INVESTMENT VIEWS

FROM THE BNY INVESTMENT INSTITUTE

October 2025

Japan’s newly elected Prime Minister, Sanae Takaichi, is expected to pursue dovish fiscal and monetary policies, which could boost Japanese equities but pressure the yen.

Japan’s Liberal Democratic Party (LDP) held a runoff election for party leadership which resulted in a win for Sanae Takaichi. If, as we expect, she is confirmed on the floor of parliament (around mid-October), she will be Japan’s first woman Prime Minister (PM). Her victory in the weekend runoff comes as a surprise as the reformist candidate, Shinjiro Koizumi, was widely seen as the favorite and it hints at factional infighting to put off generational changes in the LDP leadership.

The Japanese yen (JPY) is likely to come under relative pressure as the markets widely regard Takaichi as a fiscal dove with a preference for more gradual monetary policy normalization than has already been priced in by the market. The uncertainty around fiscal objectives and an increased chance of government intervention on monetary policy are likely to result in more pain for the yen. To be sure, amid a weak (or at least, less strong) U.S. dollar, we do not expect a sharply weaker bilateral exchange rate. But the JPY is likely to underperform other major FX-crosses until there is greater policy clarity.

The near-term impact on Japanese government bonds (JGB) is likely to be minor or indeterminate. This is because much depends on Takaichi’s cabinet appointments and the actual course of her policies. For instance, the appointment of a conservative finance minister, from one of the traditional factions of the LDP, could allay some doubts about fiscal slippage. But efforts to provide immediate relief, in the year-end supplementary budget, against cost-of-living difficulties, could involve subsidies and tax credits to low-to-middle-income households which will be closely scrutinized by the markets.

Broader concern about government stability will lurk for a while as political bargaining and coalition stresses come to the forefront. We believe the next step after providing immediate cost of living relief via subsidies and tax credits, in the supplementary budget, will be an effort to lower the sales tax rate or exempt key food items from the sales tax. This will require a legislative change backed by a simple majority in both houses of parliament. But given the LDP’s minority status, and odds of infighting within the LDP, compromises may have to be struck with opposition parties – failing which fresh elections may have to be called to obtain a clearer mandate. These uncertainties could limit upside scope for the yen.

