April 2025

Scope for tariff reductions?

At the start of the year, the US was expected to collect around $100 billion in tariffs. That quickly became $200 billion, $300 billion, and with the April 2 announcement of worldwide reciprocal tariffs, that figure ballooned to potentially $800 billion.1

“The size of tariffs has grown significantly enough to represent a meaningful tax on consumers and corporations alike. It’s possible that negotiations could reduce these figures, but if the administration views tariffs as a revenue source — and we believe revenue is one of the motivations of this administration — then there may be limited meaningful scope for tariff reductions,” according to Eric Hundahl, Head of the BNY Investment Institute.

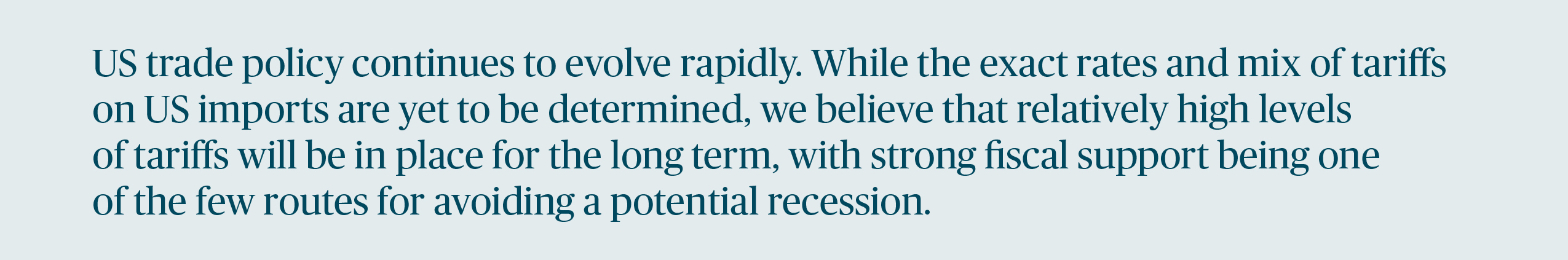

Drag on sentiment

Policy uncertainty is already affecting consumer behavior. The University of Michigan Consumer Sentiment report, released on April 11, 2025, showed a significant drop to 50.8, its secondlowest reading on record. “On one end, households face rising prices and must make tough decisions about purchases.

On the other end, due to market fluctuations, a certain amount of wealth that was invested may not be there anymore. Some of this wealth may have been ear-marked for big purchases, and that capital would have gone back into the economy,” says Hundahl. “In this way, uncertainty is eroding growth.”

We believe that fiscal intervention in the form of tax cuts may be key to avoiding a recession. Targeted tax cuts, including reductions in corporate taxes, personal income taxes, taxes on tips and taxes on Social Security, could provide muchneeded relief. In addition to boosting liquidity for both consumers and companies, policymakers may need to introduce pro-growth measures to counteract the economic drag of tariffs. We believe there may be deregulation and other pro-growth policies later this year or in 2026.

