June 2025

INVESTMENT VIEWS

From the BNY Investment Institute

Tariff Shock Changed the U.S. Outlook

On April 2, the U.S. announced broad tariffs that hit global markets hard. U.S. stocks dropped over 12% in a few days, and bond yields surged. Even though some tariffs have been reduced, trade tensions remain high, especially with China.

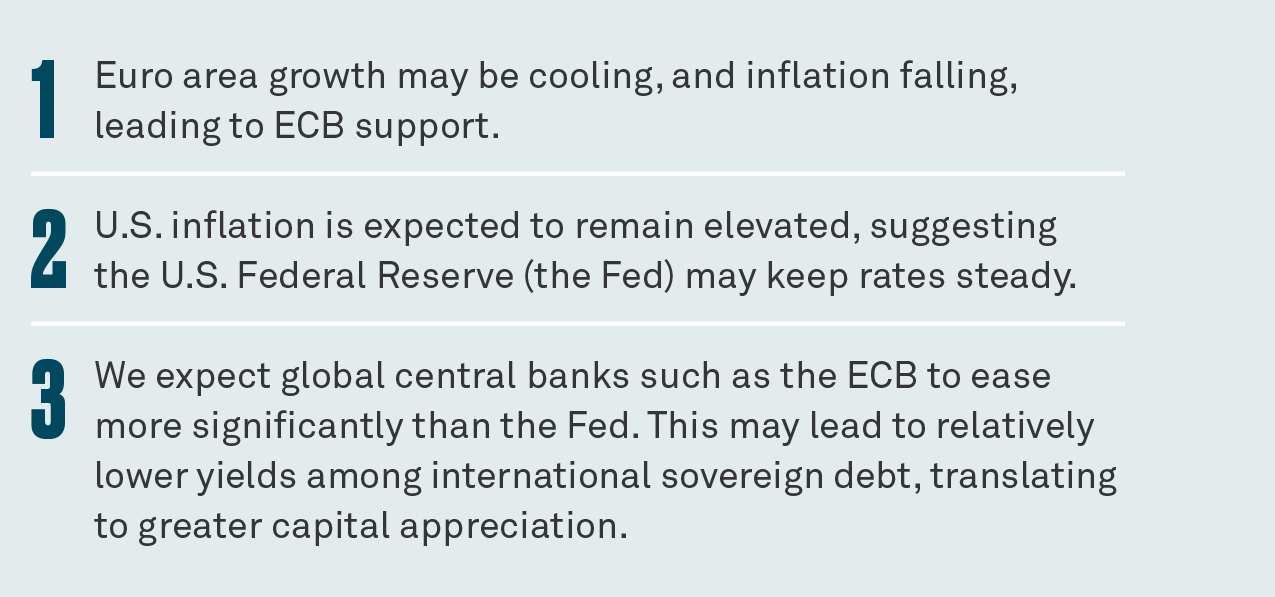

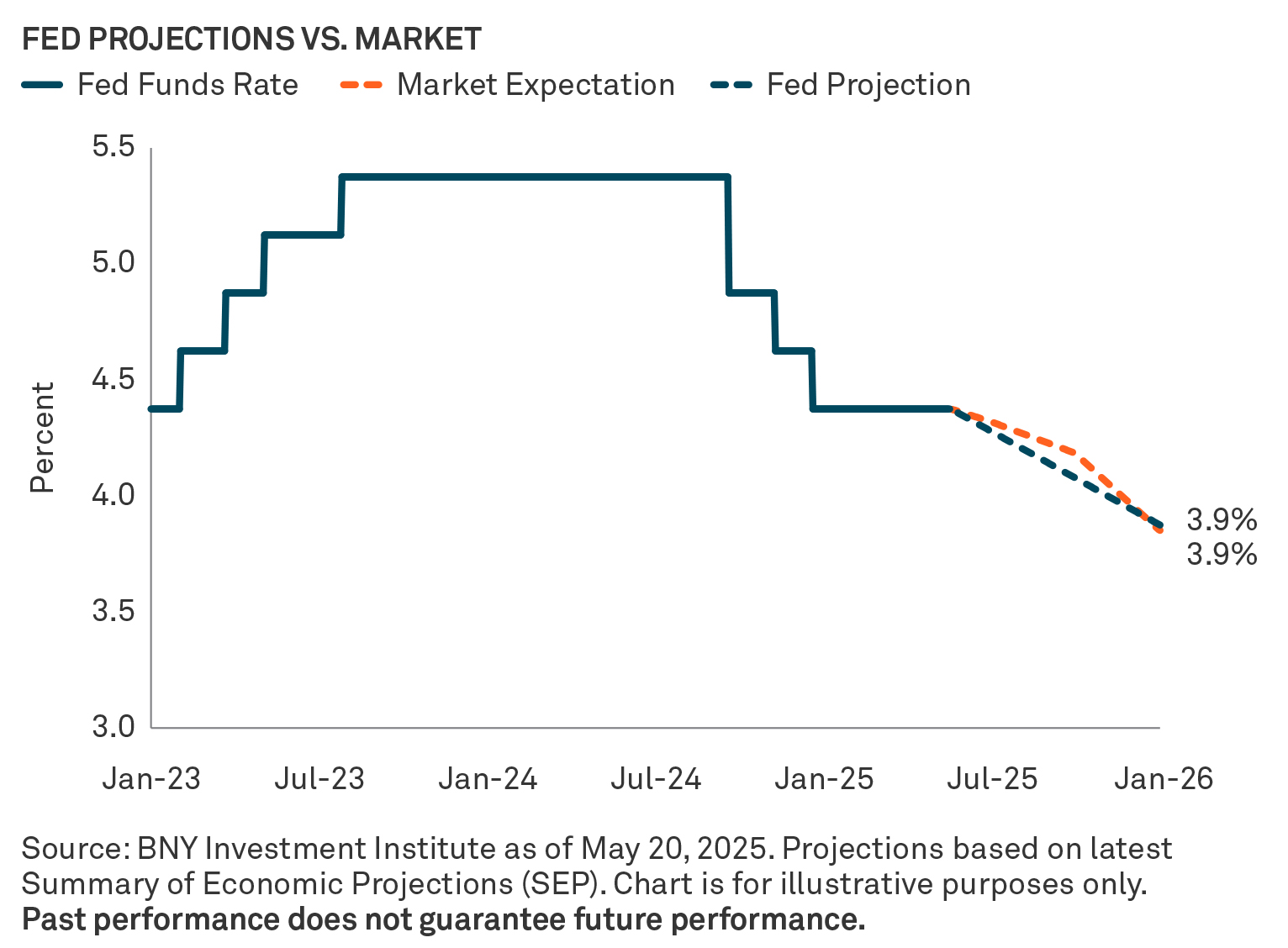

Our base case is ‘slowdown,’ with ‘stagnation’ (slow growth coupled with sticky inflation) now at a 30% probability.

As a result, we expect the Fed to stay on hold or cut rates a maximum of one time this year.

Trade war history lessons

Meanwhile, Europe may face disinflation. The last major episode of elevated tariffs occurred in 2018, when the effective U.S. tariff rate on China was around 18%. This led to a significant decline in Chinese exports to the U.S.

