May 2025

How did markets perform during previous periods of volatility?

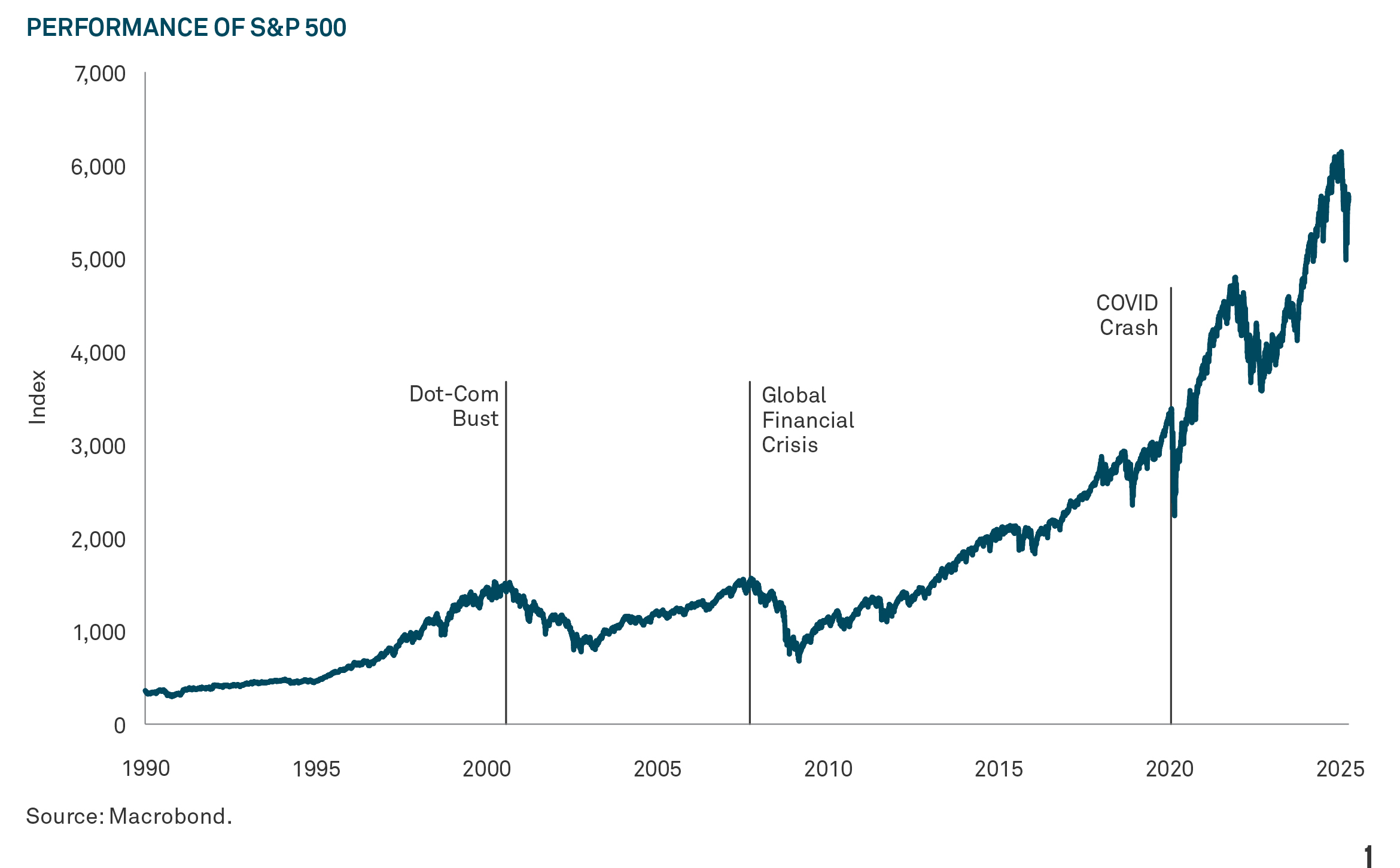

Markets have once again found themselves on unsteady ground, this time rattled by escalating trade tensions and uncertainty around the trajectory of tariffs. While volatility always feels unsettling in the moment, history provides a critical reminder: markets have weathered difficult periods before and have typically emerged stronger on the other side.

To put today’s market situation into perspective, we examine how various markets behaved during previous bouts of severe volatility.

