May 2025

Moody’s has downgraded the U.S. government’s credit rating from Aaa to Aa1, becoming the third major credit rating agency to do so.

This downgrade likely won’t lead to forced selling since investment mandates typically refer to U.S. Treasuries (USTs) without regard to ratings. Banks using the internal risk-based approach and FX reserve managers are unlikely to be impacted mechanically either. For collateral purposes, a downgrade to Aa1 is also unlikely to have an effect. Haircuts on USTs are based on maturity and security type, not ratings, or are the same for fixed income instruments with different ratings (e.g.: USTs and Gilts).

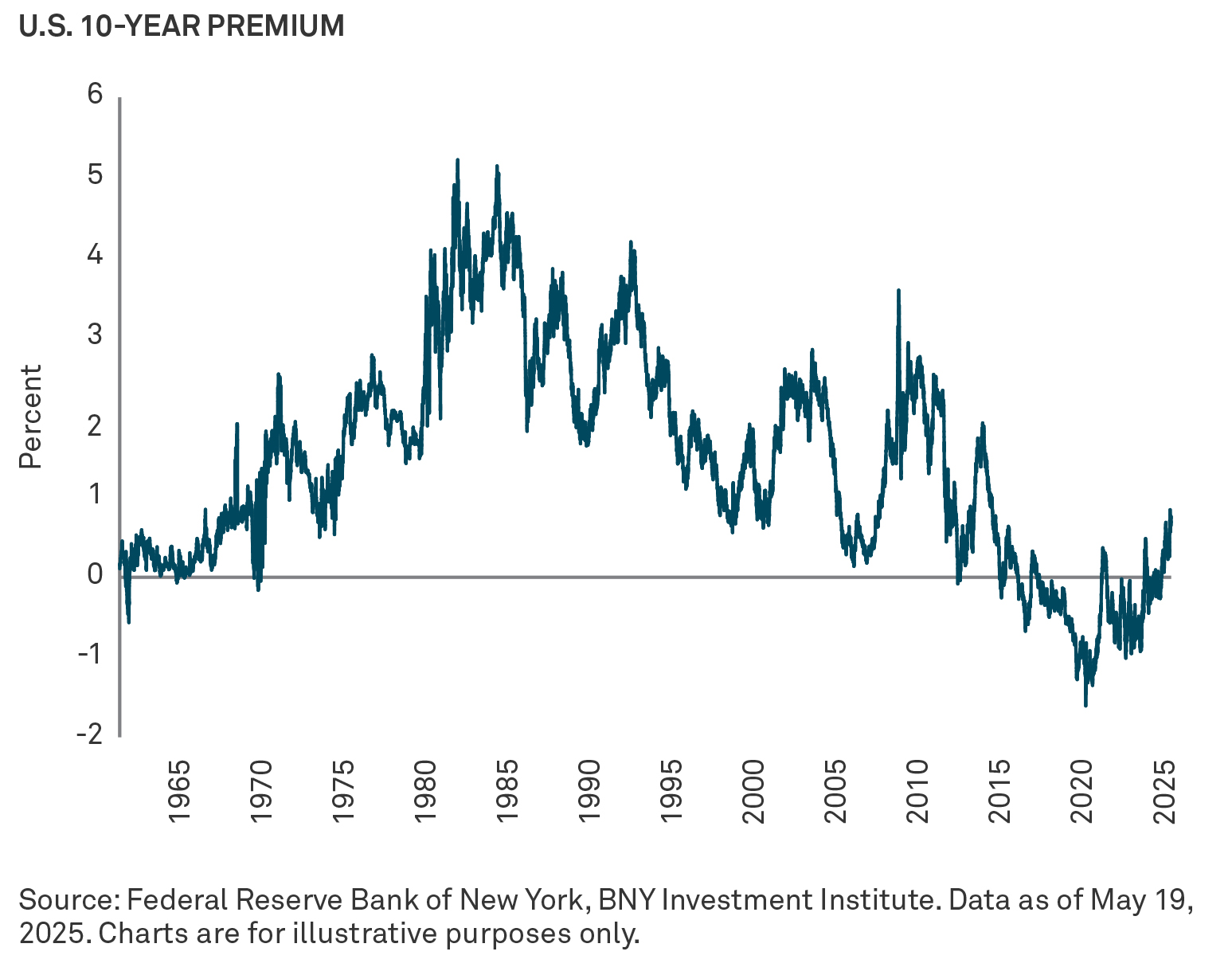

More fundamentally, the U.S.’ fiscal and debt issues are well known, and Treasuries have already underperformed in recent weeks and have not played the ‘safe haven’ role as is typical amidst heightened trade-related macro uncertainty and financial volatility. That said, with large primary (noninterest) fiscal deficit and the fraught nature of ongoing discussions on fiscal stimulus, we would not be surprised to see range-bound long-term UST rates drift a bit higher in the coming weeks.