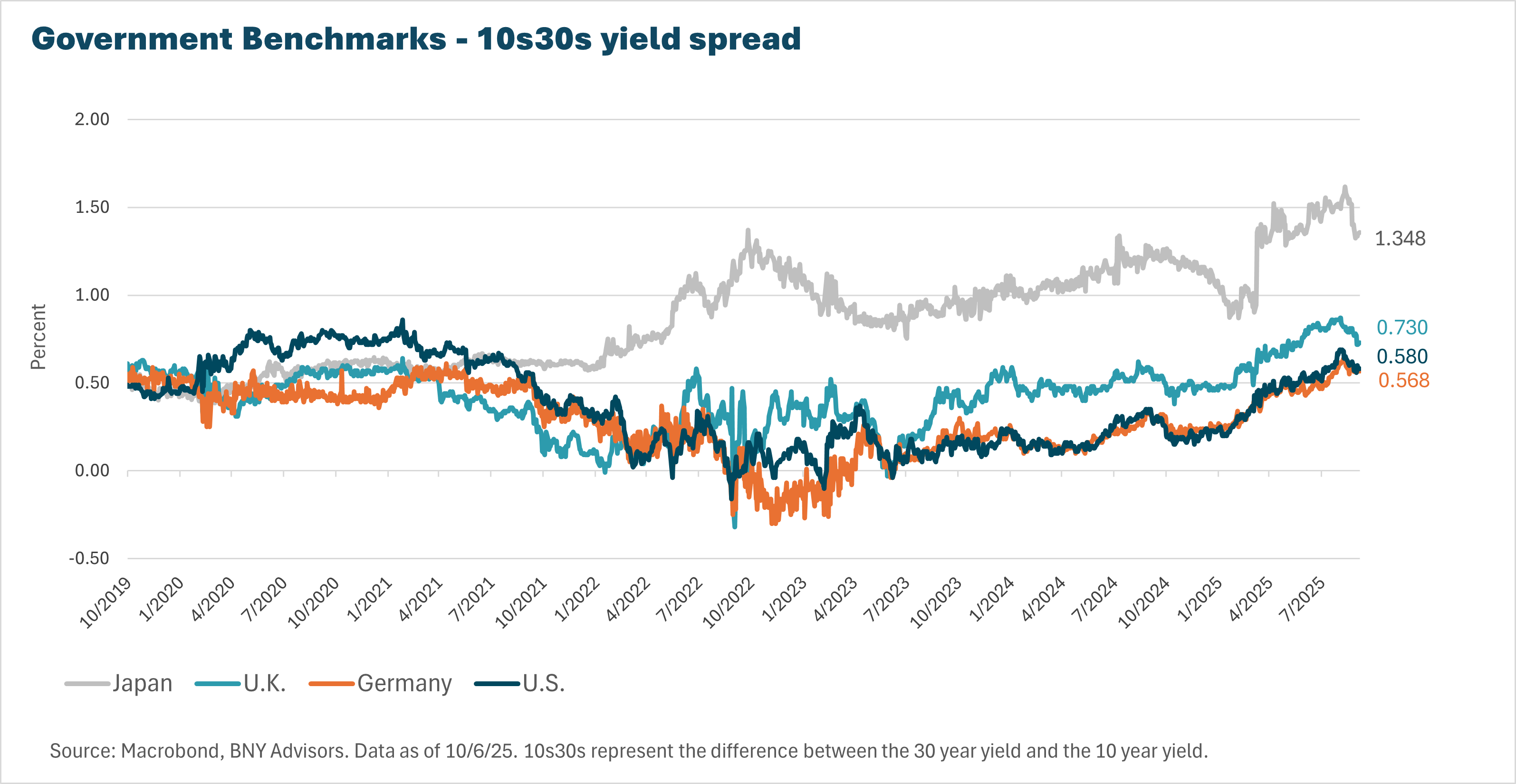

Japanese equities are likely to do relatively better in the days ahead as the new PM’s inclinations are perceived to be dovish and the contours of the broader macro policy stance are seen as fueling looser for longer financial conditions. A more favorable fiscal impulse, firmer nominal gross domestic product (GDP) growth, a relatively weaker yen and lower odds of a flattening (or even a re-steepening) in the JGB yield curve bode well for stocks. But any rally could take a breather if the Bank of Japan goes through with another interest rate hike at one of its upcoming meetings – on October 30 or December 19.

