March 2025

Mega-cap tech firms have led returns, but with valuations stretched, we believe there may be opportunity in value.

The macro environment appears to be filled with news of ongoing uncertainty. With change continuing to be the norm, we expect inflation to remain persistent, likely prompting the Federal Reserve (the “Fed”) to keep rates elevated. This, combined with slowing growth and higher valuations, lead us to reiterate our view that there is investment opportunity in value-oriented stocks.

In late 2024, we made a case for US large-cap value investing in “A Style (Value) for All Seasons.” We believed that a return to a pre-2008 global financial crisis macro environment would normalize growth/value performance. Second, we observed a rising concentration risk, as equity markets — and investor portfolios — were increasingly exposed to the “magnificent seven” (M7), a narrow group of expensive large-cap growth stocks. We argued for rebalancing, rather than fully rotating, toward US large-cap value, as we did not see an obvious catalyst for a change in market leadership.

Today, however, we are seeing evidence that some of the key drivers of growth leadership, such as aggressive US monetary-policy easing and US leadership in artificial intelligence (AI) development, are softening. This has led to large cap growth’s performance lagging value year to date. While this period is short, it emphasizes the importance of a balanced allocation to US large-cap value stocks.

Investors Starting to Embrace “Higher for Longer?”

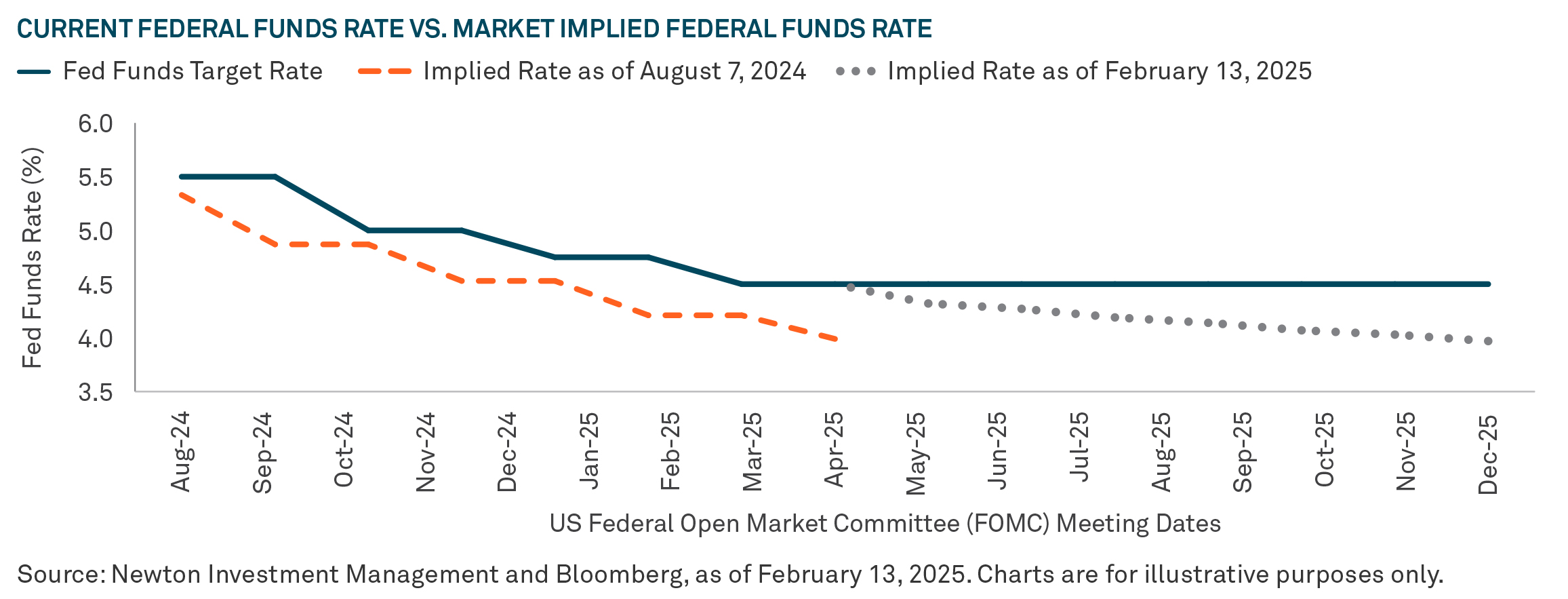

Federal Reserve Chair Jerome Powell said at the beginning of the year that the central bank “doesn’t need to rush to adjust interest rates” and would be “patient before lowering borrowing costs further.” The Fed’s message was quickly reflected in market-based expectations.

