August 2025

INVESTMENT VIEWS

OUR PARTNERS AT WALTER SCOTT

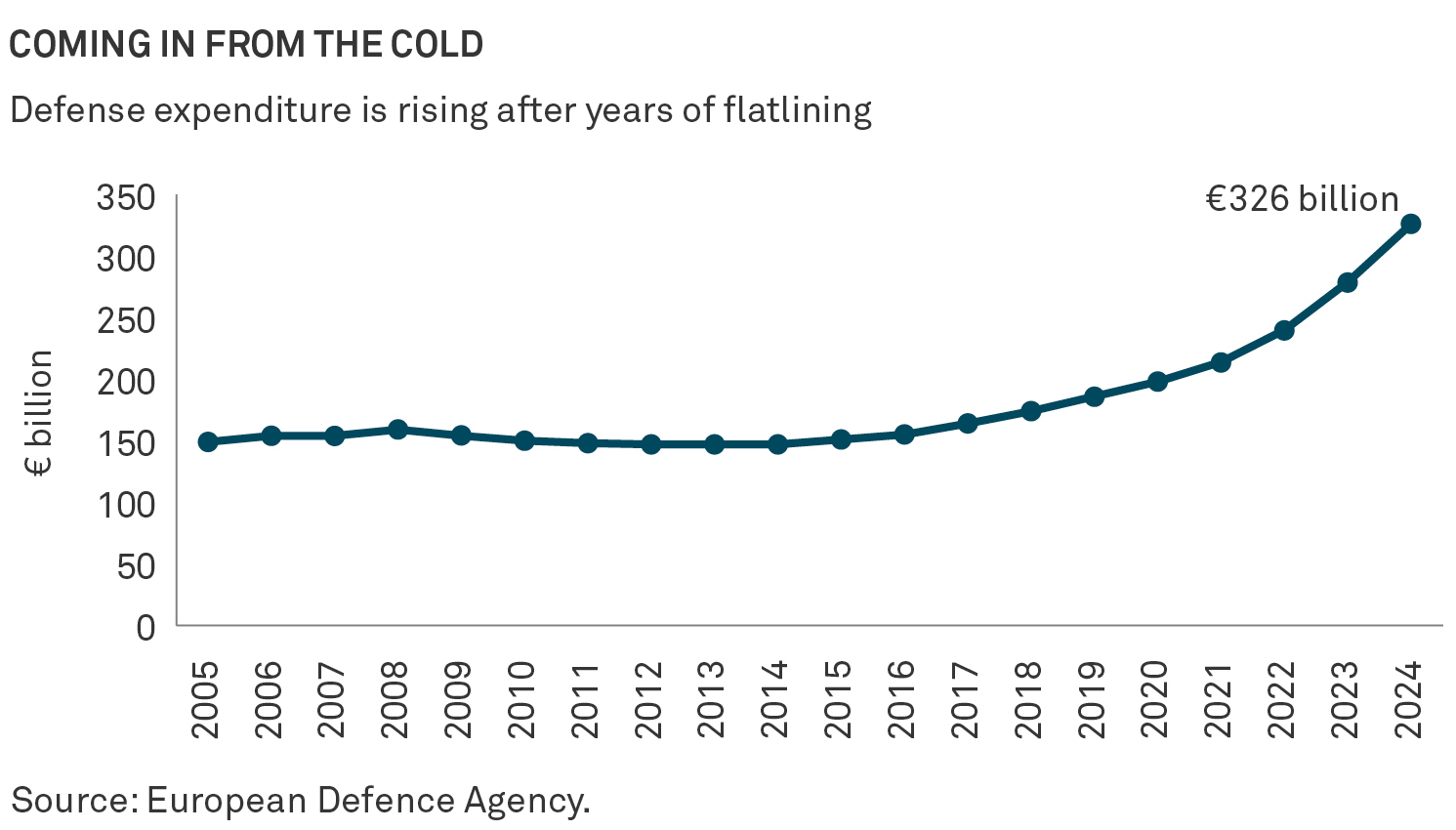

After years of underinvesting in its military capacity, Europe is rapidly increasing defense spending. Responding to the twin shocks of a threatened reduction in U.S. military support and Russian belligerence in Ukraine, European Union (EU) member states have lifted spending by 30% in recent years. A further €100bn is expected by 2027.1