As market interest rates have remained elevated in recent months, alongside high trade policy uncertainty, growth expectations have deteriorated. Our quantitative modeling and macro scenarios suggest that the probability of real interest rates rising above real growth for the U.S. is as high as 50% in 2025 and beyond. If interest rates do rise above growth, fiscal and monetary policies will come under pressure. This is because the deficit will have to be seen as falling for debt to be sustainable in the future. Without a realistic path to fiscal adjustment, a rise in borrowing costs relative to growth could lead to a further, near-term, steepening of the U.S. yield curve.

One for the history books

Moody’s ratings action over the weekend will also be one for the history books — it has had a triple-A issuer rating for the U.S. government since 1949. While the downgrade now takes the issuer ratings down to where S&P and Fitch have already downgraded, respectively, in 2011 and 2023, it underscores the scarcity of “triple-A rated” sovereign securities. To place this in a crosscountry context, currently, only Germany, Netherlands, Australia, Switzerland, Denmark, Sweden, Norway, and Singapore have triple-A ratings from all three major ratings agencies. Canada and New Zealand have triple-As from at least one (but not all) agency(s). But the main point is that the sovereign bonds of these issuers cannot match the scale or liquidity of U.S. Treasury securities.

Countries like Britain and France lost their triple-A ratings several years ago (following the Euro Area debt crisis, and then Brexit), and Japan lost its triple-A by the early noughties (after its asset price downturn, and ballooning government debt, in the 1990s). China’s sovereign ratings are in the mid-to-high single-A space, and the scale of its bond market is approaching that of the U.S. But credit pressures are rising there as well — on intensifying deflation and a worsening quasi-fiscal position. Beijing has, itself, faced issuer ratings downgrades lately —most recently a one-notch downgrade from Fitch in April 2025.

In theory, at least, no issuer or security is totally ‘risk-free’ in an absolute sense. But having a triple-A rating has an aura of unbounded credit quality. When you are rated triple-A it is not possible to measure further credit strength (for instance, there is no quadruple-A or quintuple-A rating). But following the loss of the U.S.’ triple-A status from all three major agencies, the norms around what truly constitutes risk-free securities in a relative sense may come under greater medium-term scrutiny.

Asides from the risk of an entrenchment of term premia, the loss of the U.S.’ triple-A rating may also constrain the ratings of other (e.g.: sub-national and corporate) issuers. This is because sovereign ratings typically act as a ceiling on other debt issuers. In rare cases, these can be pierced — for instance, if the corporation/issuer in question can demonstrate enough credit resilience — large net assets in or cashflows — from offshore sources (and triple-A rated jurisdictions).

About the

BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

Fitch Ratings, Moody’s and S&P are global credit rating agencies that award credit rating grades to a country or large corporate borrower indicating the probability of default. Fitch Ratings (Fitch) is a system for rating investments’ credit quality and default risk, such as corporate bonds and sovereign debt. It uses a letter system that ranges from AAA (very high quality) to D (defaulted). Moody’s ratings are a system used to assess the credit risk of fixed-income obligations. The ratings range from Aaa (highest quality) to C (lowest quality), with 21 notches in total. They are divided into two categories: Investment Grade, which indicates financially sound companies, and Speculative Grade, which indicates companies with a higher risk of defaulting. Moody’s ratings help investors understand the likelihood that a borrower will meet its financial obligations. S&P Global Ratings (S&P) is an American credit rating agency and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. Forex (FT) refers to the global electronic marketplace for trading international currencies and currency derivatives.

FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS. FOR GENERAL PUBLIC DISTRIBUTION IN THE U.S. ONLY.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are those of the author as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY is not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Charts are provided for illustrative purposes only and are not indicative of the past or future performance of any BNY product. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance is no guarantee of future results. Information and opinions presented have been obtained or derived from sources which BNY believed to be reliable, but BNY makes no representation to its accuracy and completeness. BNY accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: For Institutional, Professional, Qualified Investors and Qualified Clients. For General Public Distribution in the U.S. Only. • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered brokerdealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • Singapore: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

BNY COMPANY INFORMATION

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. • Mellon Investments Corporation (MIC) is a registered investment advisor and subsidiary of The Bank of New York Mellon Corporation. MIC is composed of two divisions: Mellon, which specializes in index management, and Dreyfus, which specializes in cash management and short duration strategies. • Insight Investment – Investment advisory services in North America are provided through two different investment advisers registered with the Securities and Exchange Commission (SEC) using the brand Insight Investment: Insight North America LLC (INA) and Insight Investment International Limited (IIIL). The North American investment advisers are associated with other global investment managers that also (individually and collectively) use the corporate brand Insight. Insight is a subsidiary of The Bank of New York Mellon Corporation. • Newton Investment Management – “Newton” and/or “Newton Investment Management” is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021, NIMJ was established in March 2023. NIM and NIMNA are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of The Bank of New York Mellon Corporation. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of The Bank of New York Mellon Corporation. • Siguler Guff – The Bank of New York Mellon owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC). • BNY Mellon Advisors, Inc. (BNY Advisors) is an investment adviser registered as such with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Advisors is a subsidiary of The Bank of New York Mellon Corporation.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2025 The Bank of New York Mellon Corporation.

MARK-742554-2025-05-19

GU-641-31May 2026