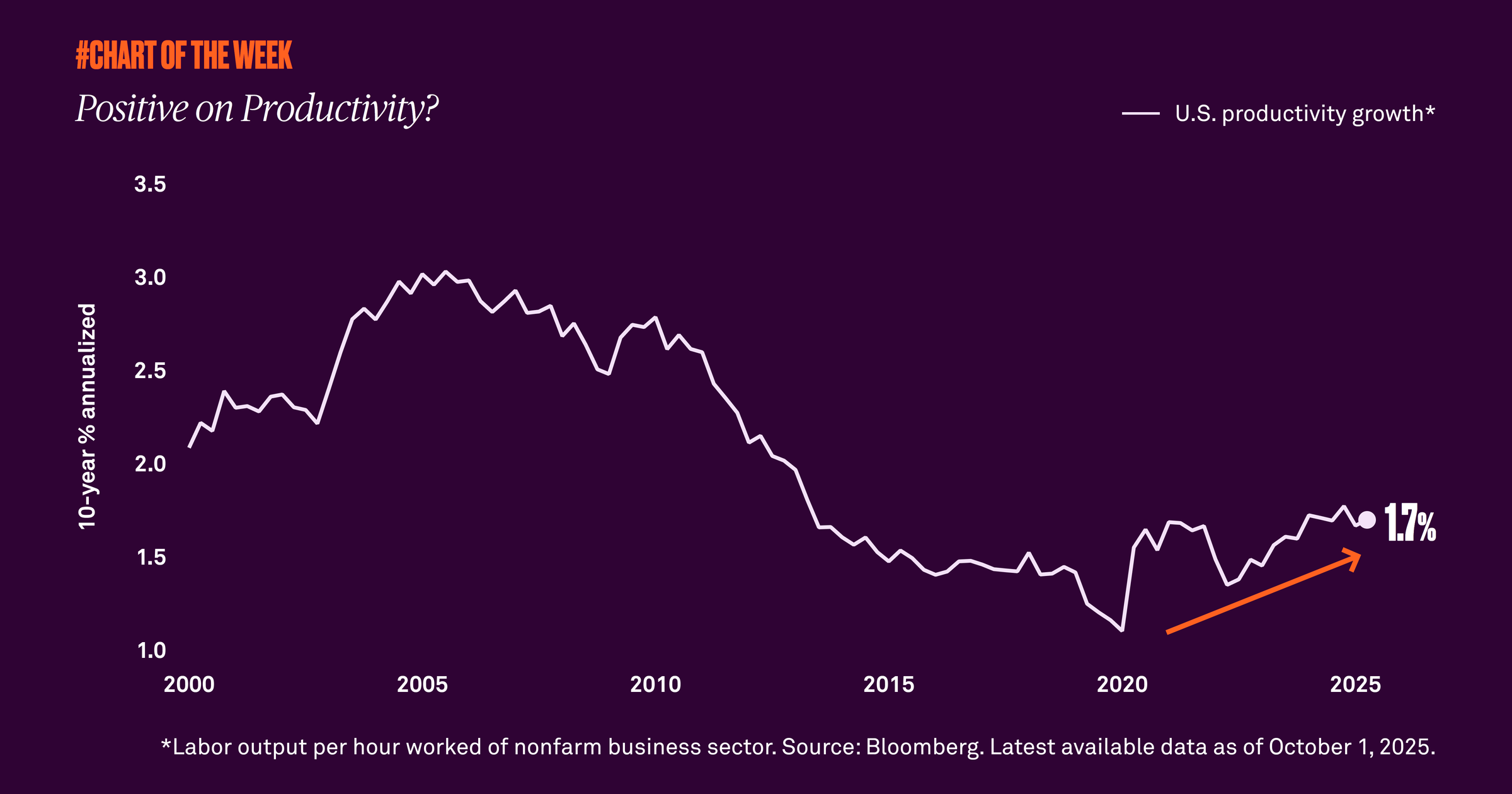

Productivity, or output per hour worked, is a key driver of long-term economic growth. Now, after years of stagnation, productivity is on the rise again, a positive sign for future growth.

The level of productivity in the U.S. economy is something we watch closely because it is a key driver of long-term economic growth: it measures how efficient a country is at producing goods and services with a given level of inputs. Now, after years of stagnation, productivity growth, as measured by output per hour worked, is on the rise again. Productivity has expanded 1.7% on an annualized basis over the last 10 years.

Several factors have been weighing on economic growth of late. One is a reduced labor supply owing to an aging population and declining immigration. Additionally, the job market has been softening as payroll growth has stalled in recent months. In the face of these structural challenges, enhanced productivity may be critical to improving economic growth.

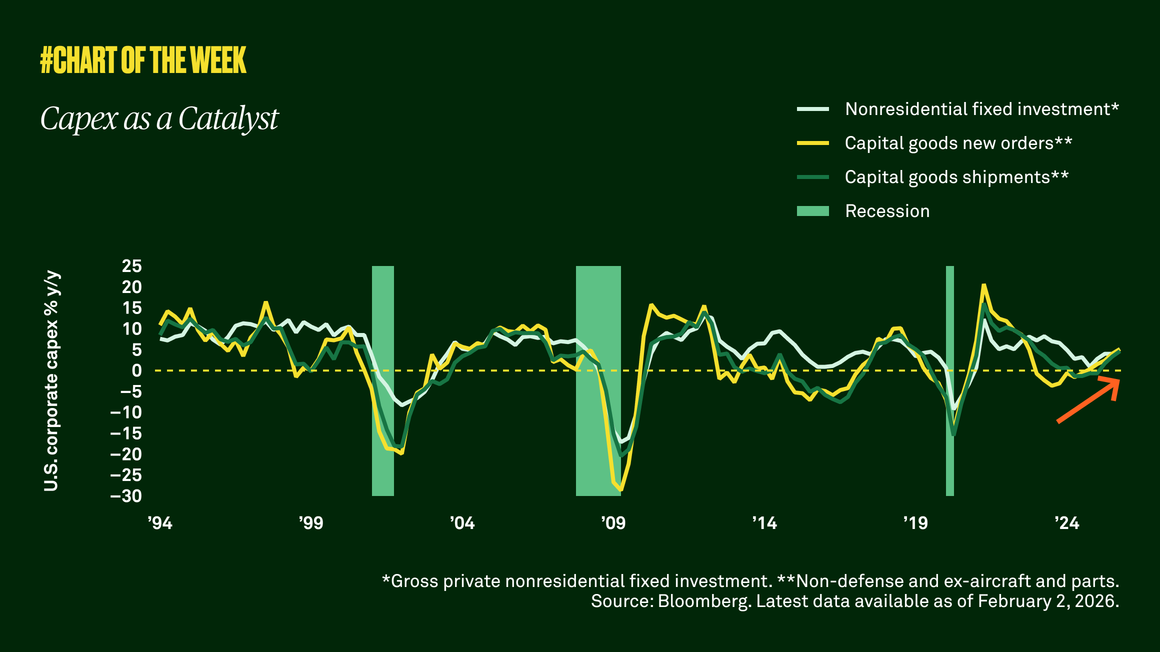

We therefore believe there is reason for optimism. With capital expenditures increasing thanks to provisions in this year’s tax and spending bill, we anticipate a continued acceleration in investment in and adoption of artificial intelligence, which could further improve productivity.

Additionally, higher productivity allows the economy to expand without adding inflationary pressures, which is critical at a time when inflation remains above the Federal Reserve’s 2% target. Given our productivity expectations, our view on the U.S. economy remains constructive.