April 2025

Investment views from our

partners at Walter Scott

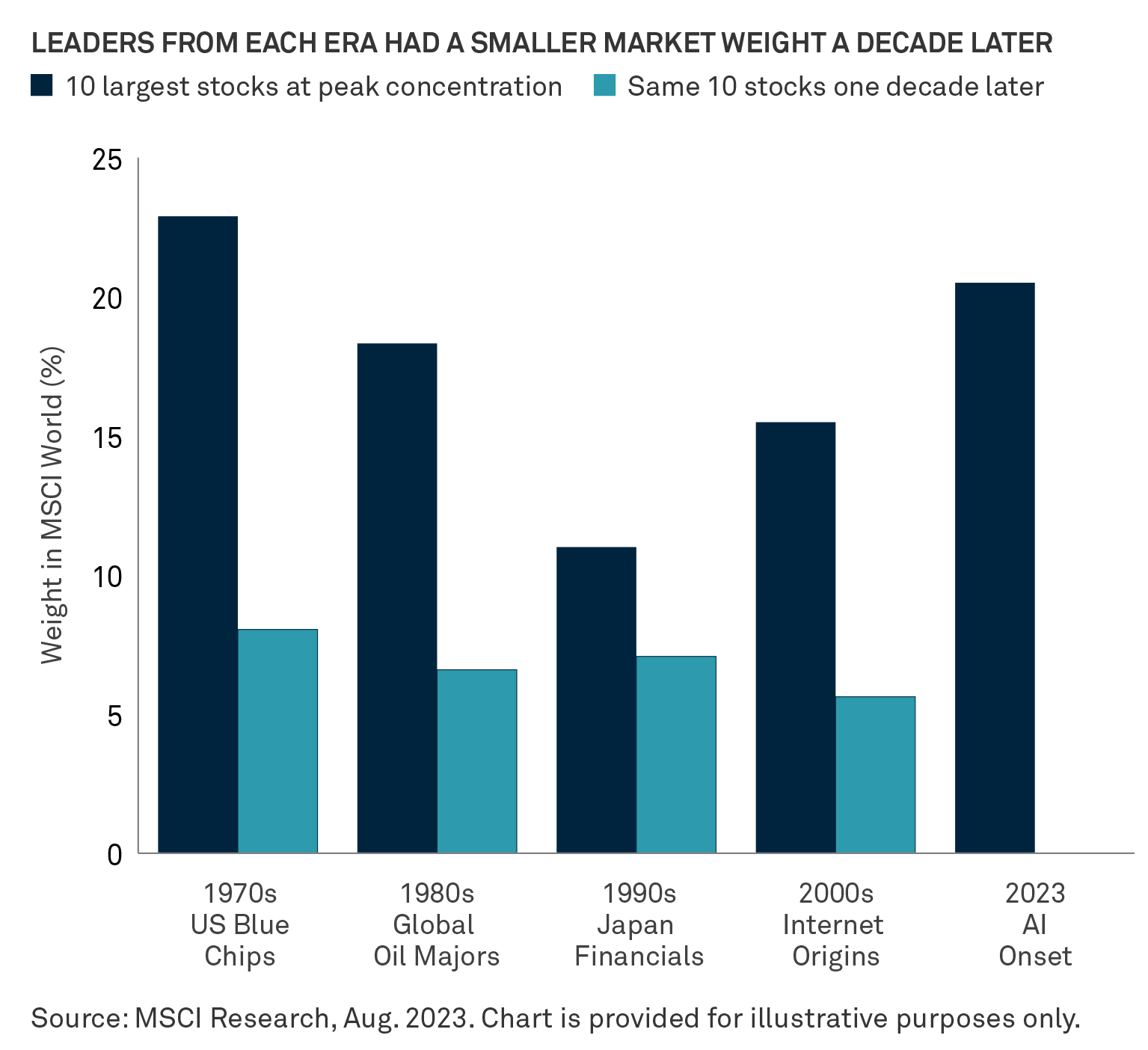

The recent AI-driven surge has led to market concentration levels not seen for decades, with ten companies accounting for more than 20% of the market.1

We do not see such concentration often but there is market precedent. From the established blue-chip giants of the 1970s to the mobile telecommunications and internet companies of the early 2000s, stock markets have experienced periods where a select few companies have held significant dominance. However, as the chart shows, these eras of market concentration rarely last.

What happened to these once dominant companies in subsequent decades? Dropping out of the top 10 could be due to any number of factors, from industry consolidation to regulation or a failure to innovate and adapt. Whatever the reason, it suggests that investors should be cautious about extrapolating today’s market trends too far into the future.

Long-Term Leaders

Some companies do feature in the top 10 from one decade to another (and another). Until recently, companies such as Exxon, General Electric, and IBM were prominent members of the group regardless of market trends.

Today, Microsoft appears to be one of those staying the distance, having been there in the early 2000s and now very much part of the AI story. We believe this speaks to the software company’s continued ability to innovate and adapt from a leader in software to being at the forefront of AI, having first invested in OpenAI in 2019. More recently, it has incorporated Copilot, an AI-powered digital assistant, into Word, PowerPoint, Outlook and Excel. Looking to 2030 and beyond, we believe Microsoft has the potential to keep its leading position in the AI theme.

Another company that we believe has staying power is Alphabet, a business which has built up a prominent position in online advertising and search through Google. Like Microsoft, it has also been in the AI game for years, having bought the UK-based AI research laboratory DeepMind back in 2014. Alphabet, in our view, has a strong long-term competitive position due to its ownership of multiple platforms with billion-plus users, strong data-gathering capabilities, proprietary hardware and mobile operating systems (Android).

Beyond Sentiment

It’s still very early days for AI and progress is rarely linear. While we believe many of today’s market leaders will likely continue to play an important role in the AI ecosystem for decades to come, history suggests that recent concentration levels are unlikely to persist. As investors, we look beyond just current market momentum, and instead evaluate companies on an individual basis.

1 MSCI Research, Aug. 2023.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Company information is mentioned only for informational purposes and should not be construed as investment or any other advice. The holdings listed should not be considered recommendations to buy or sell a security.

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. Investors cannot invest directly in any index.

The technology sector involves special risks, such as the faster rate of change and obsolescence of technological advances and has been among the most volatile sectors of the stock market. A concentration of companies in a narrow sector could cause performance to be more volatile than funds invested in a broader range of industries. Equities are subject to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular investment, strategy, investment manager or account arrangement and should not serve as a primary basis for investment decisions. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Please consult a legal, tax or investment professional in order to determine whether an investment product or service is appropriate for a particular situation. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believe to be reliable, but not guaranteed.

Walter Scott & Partners Limited (“Walter Scott”) is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott and BNY Mellon Securities Corporation are companies of The Bank of New York Mellon Corporation.

© 2025 BNY Mellon Securities Corporation, distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-704291-2025-03-14