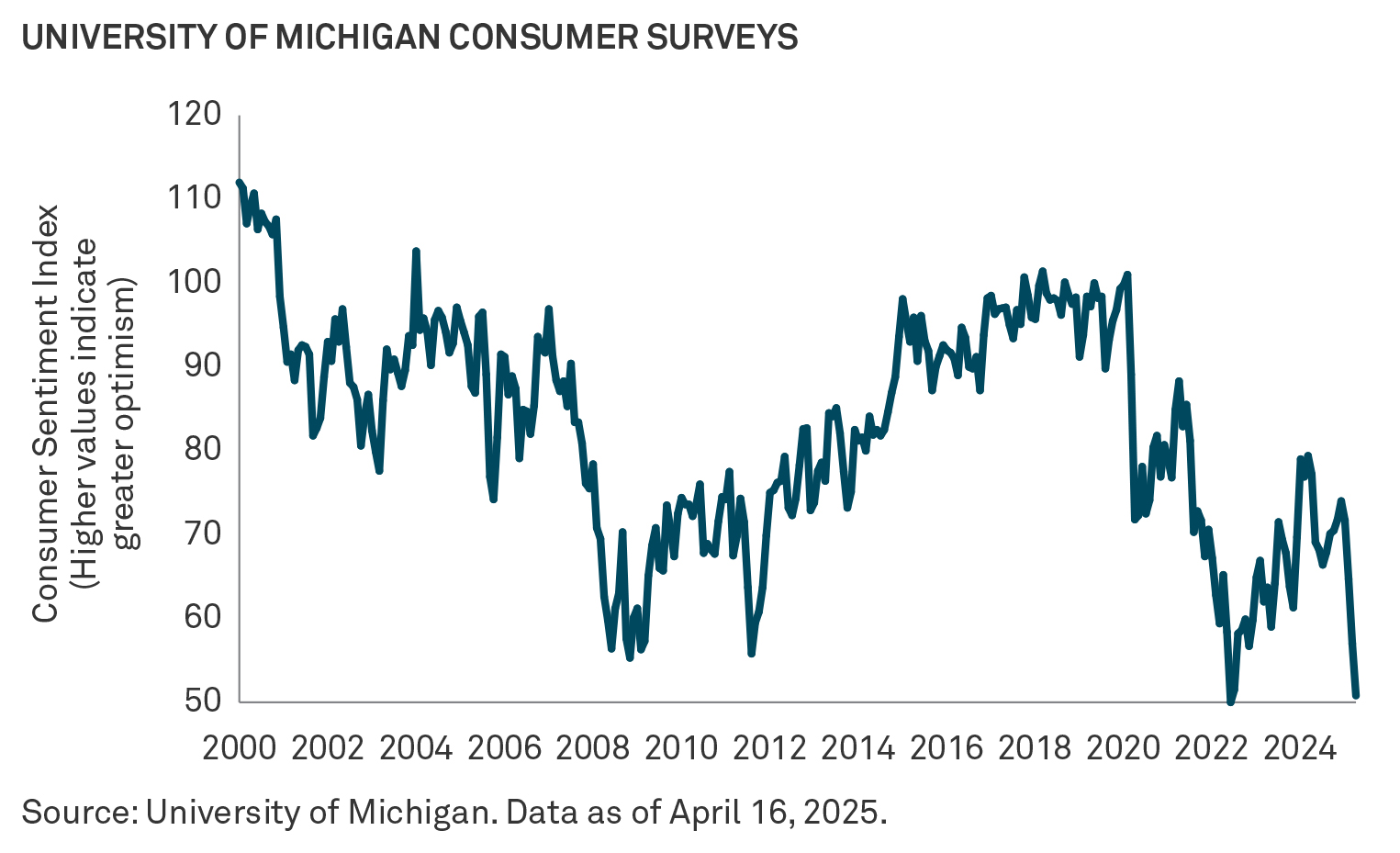

As for the Federal Reserve (the Fed), we’ve long held the viewpoint that the Fed may struggle to cut rates and we believe the central bank is now in “wait and see” mode. The central bank is unlikely to cut rates until it’s clear the labor market is struggling. Therefore, the weekly jobless claims report is, in our view, the single most important data point these days. However, these claims can be noisy week-to-week, so it’s the trend over a few weeks that yields the most reliable signal, points out Hundahl.

Positioning amid volatility

Trade policy is likely to remain fluid, and the volatility of portfolio positions may be elevated.

Historically, companies that grow and pay dividends tend to be more resilient in downturns. Read more in Why Dividends Are Set to Shine. We see potential opportunities and value in value stocks. See our report: Inflation and Magnificent 7 Volatility Could Point to Large Cap Value Opportunities.

Finally, this could be a particularly meaningful time to consider global fixed income, given it’s likely that a number of global central banks will lower rates more substantially than in the US. Investing in global fixed income, particularly on a hedged basis, can provide diversified sources of return to a domestic-only fixed income portfolio. See our report: Vigilantes Stay Home.

BNY Investments will continue to monitor the situation and bring you our latest analysis.

1 BNY Investment Institute estimate, based on assuming no reduction in trade flows and extrapolating using 2024 import figures and an estimated 25% effective tariff rate.

IMPORTANT INFORMATION

All investments involve risk including loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Past performance is not necessarily indicative of future results. Asset allocation and diversification do not ensure a profit or protect against a loss.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances.

Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

BNY Investment Institute consists of BNY Mellon Advisors, Inc.’s (BNY Advisors) macroeconomic research, asset allocation, manager research and operational due diligence teams. BNY Advisors is an investment adviser registered as such with the US Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Advisors is a subsidiary of The Bank of New York Mellon Corporation.

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

Investments: Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

MARK-723561-2025-04-17