Second quarter earnings season is winding down. Nearly all companies have reported, and the majority beat expectations as margin estimates continue to rise.

Second quarter earnings season is winding down, with ~92% of S&P 500 companies having reported. Over 80% of those companies beat analysts’ expectations, pleasing many investors and correcting a downward shift in S&P 500 margin estimates that has stabilized since May.

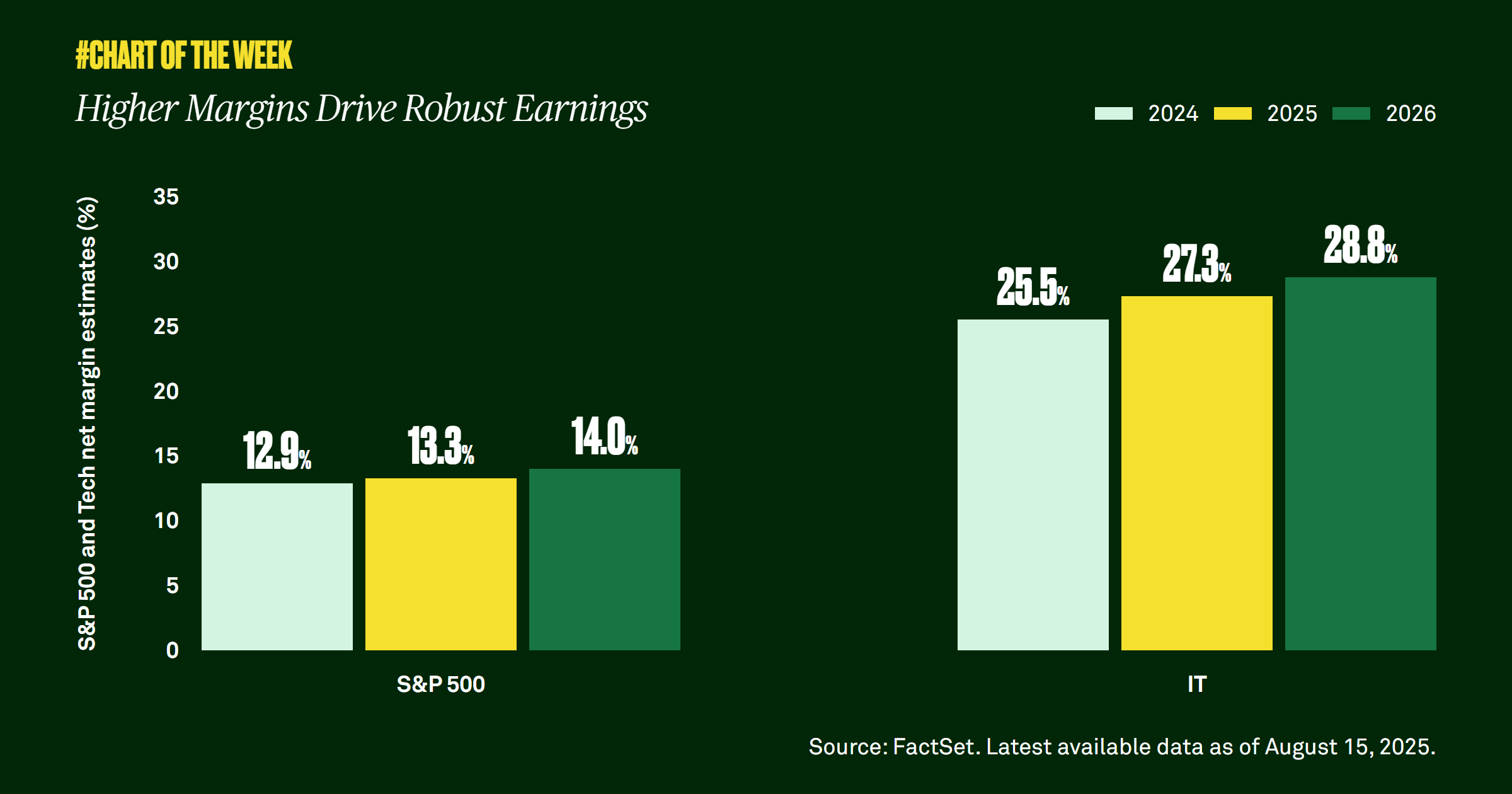

Margins illustrate the quality and durability of corporate earnings by demonstrating how effectively a company controls costs and converts sales into profits. In 2025, net margins are expected to reach 13.3%, up from 12.9% in 2024, as well as increase another 0.7% to 14.0% in 2026. Notably, estimates for technology companies are significantly better than those of the entire S&P 500.

In fact, technology enhancements are the key driver of higher margins for the index. Specifically, the continued development and broadening adoption of artificial intelligence (AI) should bolster companies’ productivity and, in turn, lead to higher margins. Some of the ways that AI increases margins include improving operational efficiency, employing data-driven decision making, enhancing supply chain optimization, and enabling product and service innovations.

The immense progress in AI and its encouraging potential support our constructive view of equities. Improving estimates for both margins and earnings underscore our overweight position in large cap stocks and should push the market higher by year end.