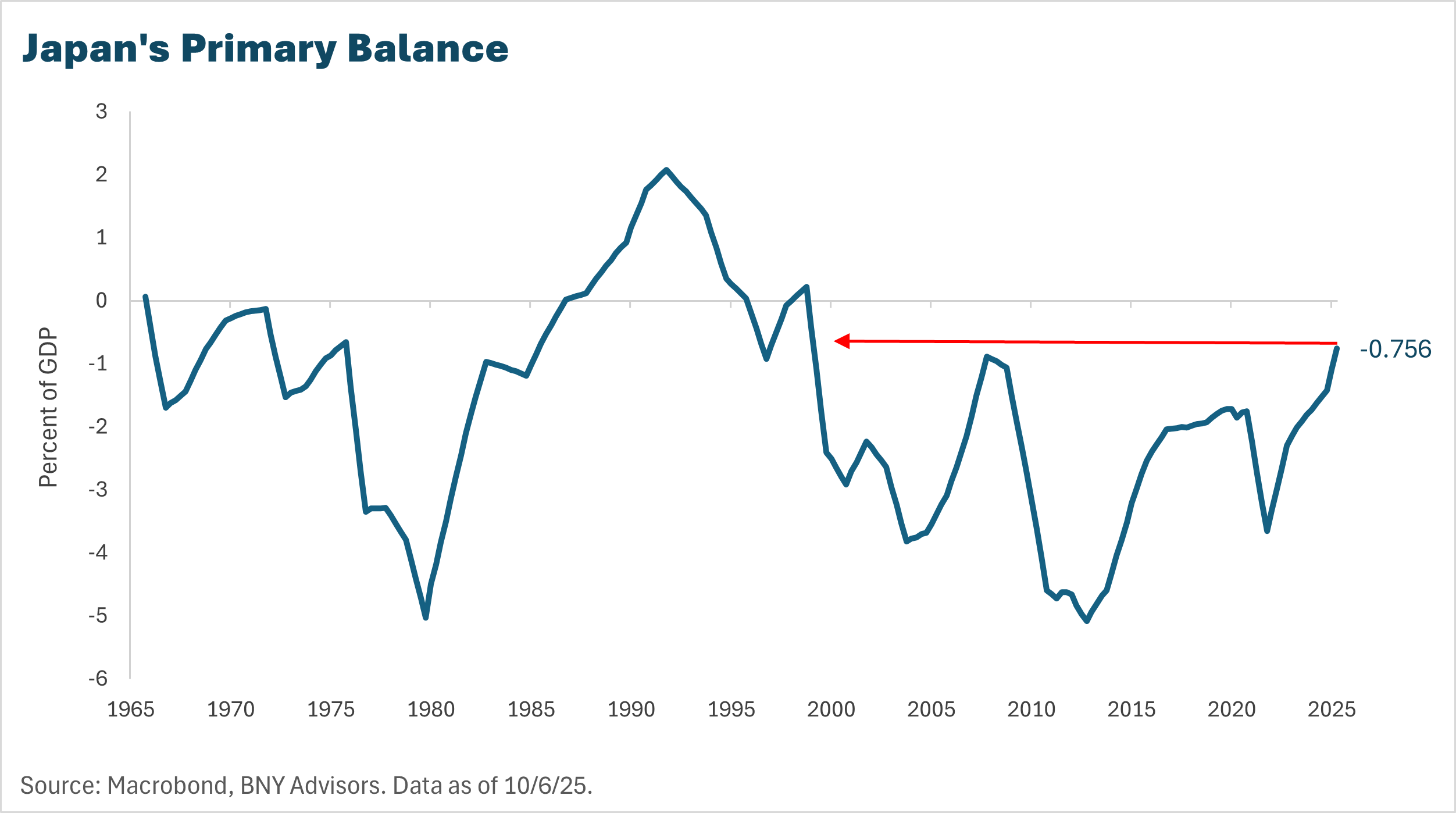

All in all, greater protection against downside JPY risks seems warranted amid uncertainty, but it remains too early to get overly concerned about large-scale fiscal slippage or government debt unsustainability. Outgoing PM Ishiba had maintained a tight grip on fiscal policy - with the primary deficit being brought down to just 0.8% of GDP, its lowest since the late 1990s. Strong nominal growth and tight fiscal settings also contributed to placing Japan’s enormous public debt burden on a downward trajectory – easing from 226% of GDP at the end of 2020 to 210% as of mid-2025. Alongside, the year-to-date widening in term premia and real yields, which have seemed excessive versus advanced economy peers, we believe Japan’s reasonably sound debt dynamics and attractive JGB valuations (especially, on the long end) provide some insulation for rates against swirling political uncertainty.

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Term premia is the additional yield that investors require for holding a longer-term bond compared to shorter-term bonds.

Real yields refer to the interest rate than an investors receives from government bonds after accounting for inflation.

FOR GENERAL PUBLIC USE.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are those of the author as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY is not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Charts are provided for illustrative purposes only and are not indicative of the past or future performance of any BNY product. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance is no guarantee of future results. Information and opinions presented have been obtained or derived from sources which BNY believed to be reliable, but BNY makes no representation to its accuracy and completeness. BNY accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations. • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

IMPORTANT INFORMATION FOR ASIA PACIFIC AUDIENCE

This document is provided to the recipient for information purposes only. This document may not be used for the purpose of an offer or solicitation, directly or indirectly, in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. This document has not been reviewed or approved by any regulatory authorities and is only for “Eligible Recipients”. “Eligible Recipients” means professional clients (i.e. non-retail clients) and (in jurisdictions where there are restrictions on (i) the types of professional clients which can be provided with this document; and (ii) the purposes for which this document can be provided to such professional clients) such types of professional clients (e.g. eligible financial institutions or financial intermediaries) which shall only use this document for the specific purposes as permitted under applicable laws and regulations.