DOT-COM BUST

(2000–2002)

A long, grinding bear market

The bursting of the tech bubble in 2000 ushered in a prolonged bear market. From March 2000 through October 2002, the S&P 500 fell more than 47% over a period of more than two years. Technology stocks, captured by the NASDAQ Composite, fell even more dramatically, losing ~78% from peak to trough.1

Recovery during this period was slower than seen in other downturns. But still, a year after the bottom, by October 2003, the S&P 500 had rebounded 33%.2

The Dot-com downturn highlighted that while volatility can linger for an extended period, the long-term trajectory of the market can also remain intact.

GLOBAL FINANCIAL CRISIS

(2007–2009)

Deepest drawdown, strongest rebound

The Global Financial Crisis (GFC) remains the most severe market downturn in modern history. The S&P 500 peaked in October 2007 and then fell for 17 months, bottoming in March 2009. Over that period, the index declined more than 55%. Yet, the recovery was also dramatic. In the 12 months following the March 2009 low, the index gained an extraordinary 70%.3

A key takeaway from the GFC is that even deep downturns can become new cycles of growth, sometimes faster than many would have anticipated.

COVID CRASH

(2020)

Fastest decline, fastest recovery

The COVID-19 pandemic triggered the fastest bear market in history In just over a month — from February 19 to March 23, 2020 — the S&P 500 lost 34% of its value. The speed and severity of the decline were unprecedented in modern history, reflecting the extraordinary uncertainty about the global economy as lockdowns swept across the world.

Yet, markets also rebounded rapidly. Massive fiscal and monetary stimulus helped fuel a significant rally. From the March 2020 bottom, the S&P 500 surged 74% over the next 12 months, one of the strongest one-year returns on record.4

