October 2025

2023 wasn’t just another year for technology, it was the year AI went mainstream. ChatGPT was the first large language model (LLM) to achieve widespread public adoption, launching a wave of consumer interest in AI. It was quickly followed by LLMs from major hyperscalers, which collectively accelerated the democratization of access to LLMs.

We believe this is the “third epoch of technology,” a turning point comparable to the dawn of the internet or the rise of the smartphone. AI is racing from experimental novelty to everyday necessity, with its vast potential still unfolding.

The first two AI waves have primarily benefited large technology companies. The third wave appears to be reshaping traditional industries, poised to create potential value beyond the tech sector.

For investors, this opens opportunities to explore companies that are transforming their models, boosting efficiency and unlocking innovation — often with the potential for attractive valuations.

AI’s first movers: laying the foundation

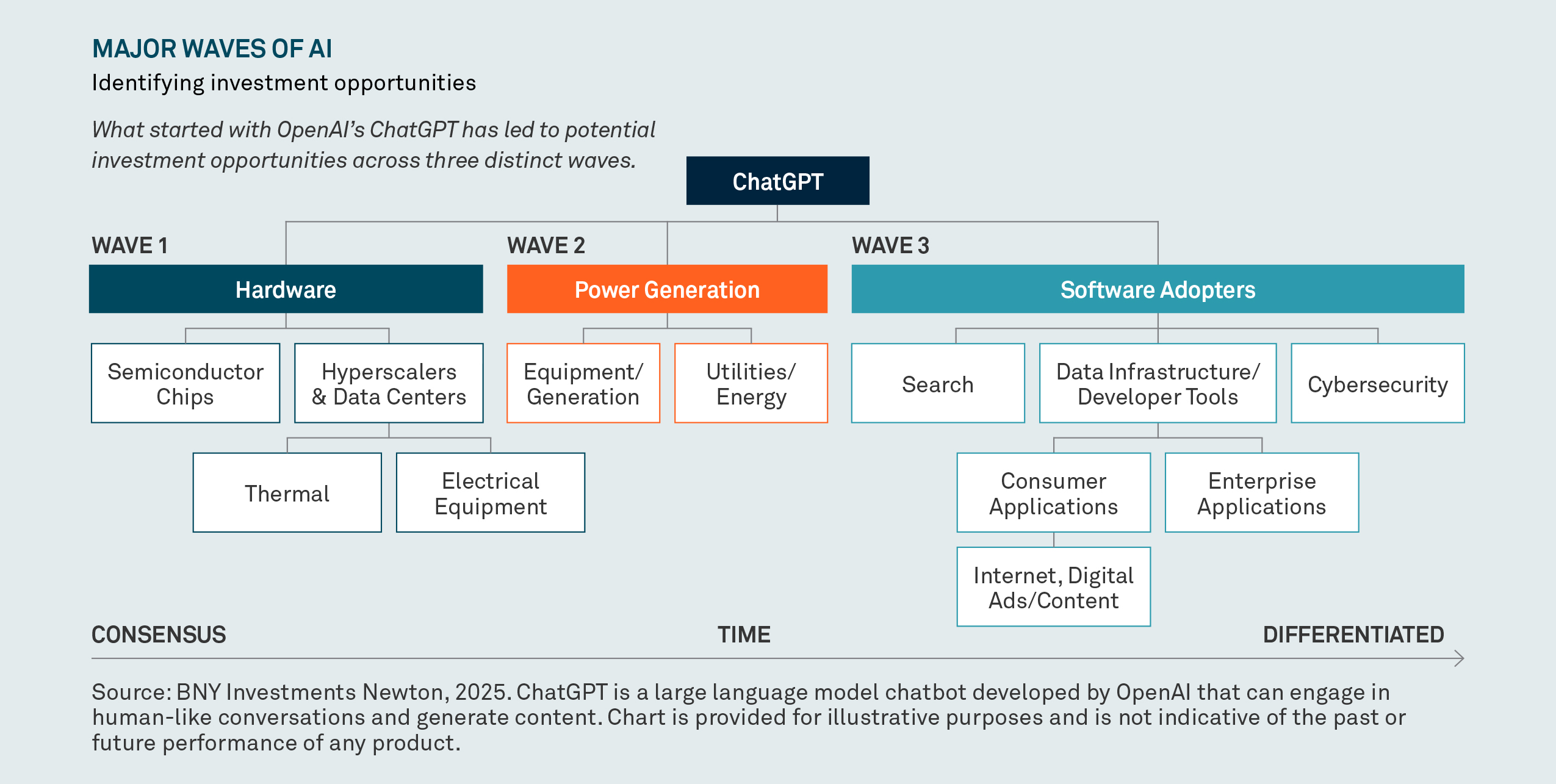

To navigate this dynamic landscape, we utilized BNY Investments Newton’s multidimensional research across fundamental, thematic, private market, investigative and quantitative to construct a comprehensive view of the investment landscape. Through this lens, we identified AI investment opportunities in three distinct waves, each representing a phase in AI’s evolution and expansion into the broader economy.

The first wave of AI adoption centered on foundational hardware such as semiconductors, data centers and infrastructure required to power AI.

We see significant capital investment by large hyperscalers, all well-known technology companies, to expand capacity for AI workloads, with strong demand for graphics processing units, AI accelerators and integrated circuits. These companies scaled up data centers and the related infrastructure necessary to meet the surging demand for AI workloads and monetize related enterprise services.

