More tit-for-tat than full-blown conflict

Key points:

- Latest trade tensions are unlikely to morph into a full-blown trade conflict.

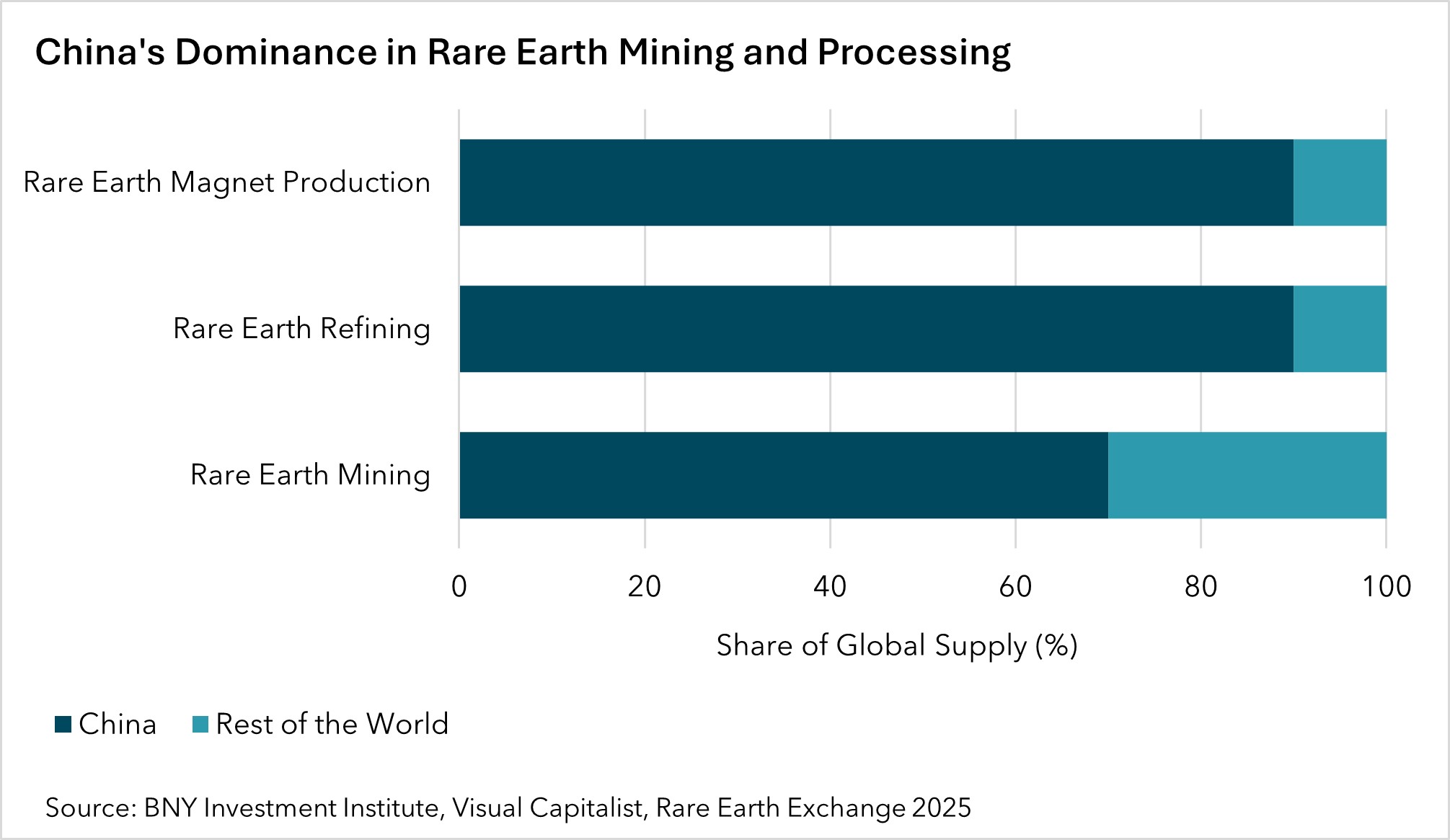

- China announced that a license will be required for foreign companies to export products with more than 0.1% of Chinese-origin rare earth.

- This prompted the U.S. to announce 100% tariffs on China

- We believe these constitute tit-for-tat moves. Both countries are seeking to gain leverage ahead the forthcoming APEC summit.

- Signaling a tough stance but ultimately striking a compromise makes sense for both sides.

- A strict imposition of export controls in critical upstream technologies and inputs by either side raises the prospect of mutually assured losses.