Those European countries that are members of NATO are likely to have to go even further. Mark Rutte, the secretary general of the transatlantic alliance, has called for a “quantum leap” in spending. Share prices of European aerospace and defense (A&D) have reflected this surge in the first half of the year, comfortably outstripping a +20% return of the wider MSCI Europe index.2

Control of destiny

Walter Scott’s international strategy has a longstanding underweight exposure to the A&D industry. This position is not predicated on any inherent negative bias; no industry or sector is off our research radar. Rather, we have been largely absent for reasons consistent with our investment philosophy.

COMING IN FROM THE COLD

Defense expenditure is rising after years of flatlining

Before we invest in a company, we try to establish the extent to which it has control of its own destiny. How wide is its competitive moat? Does it have pricing power? Is it too reliant on a single or small group of customers? We believe that the greater the control of destiny, the greater the likelihood a company can sustain high levels of growth and profitability over time.

For several reasons, however, traditional A&D businesses have historically lacked the necessary control of destiny we look for:

- Defense budgets, procurement policy and contract structures are partially driven by political rather than economic factors.

- Companies can be heavily reliant on single contracts.

- Contracts are often necessarily opaque due to classified information. Strategic autonomy is limited by the need to align with government demand.

This is particularly true of the European “defense primes”, the handful of large, strategic military contractors with direct government relationships and historically dominant shares of national procurement budgets.

The world has changed…

According to the Peace Research Institute Oslo, 2024 marked a historic peak in state-based conflicts, with 61 active conflicts across 36 countries — the highest number recorded since 1946. Given today’s proliferation of geopolitical tensions, it is hard to argue convincingly for this trend to meaningfully reverse in the medium term.

Faced with an increasingly fractious world, defense budgets are likely to continue to grow as governments make up for years of underinvestment. Judging by the recent performance of A&D companies, the market seems to share this view. Before we think about potential opportunities in the A&D sector, we believe it is important to think about what higher defense spending might look like.

...and so has warfare

The structural increase in spending outlined above is happening at a time when warfare is undergoing a technological transformation. The conflict in Ukraine is a petri dish for the use of advanced technology for military purposes, notably drones and artificial intelligence (AI). According to a recently published paper by Chatham House “Ukraine has built a defense-tech ecosystem that is reshaping the rules of modern combat.”

The ability to withstand Russia’s vastly superior manpower has not just been due to individual technologies, however. It is also the result of Ukraine’s ability to “regularly outpace Russia in the innovation cycle.” Put simply, warfare is being disrupted by technology more frequently and with greater impact than at any time in history.

There is already evidence that governments are taking the lessons of Ukraine on board. In the UK, the government’s recent Strategic Defense Review vowed to establish “a leading tech-enabled defense power.” “With technology changing warfare so quickly,” the review warns “business as usual is no longer an option.”

Brains over brawn

The evolution of warfare reorients the compass for investors looking to gain exposure to the structural tailwind of higher defense spending.

If incremental advantage in conflict now lies in disruptive technology rather than sheer mass of conventional weaponry, we can expect the companies providing the former to secure a greater share of future defense spend. More cybersecurity, sensors and software; less bombs, bullets and tanks.

This shift in emphasis presents opportunities for more specialist tech-focused A&D players, as well as non-A&D tech companies, to muscle in on rising procurement budgets at the expense of the defense primes. Here, the U.S. offers a glimpse of the future.

Tasked with developing the “Golden Dome” missile defense system, the U.S. Department of Defense is encouraging the involvement of non-traditional contractors with “innovative and disruptive capabilities.” Expect similar exhortations from European governments.