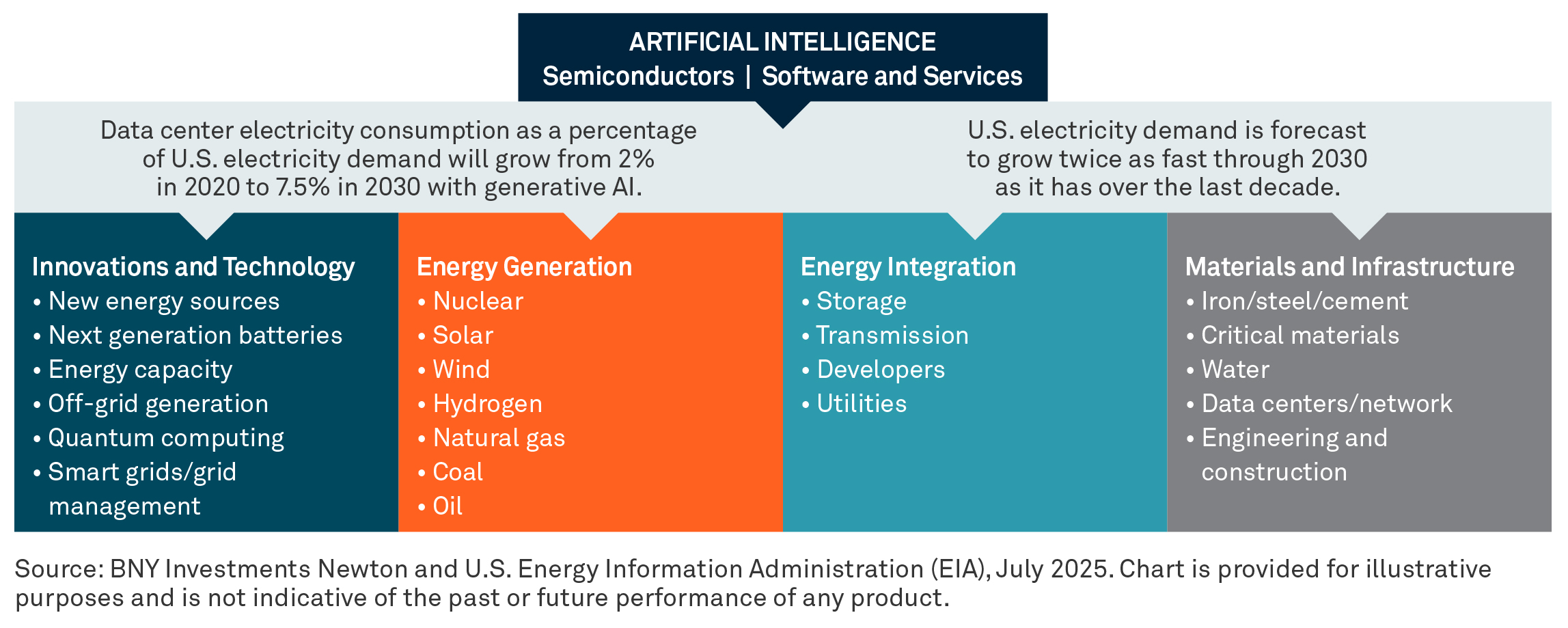

The second wave focused on power systems needed to meet AI’s rapidly growing computational demands. U.S. data-center power usage is projected to rise from 2% of total consumption in 2020 to 7.5% by 2030, fueled by generative AI, onshoring and electrification.1

We believe this shift created compelling opportunities across energy, utilities and industrials — sectors traditionally seen as cyclical but now potentially essential to AI’s scalability.

Unlocking potential “value” in AI’s third wave

We believe the third wave marks a shift from building AI infrastructure toward widespread adoption. In our view, this wave remains largely untapped despite representing a $2–3 trillion opportunity.2 From enterprise applications to agents and consumer tools, this wave broadens the investment landscape beyond tech companies and appears to be permeating traditional industries such as retail, healthcare, finance and advertising.

BEYOND AI: WHAT COMES AFTER SEMICONDUCTORS AND SOFTWARE?

Energy demand > energy supply > energy innovation + infrastructure

In the third wave, we believe there are two broad categories of AI adoption for more traditional companies.

- Consumer: Deployment of AIpowered agents, decision systems and customer experience platforms that are reshaping how businesses engage and compete.

- Enterprise: The utilization of AI to automate the storage, organization and optimization of data, enhancing operational efficiencies.

This expansion may present a compelling opportunity to identify companies in legacy sectors that are embracing AI to drive transformation and value creation.

Much like the early days of the internet, we expect to see new businesses built on top of this technology. Whether it’s a logistics firm using predictive analytics to optimize delivery routes or a healthcare provider deploying AI for diagnostics and patient engagement, potential value creation from the third wave of AI will come from companies outside the traditional tech sphere.