This document is for the exclusive use of the Eligible Recipient. This document may not be copied, duplicated in any form by any means, published, circulated or redistributed or caused to be done so, whether directly or indirectly, to any other persons without the prior written consent of BNY. It is not intended for onward distribution or dissemination to the retail public and is not to be relied upon by retail clients. This document is not for distribution to, or to be used by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation, or where there would be, by virtue of such distribution or use, new or additional registration or approval requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution or use of this document in their jurisdictions.

Accordingly, this document and any other documents and materials, in connection therewith may only be circulated or distributed by an entity as permitted by applicable laws and regulations. BNY Investments do not have any intention to solicit Eligible Recipients for any investment or subscription in a fund or use of BNY Investments services and any such solicitation or marketing will only be made by an entity permitted by applicable laws and regulations. BNY Investments do not intend to conduct any offering activities, investment management business, investment advisory business, and/or any other securities business in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized.

Any views and opinions contained in this document are those of Investment Manager as at the date of issue; are subject to change and should not be taken as investment advice. BNY is not responsible for any subsequent investment advice given based on the information supplied.

BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation.

This document is not intended as investment advice. Investment involves risk. Past performance is not indicative of future performance. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. The value of investments and the income from them is not guaranteed and can fall as well as rise due to stock market and currency movements. When you sell your investment you may get back less than you originally invested.

No warranty is given as to the accuracy or completeness of this information and no liability is accepted for errors or omissions in such information. BNY accepts no liability for loss arising from use of this material.

The investment program contained in this presentation may not meet the objectives or suitability requirements of any specific investor. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. You are advised to exercise caution when reading this document. If you are in any doubt about the contents of this document, you should obtain independent professional advice.

The information contained in this document should not be construed as a recommendation to buy or sell any security. It should not be assumed that a security has been or will be profitable. There is no assurance that a security will remain in the portfolio. Tax treatment will depend on the individual circumstances of clients and may be subject to change in the future.

If there is any inconsistency between this warning statement and the disclosure stated under this document, this warning statement shall prevail to the extent of the inconsistency.

BNY COMPANY INFORMATION

BNY Investments is the brand name for the investment management business of BNY and its investment firm affiliates worldwide. BNY is the corporate brand of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. • Mellon Investments Corporation (MIC) is a registered investment adviser and subsidiary of The Bank of New York Mellon Corporation (BNY). MIC is composed of two divisions; BNY Investments Mellon (Mellon), which specializes in index management, and BNY Investments Dreyfus (Dreyfus), which specializes in cash management and short duration strategies. • Insight Investment - Investment advisory services in North America are provided through two different investment advisers registered with the Securities and Exchange Commission (SEC) using the brand Insight Investment: Insight North America LLC (INA) and Insight Investment International Limited (IIIL). The North American investment advisers are associated with other global investment managers that also (individually and collectively) use the corporate brand Insight. Insight is a subsidiary of The Bank of New York Mellon Corporation. • Newton Investment Management - “Newton” and/or “Newton Investment Management” is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021, NIMJ was established in March 2023. NIM and NIMNA are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of The Bank of New York Mellon Corporation. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of The Bank of New York Mellon Corporation. • Siguler Guff - The Bank of New York Mellon owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC). • BNY Mellon Advisors, Inc. (BNY Advisors) is an investment adviser registered as such with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Advisors is a subsidiary of The Bank of New York Mellon Corporation.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

©2025 THE BANK OF NEW YORK MELLON CORPORATION

MARK-814279-2025-10-06

GU-722 - 30 October 2026