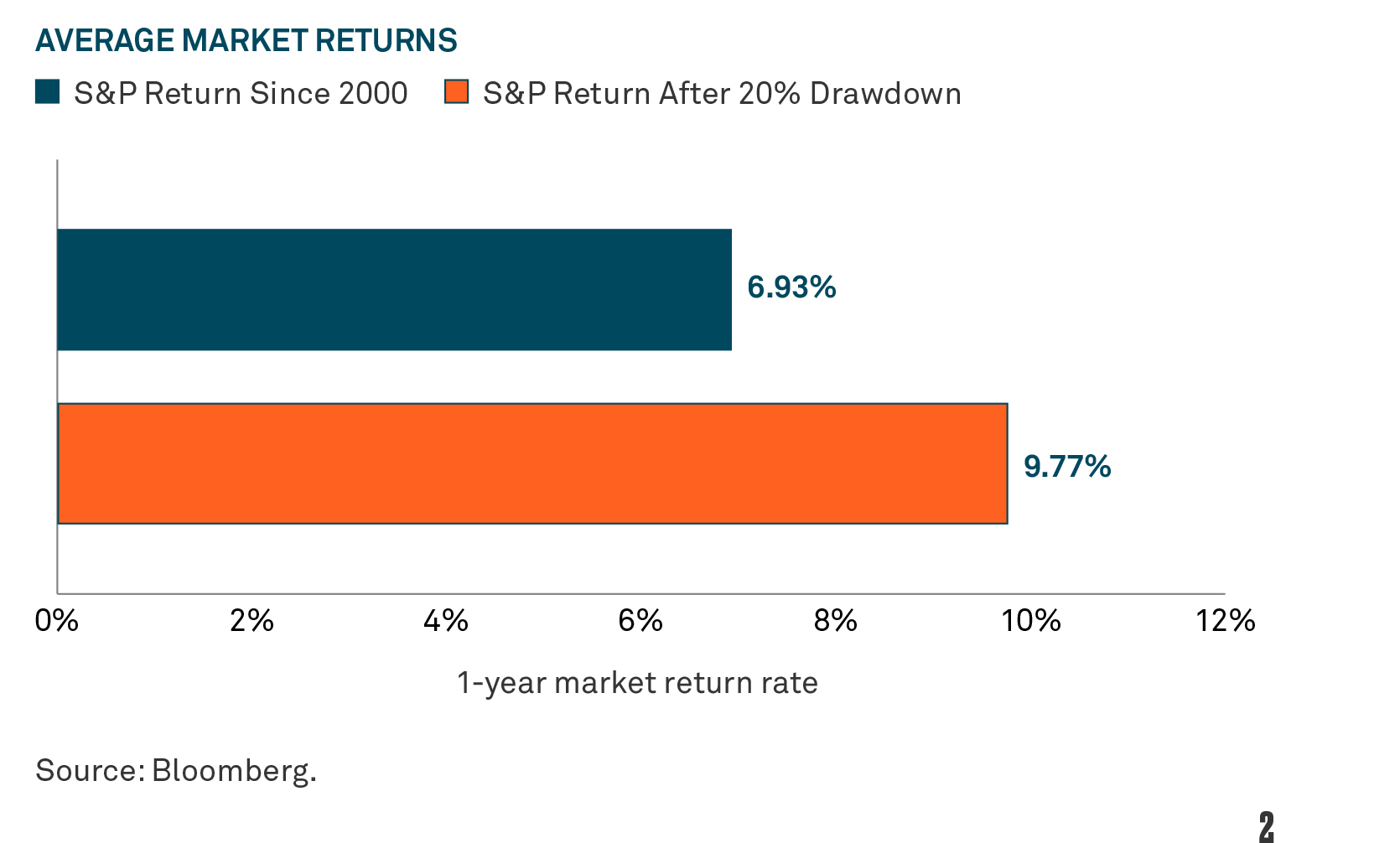

After deep drawdowns

Taking a step back to examine the S&P 500 more broadly, we see that since 2000, average market returns are just under 7%. However, since 2000, the average 1-year return after periods of a 20% drawdown are more than 9.7%.5

Bond markets: duration could be your friend

In each of the three market crises we’ve addressed, bond yields fell as investors sought the safety of fixed income. For example, during the GFC, the 10-year U.S. Treasury yield, which stood above 5% in mid-2007, fell to below 2.5% by the end of 2008. Yields remained below 4% for most of the next decade, as the Federal Reserve maintained ultra-accommodative policies to support the economy.6

During the Covid-19 pandemic, bond markets reacted sharply — the 10-year Treasury yield plunged to an all-time low of just ~0.5% in March of 2020 and remained below 2% until economies around the world reopened in 2022.7

Longer-duration bonds (Treasuries with 10-to-30-year maturities) saw significant capital appreciation during these periods due to bond prices surging. In some cases, these gains helped stabilize portfolios and provided total return, even though rates were low.

It’s notable that during these times that spreads on sub-investment grade bonds widened significantly, suggesting caution around over-exposure to high yield credit during volatile times.

Lessons for investors

Market history shows that though periods of volatility are painful, equity drawdowns have consistently been followed by recovery.

And while bond yields have historically taken longer to recover, there are opportunities in fixed income during volatile times as well.

Overall, amid market volatility, it’s valuable to keep in mind that:

1

Market declines are a feature, not a bug, of long-term investing.

2

The depth of a downturn does not preclude a strong rebound.

3

Trying to time the market amid uncertainty is exceedingly difficult — and often counterproductive.

4

Staying invested, diversified, and focused on long-term goals remains a reliable strategy.

In times of turbulence, perspective is one of the most powerful tools an investor can have. While tariffs and trade tensions may dominate today’s headlines, history suggests that volatility, however uncomfortable, is rarely the end of the story.

Read more about markets and strategies at BNY Investments’ Perspectives page.

1–4 Morningstar, April 2025.

5–7 Bloomberg, April 2025.

IMPORTANT INFORMATION

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks, to varying degrees. Value stocks involve risk that they may never reach their expected full market value, either because the market fails to recognize the stock’s intrinsic worth or the expected value was misgauged. The technology sector involves special risks, such as the faster rate of change and obsolescence of technological advances, and has been among the most volatile sectors of the stock market. Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. High yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis.

Asset allocation and diversification cannot ensure a profit or protect against loss.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Past performance is not necessarily indicative of future results. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

This information has inherent limitations and is being provided with the benefit of hindsight. Prevailing market conditions may be materially different from historical market conditions and may produce materially different results from those shown here.

Charts are provided for illustrative purposes and are not indicative of the past or future performance of any BNY product.

The S&P 500® Index is widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity.

Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Newton Investment Management Limited (“NIM” or the “Firm”) is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business, and subsidiary of The Bank of New York Mellon Corporation (“BNY”). The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management” (“Newton”). Newton currently includes NIM, Newton Investment Management North America, LLC (“NIMNA”).

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Mellon Securities Corporation is a subsidiary of BNY.

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-745968-2025-05-27