Sino-U.S. disagreements on export controls over technology and critical minerals are unlikely to morph into a full-blown trade conflict. Despite the latest trade tiff, we believe the U.S. and China are currently taking a tough stance but ultimately striking a compromise makes sense for both sides.

China said last week that starting on December 1, a license will be required for foreign companies to export products with more than 0.1% of Chinese-origin rare earths. Beijing has also reserved the right to approve exports of rare earths for the production of certain advanced semiconductors. This announcement prompted a renewed threat by President Trump to raise tariffs on China to above 100%.

We believe the tariff threats and China’s own potentially wide-ranging critical minerals restrictions constitute tit-for-tat moves. The adverse market reaction is an important reminder of the downside risks of mutual suspicion, miscalculation, and a potentially large-scale de-coupling of the world’s two largest economies.

Compromise makes sense

China will hold a major party meeting later this month and formulate its next five-year plan in the coming 4-5 months. The country is unlikely to welcome new strategic instability, especially as it seeks to support domestic technology companies that have been closing the gap with Western counterparts.

From the other side, U.S. companies will likely be better off diversifying the sourcing of critical minerals and magnets rather than clashing with the main supplier of these products.

We believe both countries are primarily seeking to gain leverage ahead of the expected meeting between Presidents Trump and Xi at the forthcoming APEC summit in South Korea.

However, these flareups and mutual recrimination also highlight how difficult it will be for authorities, on both sides, to accomplish a stated desire to stabilize economic relations as well as pursue long-term, strategic, de-coupling.