Furthermore, while we continue to question the control of destiny of the primes, more specialist A&D players and tech companies have greater scope to innovate and deliver valueadd capabilities. This should allow them to further grow their share of procurement budgets.

Potential snafus

We are aware of the potential investment opportunities arising from the evolving geopolitical and military landscape. We have visited A&D and related companies in Germany and Sweden, as well as in the U.S., and they have provided valuable insights into not just the positives of the current spending tailwind, but also the challenges. For example, the need to invest significantly in capex to fully capture potential opportunities or the difficulties of ramping-up production to meet rising demand.

There are two other points that we believe merit close consideration when thinking about potential A&D opportunities:

- First, one does not have to be a cynic to view political rhetoric with a degree of skepticism. A Europe of strained government finances is one where difficult choices must be made and not every electorate will find the trade-offs demanded by higher defense spending palatable. Don’t bank on every “promise” of investment materializing.

- Second, we are conscious that the valuations for A&D stocks have traveled a long way in recent months, reflecting lofty expectations for future earnings growth. A great deal of this is likely already baked into share prices.

Staying disciplined

Whether our ongoing research and analysis of specific names converts to portfolio investments will hinge on our assessment of their ability to reliably compound earnings over our long-term investment horizon. The world might have changed, but our commitment to rigor and diligence remains the same.

About Walter Scott

Walter Scott is the global equities-focused investment firm within BNY Investments.

AI, or artificial intelligence, is the ability of computer systems to perform tasks that typically require human intelligence. Capital expenditures (Capex) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. MSCI Europe Index captures large and midcap representation across Developed Markets countries in Europe.

IN THE UNITED STATES: FOR GENERAL PUBLIC USE.

IN ALL OTHER JURISDICTIONS: FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are those of the author as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY is not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Charts are provided for illustrative purposes only and are not indicative of the past or future performance of any BNY product. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance is no guarantee of future results. Information and opinions presented have been obtained or derived from sources which BNY believed to be reliable, but BNY makes no representation to its accuracy and completeness. BNY accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in

their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and

limitations: For Institutional, Professional, Qualified Investors and Qualified Clients. For General Public Distribution in the U.S. Only. • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue Eugène Ruppert L-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

IMPORTANT INFORMATION FOR ASIA PACIFIC AUDIENCE

This document is provided to the recipient for information purposes only. This document may not be used for the purpose of an offer or solicitation, directly or indirectly, in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. This document has not been reviewed or approved by any regulatory authorities and is only for “Eligible Recipients”. “Eligible Recipients” means professional clients (i.e. non-retail clients) and (in jurisdictions where there are restrictions on (i) the types of professional clients which can be provided with this document; and (ii) the purposes for which this document can be provided to such professional clients) such types of professional clients (e.g. eligible financial institutions or financial intermediaries) which shall only use this document for the specific purposes as permitted under applicable laws and regulations.

This document is for the exclusive use of the Eligible Recipient. This document may not be copied, duplicated in any form by any means, published, circulated or redistributed or caused to be done so, whether directly or indirectly, to any other persons without the prior written consent of BNY. It is not intended for onward distribution or dissemination to the retail public and is not to be relied upon by retail clients. This document is not for distribution to, or to be used by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation, or where there would be, by virtue of such distribution or use, new or additional registration or approval requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution or use of this document in their jurisdictions.

Accordingly, this document and any other documents and materials, in connection therewith may only be circulated or distributed by an entity as permitted by applicable laws and regulations. BNY Investments do not have any intention to solicit Eligible Recipients for any investment or subscription in a fund or use of BNY Investments services and any such solicitation or marketing will only be made by an entity permitted by applicable laws and regulations. BNY Investments do not intend to conduct any offering activities, investment management business, investment advisory business, and/or any other securities business in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized.

Any views and opinions contained in this document are those of Investment Manager as at the date of issue; are subject to change and should not be taken as investment advice. BNY is not responsible for any subsequent investment advice given based on the information supplied.

BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation.