Capabilities

FIXED INCOME

Capabilities

We believe that the resulting normalisation of yields presents an attractive opportunity, possibly the best in fifteen years. What does this mean for bond investors? Bonds once again offer prospects for ongoing returns as well as potential to achieve long-term yield objectives.

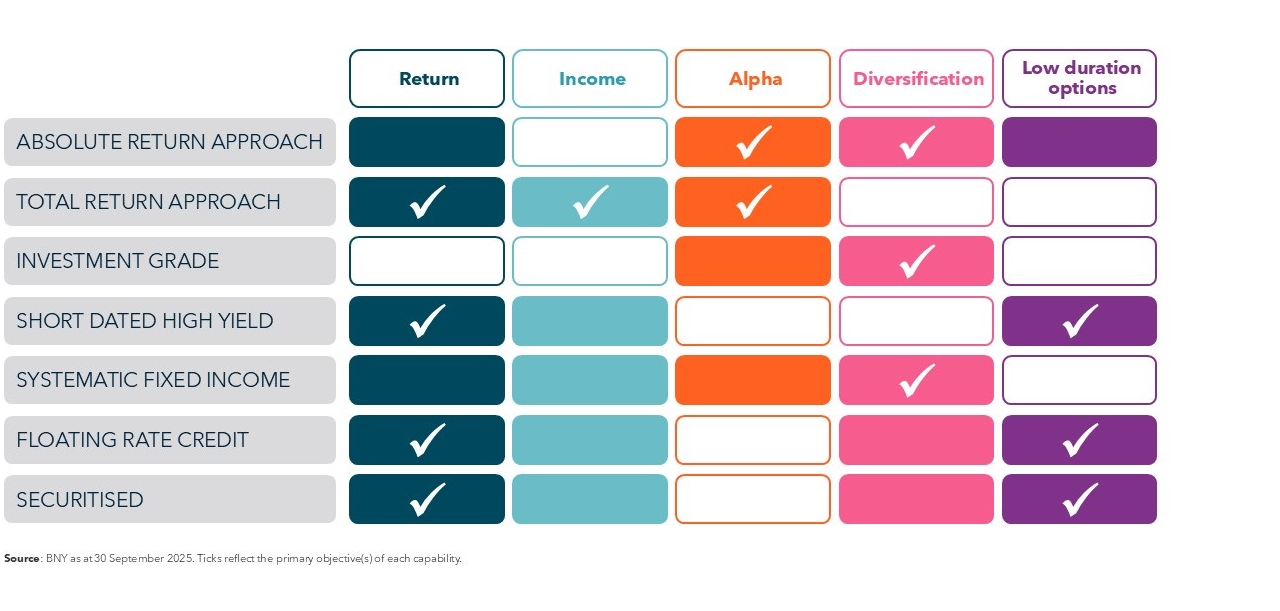

We seek out yield in unexpected places, constantly innovating to deliver refreshingly different fixed income solutions.

At Insight Investment, all they do is fixed income. Established in 2002, now decades of specialist fixed income experience across global teams provides investors with access to extensive investment opportunities. Clients can access traditional, specialised, and absolute-return strategies that can also be tailored to their specific needs.

Insight are dedicated to an approach designed to deliver precision in the way that they invest. With this focus on precision, Insight seek to deliver consistency for investors and the outcomes they rely upon, they take responsibility for delivering reliability.

fixed income assets under management globally1

fixed income investment specialists2

1 Source: Insight as at June 2025. Assets under management (AUM) are represented by the value of cash securities and other economic exposure managed for clients. Where the methodology defines it, some asset reporting focuses on cash securities only. Figures shown in GBP. Reflects the AUM of Insight, the corporate brand for certain companies operated by Insight Investment Management Limited (IIML). Insight includes, among others, Insight Investment Management (Global) Limited (IIMG), Insight Investment International Limited (IIIL), Insight Investment Management (Europe) Limited (IIMEL) and Insight North America LLC (INA), each of which provides asset management services.

2 Source: Insight as at June 2025.

After years of synchronization, global monetary and fiscal policies are now moving in different directions, reflecting varying growth dynamics, inflation pressures and policy priorities.

It’s a common question among fixed income investors: why are some bonds called early? Insight Investment’s high yield team answers this and explores some of the opportunities it can create.

After years of synchronization, global monetary and fiscal policies are now moving in different directions, reflecting varying growth dynamics, inflation pressures and policy priorities. Therefore, yield differentials, curve shapes and credit spreads are becoming more dispersed, creating new avenues for returns but potentially making it harder to spot the opportunities.

Fading cash yields could see a powerful rotation into credit markets, while AI growth financing and the emerging markets could offer new opportunities. Peter Bentley gives his 6 potential catalysts for credit investments in 2026.

The value of investments can fall. Investors may not get back the amount invested.

Please refer to the prospectus, and the KIID/KID before making any investment decisions. Documents are available in English and an official language of the jurisdictions in which the Fund is registered for public sale. Go to fund-centre.

*Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Managers Limited (BNYMFM), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2711400 Expiry 30 September 2026