From foundation to transformation

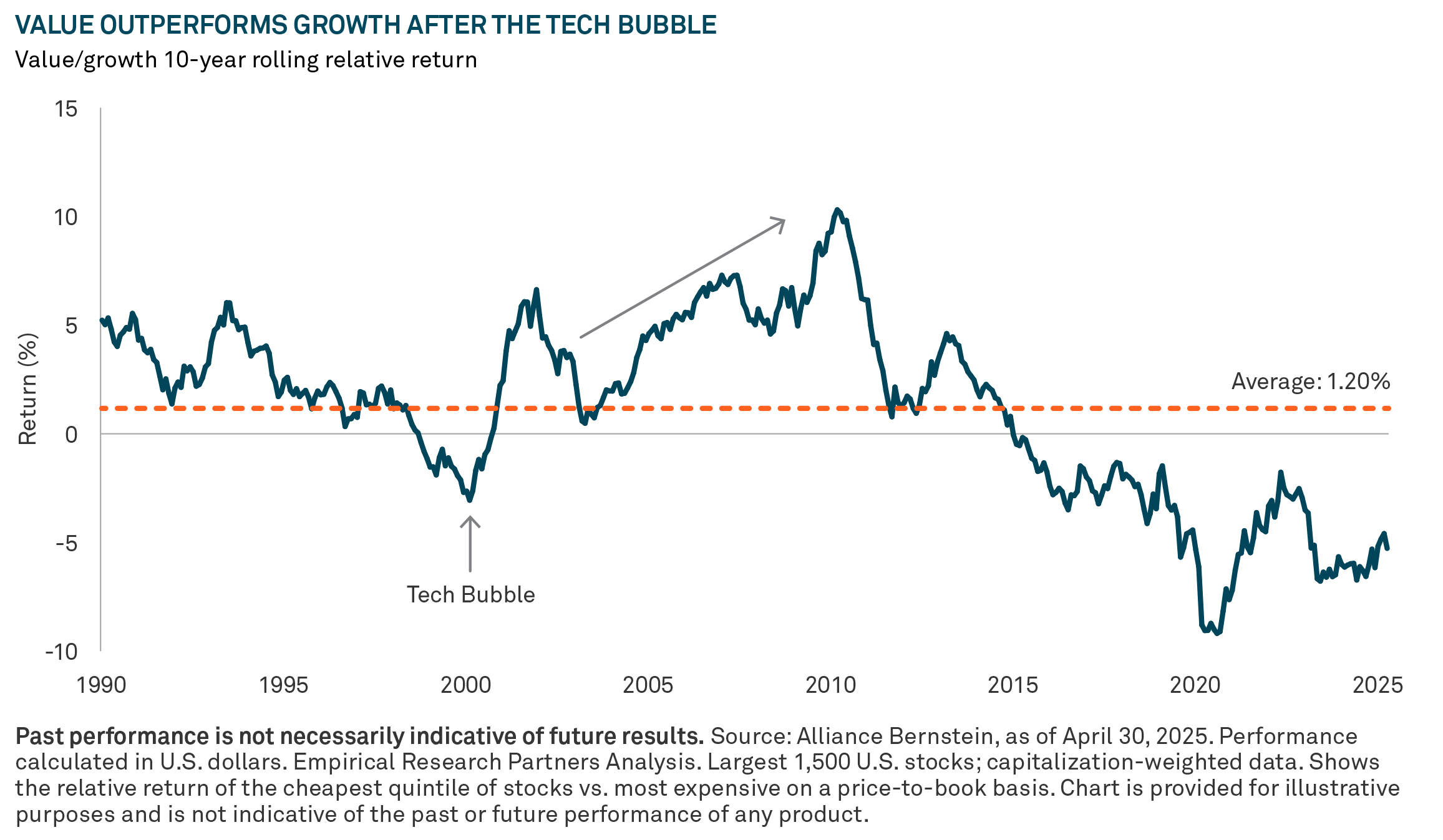

As we consider the trajectory of future AI winners and losers, parallels can be drawn to the value creation that followed the dot-com boom. Although tech-centric and hype-driven growth companies initially surged, many ultimately collapsed under the weight of unsustainable valuations.

While early innovation was concentrated in the tech sector, the internet ultimately became a foundational layer across industries — powering e-commerce in retail, enabling digital payments and mobile banking in finance, and reshaping how businesses operate at scale. We see the third wave of AI paving a similar path. While hyperscalers and hardware led early stages, they now command elevated valuations. These high-profile names dominate headlines, but AI capabilities are increasingly being embedded into traditional industries, where a new generation of potential value creation is emerging from companies outside the traditional tech sphere. This shift may represent a compelling opportunity to explore the broader landscape. As industries adapt and leverage AI, they are transforming business models, unlocking efficiencies, driving productivity and potential new domains of value — often at what can be lower valuations.

Identifying early winners across traditional industries

At BNY Investments Newton, we are positioned to identify and act on the opportunities emerging from the third wave of AI — especially as its influence expands into the broader economy. Our platform is designed to stay ahead of this curve by detecting early signals, identifying companies with what we believe have meaningful AI integration, and surfacing insights from private markets and deep research. We believe that this should enable us to identify differentiated winners and losers before the market prices them in.

1 Source: U.S. Energy Information Administration (EIA).

2 Source: BNY Investments Newton estimates: Implications of DeepSeek discussion and off-site, 2025.

IMPORTANT INFORMATION

All investments involve risk including loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Past performance is not necessarily indicative of future results.

FDIC is the Federal Deposit Insurance Corporation.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances.

Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

BNY Investments is the brand name for the investment management business of BNY and its investment firm affiliates worldwide. BNY is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally.

BNY Investments Newton is the name for a group of affiliated companies that provide investment management services under the trading name of ‘Newton’ or ‘Newton Investment Management’. Investment management services are provided in the United Kingdom by Newton Investment Management Ltd (NIM), in the United States by Newton Investment Management North America LLC (NIMNA), and in Japan by Newton Investment Management Japan Limited (NIMJ). All firms are indirect subsidiaries of The Bank of New York Mellon Corporation (‘BNY’).

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-800403-2025-09-08

BKR-BTBVALEMGHO-0925