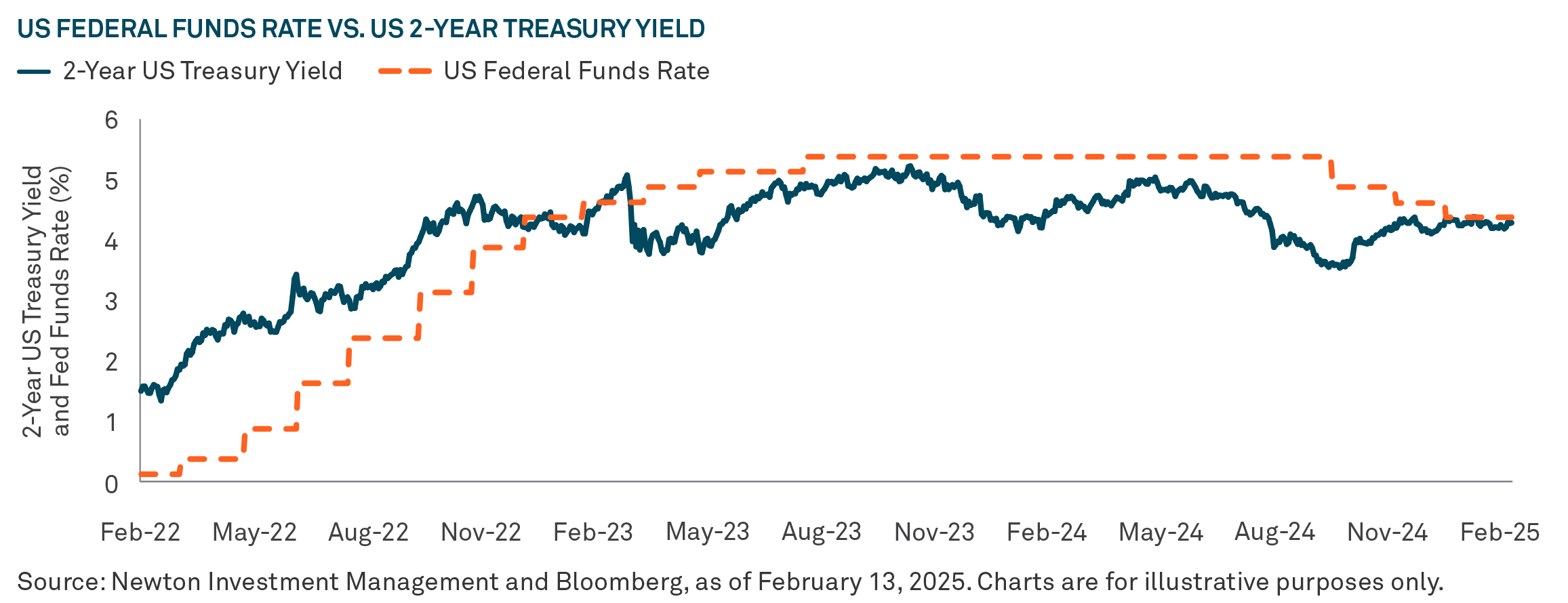

As the chart below at top illustrates, the 2-year US Treasury yield, which traded below the Fed funds rate for over a year on the expectation that interest rates would be moving lower imminently, has recently converged with the Fed funds rate.

In addition, the market-implied Fed funds rate indicates that some investors may expect rates to fall later and less than previously thought. In August 2024, the market expected the rate to be 4% by January 2025. However, the market now anticipates reaching 4% by December 2025, almost a full year later.

Changes in interest-rate expectations have typically been a big driver of relative style performance. The Fed’s low- and zero-interest rate policy helped growth outperform value in the 12 years leading up to the Covid-19 pandemic, and again after inflation peaked in 2022. With interest-rate expectations beginning to reflect the Fed’s higherfor- longer stance, we think valueoriented securities are poised to deliver competitive returns relative to growth.

Magnificent Seven Taking a Breather?

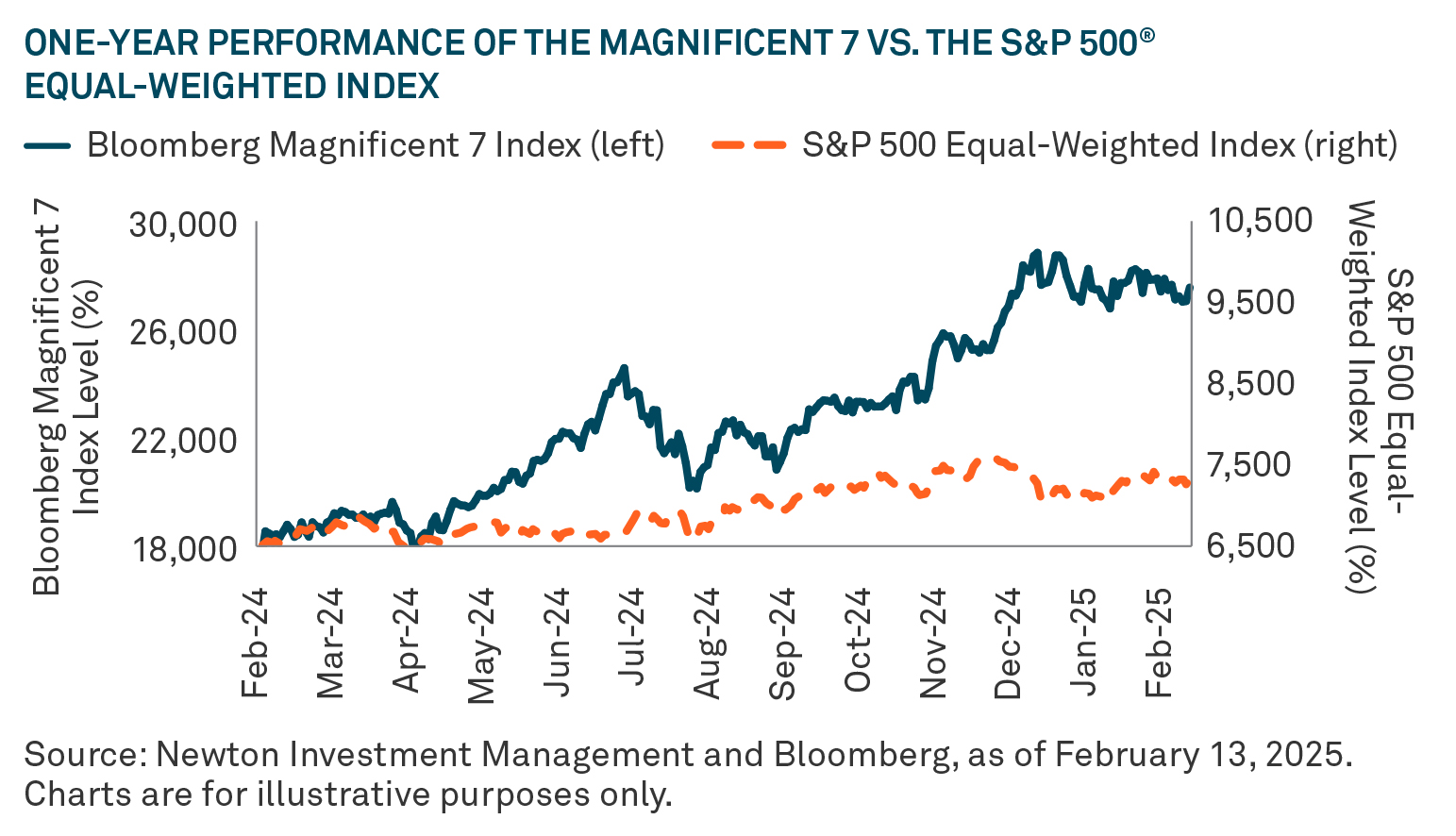

US equity market gains over the past year were driven primarily by the M7. More recently, a subset has separated themselves owing to their leadership in AI innovation, development and spending. Lately, however, these stocks have taken a breather as investors review their assumptions about US leadership in AI. The key catalyst for this was the emergence of Chinese AI developer DeepSeek, which appears to be a new platform that is reportedly more energy-efficient than its US counterparts.

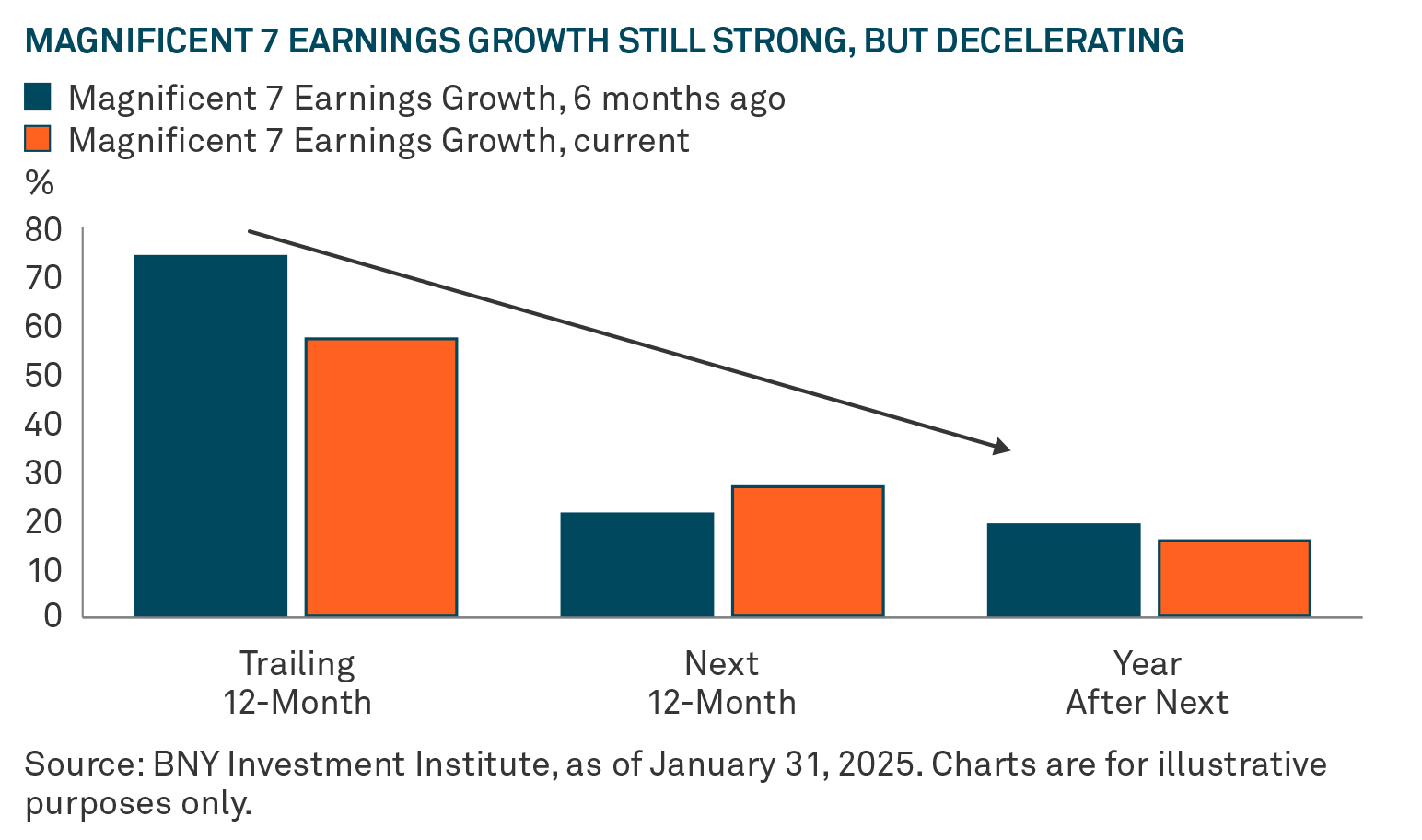

We believe investors are likely to further scrutinize the M7 companies’ future earnings growth to determine if expected earnings can still support lofty valuations. Looking at the earnings data through the end of January, this pause among the M7 seems warranted. As the chart to the right illustrates, earnings growth, while still relatively strong, is forecast to decelerate over the coming year.