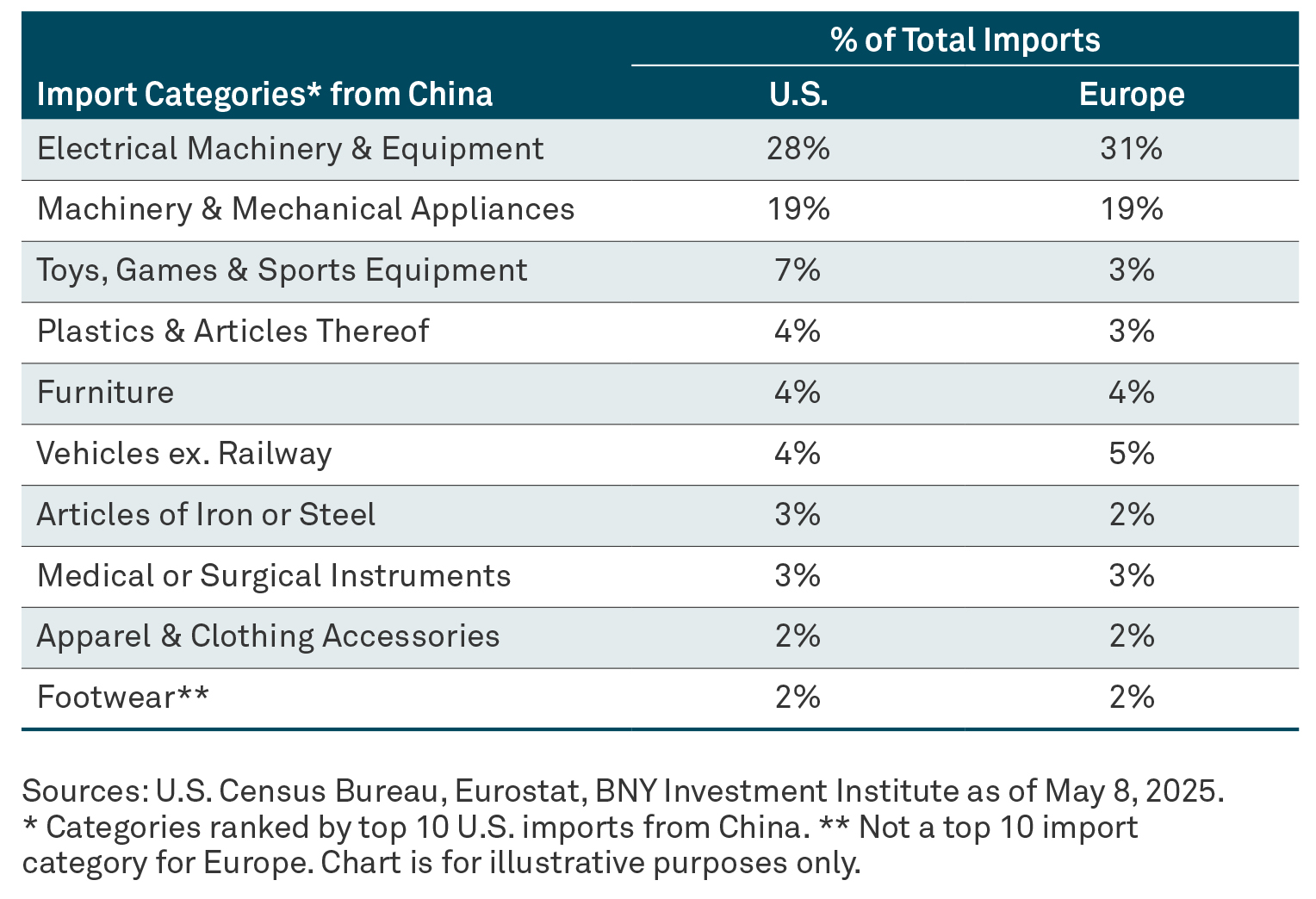

Given structural similarities with the U.S. (i.e., large consumer market, developed infrastructure and logistics, being technologically advanced) and a similar demand profile (9 of the top 10 import categories overlap), the euro area was an important alternate destination for redirected final Chinese exports during the 2018 trade war.1 More importantly, the redirected goods saw lower price tags.2 Should history rhyme, trade redirection paired with lower import prices could be disinflationary for the euro area.

At the same time, the euro area is exposed to global trade — more than 75% of its economy depends on imports and exports. That makes it vulnerable to global slowdowns.

Tariffs will likely hurt demand for European goods and increase uncertainty for companies and consumers. April surveys already show weaker hiring and investment plans, especially in Germany and France. And while Germany is rolling out a fiscal stimulus plan, real growth benefits may not show up until 2026.

With falling inflation and the need to support near-term growth, the ECB is likely to cut rates. In fact, the central bank just eased in April, and we think it may cut rates an additional two to three times this year.

A meaningful time to complement U.S. fixed income with international fixed income for a global exposure

While tariffs are usually associated with rising prices, they may have the opposite effect in Europe by slowing global trade and pulling in cheaper goods. Combined with already weak growth and fading inflation, this makes a strong case for more central bank support in the euro area — and for investors, a closer look at international bonds to complement U.S. bonds for a global exposure.

About the

BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

1 U.S. Federal Reserve, Global trade patterns in the wake of the 2018–2019 U.S.-China tariff hikes, April 2024. European Central Bank, “The implications of U.S.-China trade tensions for the euro area — lessons from the tariffs imposed by the first Trump Administration,” March 2025.

2 SSRN, The Impacts of the U.S. Trade War on Chinese Exporters, accessed April 2025.

Past performance is no guarantee of future results.

All investments involve risk, including the possible loss of principal. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

Fixed income investments are subject to interest-rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

Disinflation is a slowing down in the rate of price increases. Stagnation is a period of slow economic growth with high unemployment and high inflation. Sticky inflation refers to a persistent economic scenario where prices for goods and services do not adjust quickly to changes in supply and demand dynamics.

FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS. FOR GENERAL PUBLIC DISTRIBUTION IN THE U.S. ONLY.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are those of the author as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY is not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Charts are provided for illustrative purposes only and are not indicative of the past or future performance of any BNY product. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance is no guarantee of future results. Information and opinions presented have been obtained or derived from sources which BNY believed to be reliable, but BNY makes no representation to its accuracy and completeness. BNY accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • Singapore: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

BNY COMPANY INFORMATION

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. • Mellon Investments Corporation (MIC) is a registered investment advisor and subsidiary of The Bank of New York Mellon Corporation. MIC is composed of two divisions: Mellon, which specializes in index management, and Dreyfus, which specializes in cash management and short duration strategies. • Insight Investment — Investment advisory services in North America are provided through two different investment advisers registered with the Securities and Exchange Commission (SEC) using the brand Insight Investment: Insight North America LLC (INA) and Insight Investment International Limited (IIIL). The North American investment advisers are associated with other global investment managers that also (individually and collectively) use the corporate brand Insight. Insight is a subsidiary of The Bank of New York Mellon Corporation. • Newton Investment Management — “Newton” and/or “Newton Investment Management” is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021, NIMJ was established in March 2023. NIM and NIMNA are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of The Bank of New York Mellon Corporation. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of The Bank of New York Mellon Corporation. • Siguler Guff — BNY owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC). • BNY Mellon Advisors, Inc. (BNY Advisors) is an investment adviser registered as such with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Advisors is a subsidiary of The Bank of New York Mellon Corporation.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2025 The Bank of New York Mellon Corporation.

MARK-742058-2025-05-16

GU-637 – December 31 – 2025