Shifting trade balance

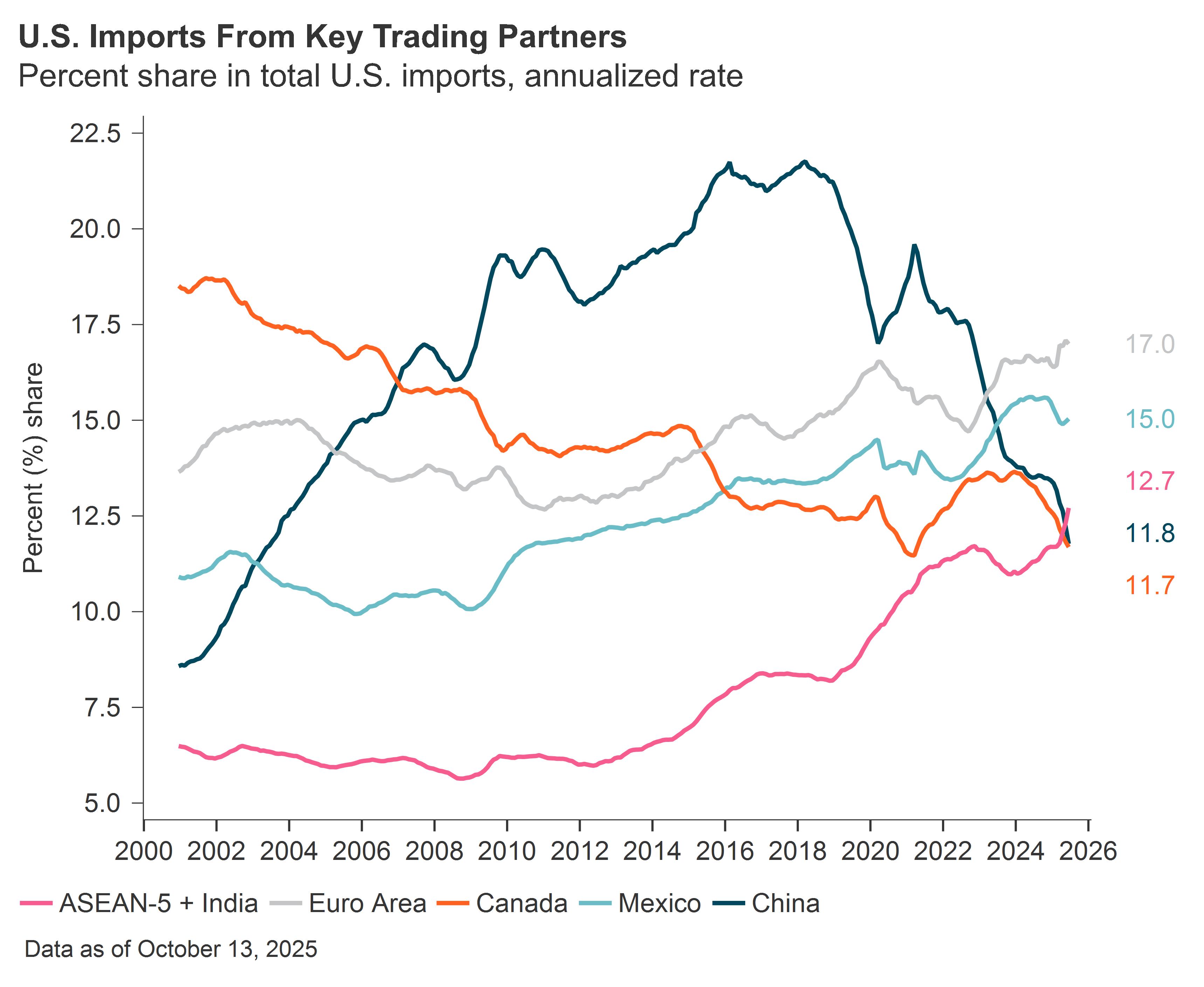

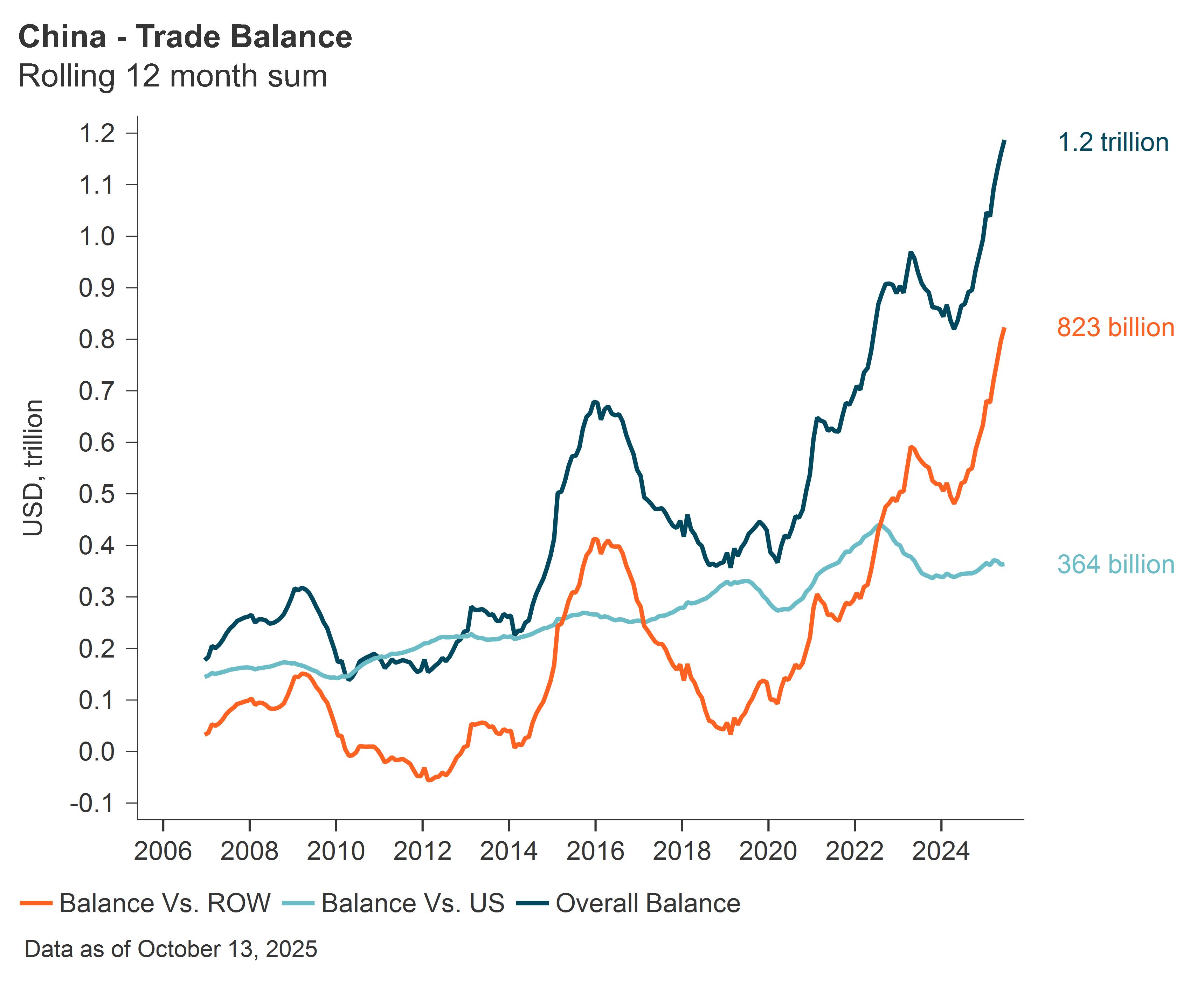

The structural reality is that the U.S.’ direct exposure to Chinese imports (and China’s direct export reliance on the U.S. market) is falling fast (Figures 1 and 2). This means that the imposition of unexpectedly steep bilateral tariffs will have a lower impact on U.S. inflation and on Chinese production than a year or two before when the headline trade reliance was much higher.

