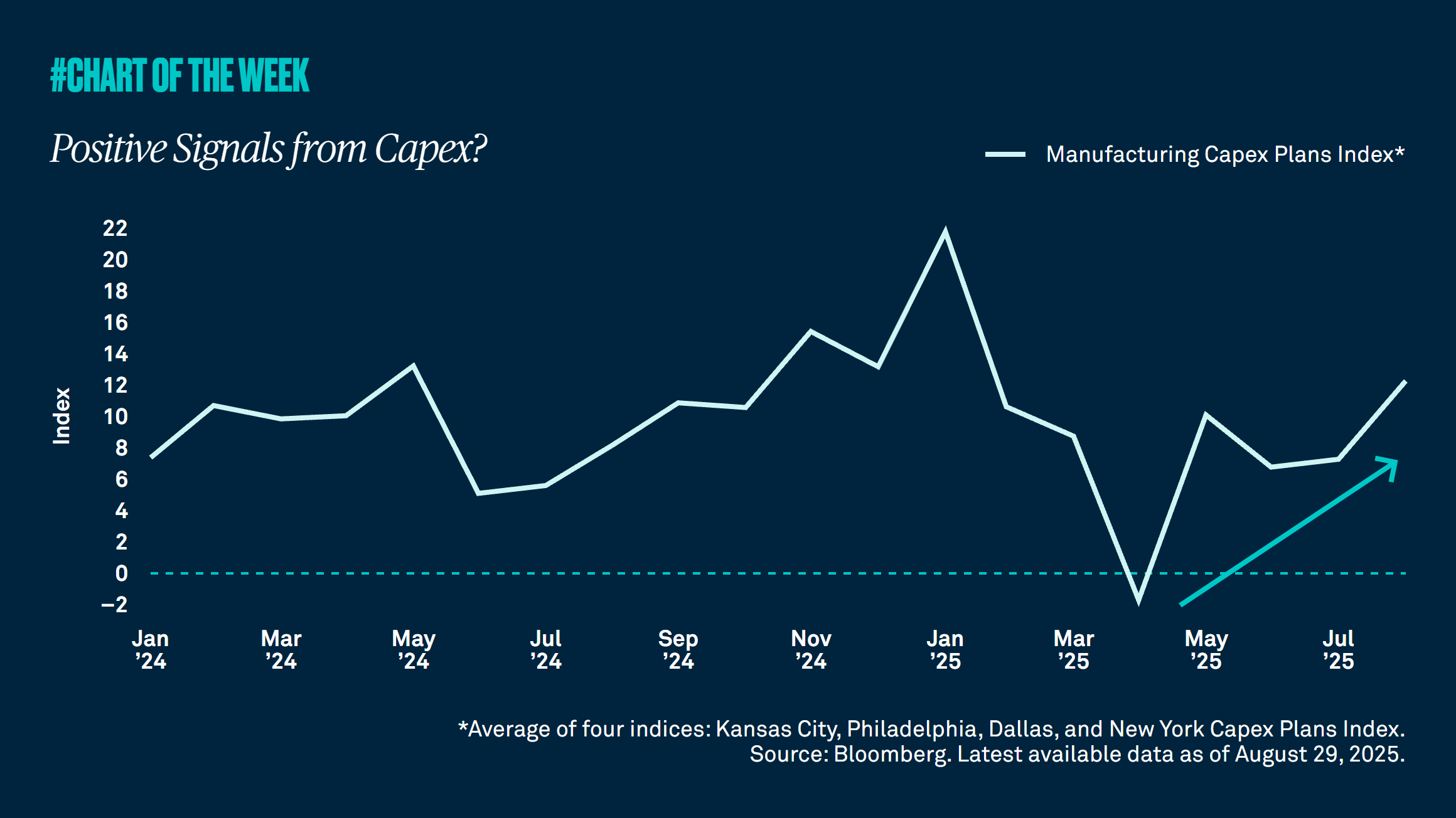

The One Big Beautiful Bill Act’s provision regarding the full expensing of capital expenditures is already having an impact on companies’ investment plans. We believe this a positive signal for economic growth.

Last Friday, Federal Reserve Chair Jerome Powell described a shift in the balance of employment and inflation risks, and the market rallied on the news. For us, nothing has changed. We have been closely monitoring the labor market and indicators of inflation, and we continue to expect two rate cuts this year.