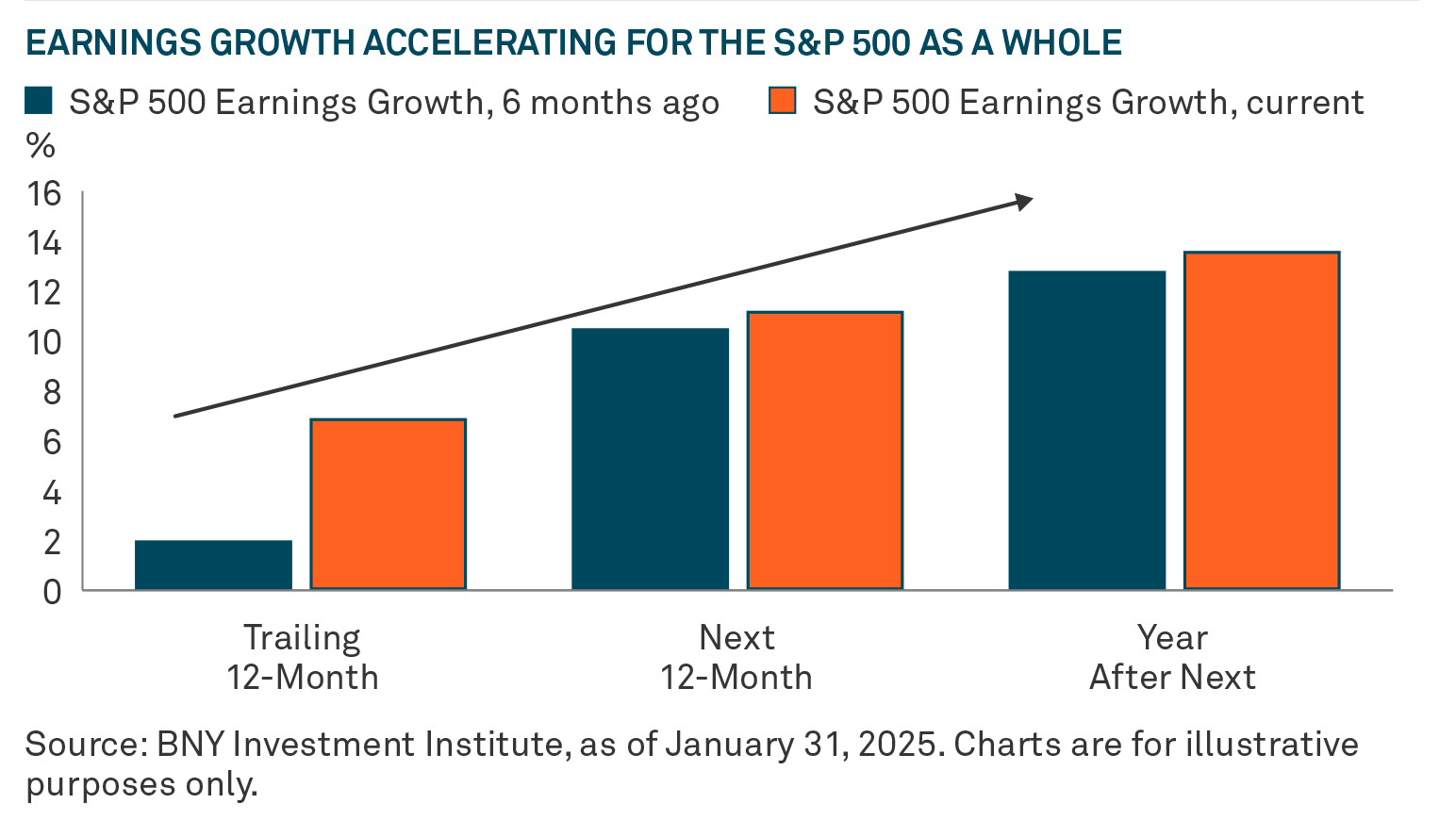

Meanwhile, earnings growth for the broader market is being revised higher from where consensus expected it six months ago and looks set to accelerate higher through 2026, which would support the case to balance out exposure beyond a small set of companies.

Conclusion

A potential scenario of elevated US interest rates, plus slowing momentum in M7 earnings growth suggests that value stocks remain an allocation opportunity. Within the value space, we believe companies with strong and improving fundamentals, attractive valuations and business momentum may provide potential investment opportunity.

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks, to varying degrees. Value stocks involve risk that they may never reach their expected full market value, either because the market fails to recognize the stock’s intrinsic worth or the expected value was misgauged. The technology sector involves special risks, such as the faster rate of change and obsolescence of technological advances, and has been among the most volatile sectors of the stock market.

Asset allocation and diversification cannot ensure a profit or protect against loss.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

The Magnificent 7 comprises seven of the largest technology-centered growth stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. Artificial intelligence refers to the capability of computational systems to perform tasks typically associated with human intelligence, such as learning, reasoning, problem-solving, perception, and decision-making.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Past performance is not necessarily indicative of future results. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

This information has inherent limitations and is being provided with the benefit of hindsight. Prevailing market conditions may be materially different from historical market conditions and may produce materially different results from those shown here.

The S&P 500® Index is widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The Bloomberg Magnificent 7 Total Return Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of seven widely-traded, US-based companies representing the Communications, Consumer Discretionary, and Technology sectors, as defined by the Bloomberg Industry Classification System (BICS). Investors cannot invest directly in any index.

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity.

Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Issued by Newton Investment Management North America LLC (“NIMNA”) or the “Firm”). NIMNA is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and subsidiary of The Bank of New York Mellon Corporation (“BNY”).

The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation.

The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management.” Newton currently includes NIMNA and Newton Investment Management Ltd. (“NIM”) and Newton Investment Management Japan Limited (“NIMJ”).

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-702919-2025-03-12