Figure 1: China’s direct exposure to U.S. import demand has plunged

Source: BNY Investment Institute, Macrobond.

Figure 2: But its exposure to the rest of the world has soared

Source: BNY Investment Institute, Macrobond.

But critical, upstream supply chain dominance is another matter. Even though China has narrowed the gap, the U.S. and its allies remain ahead in critical artificial intelligence (AI)-related semiconductor production capability. At the same time, China has overwhelming dominance in rare earths and critical minerals (Figure 3).

Figure 3: China’s dominance in rare earths and magnets is formidable

American efforts to retain a technological lead have come to rely heavily on an ability to modulate the supply of critical technology to Chinese entities.

From an upstream supply chain perspective, the two countries are economically entwined, with each holding a critical advantage. Both have managed an uneasy balance thus far.

A zero-sum game?

A stricter imposition of export controls in critical upstream technologies raises the prospect of mutually assured losses. For instance, if the U.S. implements a far-reaching regime to tighten China’s access to all advanced semiconductors, China could respond by cutting off the supply of specific rare earths which underpin the production of such advanced semiconductor products and parts. Or conversely, if China cuts off access to its rare earths and magnets for semiconductor producers, it could hurt its own access to high tech AI chips or invite a broader retaliation across other advanced technologies.

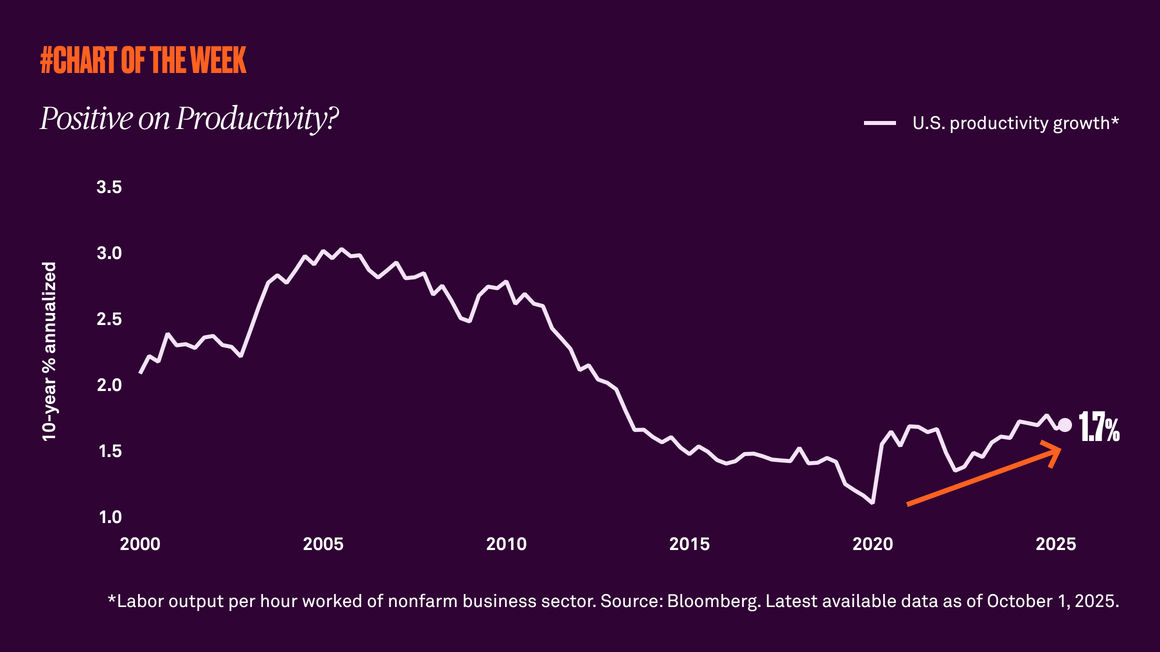

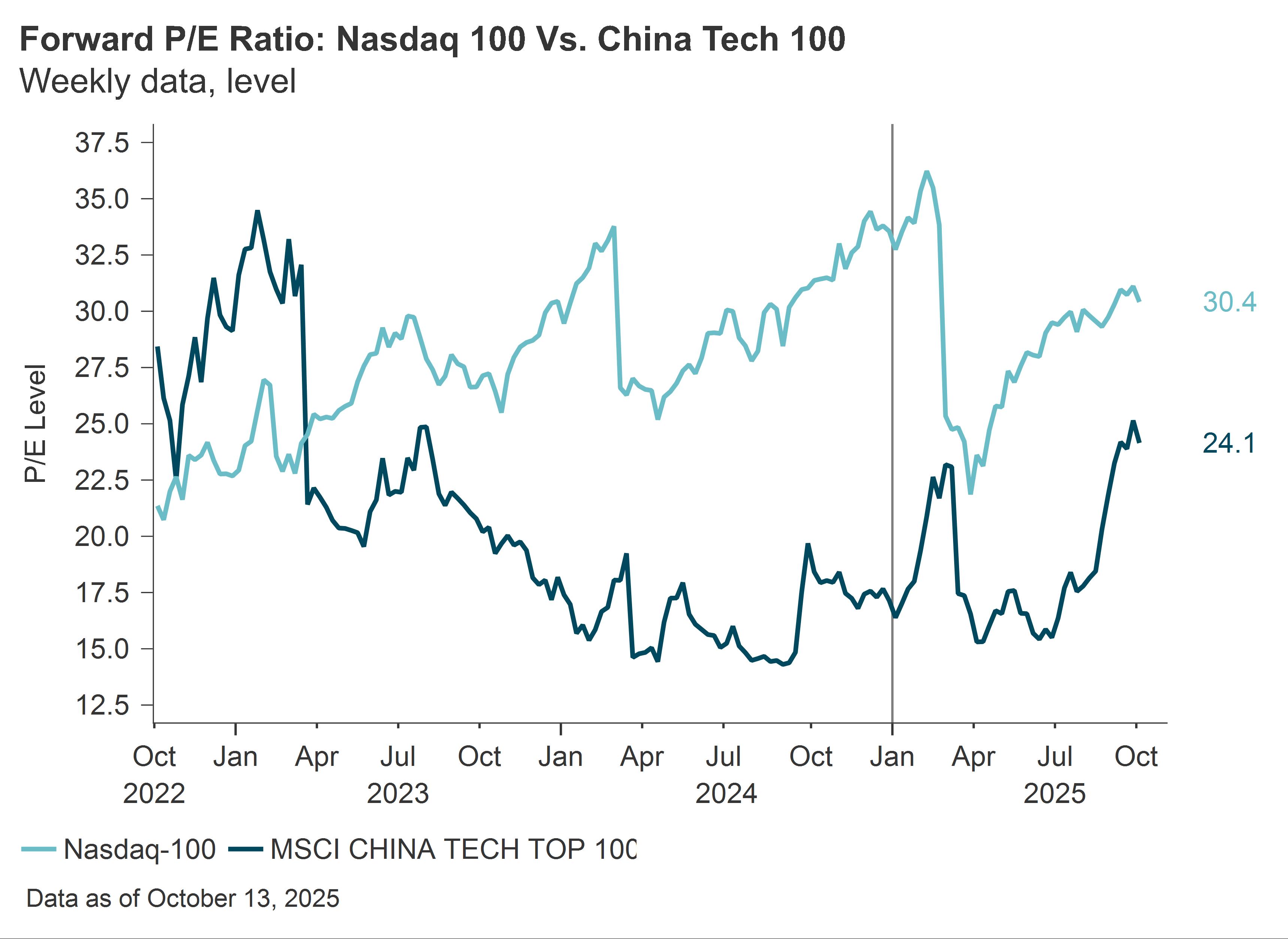

A key risk is of miscalculation – especially an effort to exercise leverage, or seek concessions, in other non-economic areas. Clear signs of near tech parity, and economic deterrence, has favored Chinese risk assets (Figure 4). But China is still encountering deflation, and its companies operate on relatively thinner margins. In this context, a stabilization of economic relations with the U.S. and a more consumption-focused stimulus to counteract economy-wide deflation is still important.

Figure 4: Technological breakthroughs and signs of narrower capability gaps have helped Chinese equity multiples but stable economic relations with the U.S. and lower deflation is still needed.

Source: BNY Investment Institute, Macrobond.

Important Information

For sole and exclusive use by Institutional Investors, Accredited Investors and Professional Investors only. Not for further distribution. This is a financial promotion and is not investment advice. Any views and opinions are those of the investment manager, unless otherwise noted. The value of investment can fall. Investors may not get back the amount invested. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation. In Hong Kong, the issuer of this document is BNY Mellon Investment Management Hong Kong Limited, which is registered with the Securities and Futures Commission (Central Entity Number: AQI762). In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited, Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore.

GU-726 - 30 September 2026